Introduction

Investors seek high return on stocks and continue to invest in the stock market. Investors with higher risk-taking abilities are rewarded higher. However, in most of the cases, investors tend to lose their capital because of lack of proper research followed by the emotion of the investor. There are many instances, where investors have received a high return from small-cap stocks. The risk to reward ratio, in case of small cap stocks are higher compared to mid-cap and large-cap space. Usually, publicly traded entities with a market cap ranging from $300 million - $2 billion, are referred as small cap companies.

Letâs have a look at the advantages of investing in small cap space as follows.

Advantages of investment in Small-cap companies

Growth rate: The scope of growth is higher for small cap companies compared to large cap companies. A company with a good business model and with good product offerings operating at a low scale has a higher possibility to enhance its earnings through higher scale of operations. The blue-chip names like Alphabet, Microsoft, Wal-Mart and so forth had small market capitalisation at one point of time. Throughout the years, the above-mentioned companies have successfully transformed their scale of business. Also, the growth rate is mostly determined by the demand of the product of the companies. A unique product which is new to the market and the demand of which is likely to grow in future would be a good bet for investment. As the company delivers bottom-line growth, the stock price would move up.

Attractive valuation: From the valuation perspective, small cap stocks trade at a lower price to earnings multiple. The price to earnings ratio tends to increase when there is a higher participation of investors in a stock. Besides, the small cap companies are not covered by major analysts and are not known to every investor in the market. Due to higher participants, the price to earnings ratio becomes higher. The increase in participants results in the rise of demand for the stock. Thus, the liquidity becomes easy for the stock as more participants are ready to buy the company at a given market price compared to any small cap name. Thus, the demand enhances the price to earnings ratio. For example, if a large-cap stock has generated 10% bottom-line growth in one year, the stock price will go higher with the help of higher P/E multiple. While in case of a small-cap stock, if the company delivers 10% return, the P/E multiple will not move up quickly as most of the analysts are not covering the stock. Thus, most of the companies in small-cap category tend to have low P/E multiples compared to the large-cap names.

Accessibility to Management: For small-cap companies, the interaction with the management is easier compared to the large-cap companies. In the case of large companies, most of the investors, and analysts seek to interview the management as the stakes are held by a large section of investors. Management of small cap companies not only try to increase their scale of business but also, the investorâs presence. The management wants to increase the net worth of the companies, and they want that a part of their stake should be owned by the sophisticated investors or fund managers. So, a small cap company which is growing at an exponential rate is a classic example of higher investors participation. Thus, management plays a crucial part to make the companyâs name visible in front of sophisticated investors and high esteemed fund managers.

