Mergers and acquisitions are vital for the competent and effective functioning of an economy. Achievement of efficiencies, reduction of competition in the market and diversification of risks and