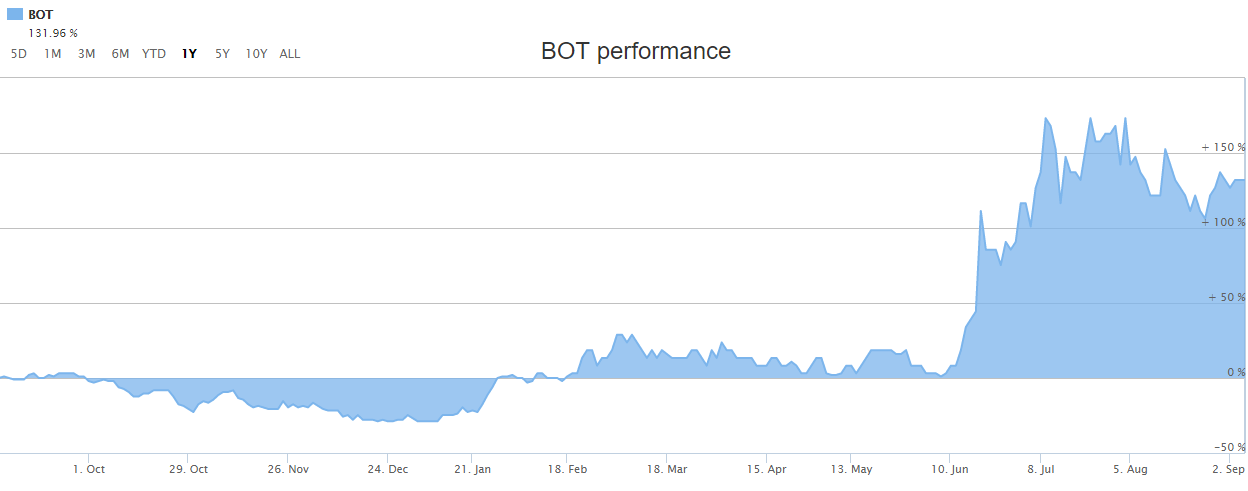

Probability to become a multi-bagger is quite higher as compared to large caps: The small cap stocks can deliver multiple returns irrespective of the market conditions, while large cap companies at an average gives double digit returns. For example, as noted on 7 September 2019, Botanix Pharmaceuticals Ltd (ASX: BOT) has generated 144.90% return to the investors during the last one year period. While during the last five years, the stock has generated 260.04% return to the investor. Current market capitalisation of the stock is at $231.48 million. Besides, the returns are much more than the S&P/ ASX 200 index performance during the last five years period. Further, a company which has reached to the matured stage would deliver decent growth as the base is higher. So, to replicate growthâs previous number, the company must put extra effort, and sometimes, even then it tends to become impossible to match up to the prior delivered numbers. The reason is simple, the product of the company reaches to the point of saturation. However, in the case of the small cap companies, most of the population is unaware of the product and, if the product has potential, it can capture the broader market. Obviously, these factors are dependent upon the management quality of the companies and their ability to work at a larger scale.

BOTâs 1-year performance (Source: ASX)

BOTâs 1-year performance (Source: ASX)

Higher Portfolio returns: A portfolio with small-cap stock tends to deliver higher returns compared to large-cap portfolio or a mutual fund. Most of the asset management companies across the globe delivers higher single digit return in normal times, whereas it tends to give higher double-digit figure during the bull market. Though, in case of small cap companies irrespective of the market conditions, they tend to behave in their own manner. The stock price moves according to the fundamentals of the company. As the companies have lower participants, the general fear of the market does not affect the stock price. For example, as noted on 7 September 2019, the stock of City Chic Collective Limited (ASX: CCX) has generated ~86.39% return to the investor in one year, while in the last five-year period, the stock has generated a healthy return of ~155.01%. The P/E multiple of the stock stands at 27.470x. Accordingly, in most of the cases, a good small cap stock tends to generate higher return in terms of percentage. In many cases, the small cap stocks tend to deliver two-three times bottom-line growth. While the same cannot be expected in case of large cap stocks because of the difference in the scale of operation these companies have.

Acquisition and merger news: In the small cap space, the probability of getting acquired is higher compared to large cap names. When a company with a good business model and able management delivers stellar earnings growth, the investors look forward to accumulating the shares of the company. In that case, due to the available scale of operations, large cap companies with a higher scale of operation may opt to buy the company. While, the large companies might look for diversification through brownfield acquisition. Thus, the shareholders get benefitted as they tend to get the merged share at decided swap ratio. While during the merger news, the stock generally moves up and the shareholders gain benefit in the market from the news. There are many instances of the stock price moving upwards drastically, as a result of the market participantsâ excitement on that stock, which increases the demand of the stock. Investors do tend to negotiate at a higher level for the small cap companies due to the merger or acquisition news. For example, when Facebook Inc. acquired WhatsApp there were only a few investors, holding the stake of WhatsApp. Therefore, all the stake holders were on the way to become multimillionaire after the acquisition news had spread in the market.

Dividend: Investors do look for companies with a high dividend yield ratio. Due to a lower P/E multiple of the stock, dividend yield tends to reach higher, as the company has enough earnings and a part of which is distributed as dividend. The companies like Blackmores Limited (ASX: BKL) and Metcash Limited (ASX: MTS) has annual dividend yield of 3.06% and 4.61%, and they are available at a P/E multiple of 23.270x and 14.090x, respectively (as noted on 7 September 2019). Also, the companies with constant bottom-line growth consider distributing dividend at regular intervals. Therefore, the small cap companies with lower P/E multiples can be bought for higher dividend yield ratio.

On the back of the discussion above, it can be said that the investors should go for fundamentally good stocks with a good growth-story and backed-up by good management of the companies they are investing in.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.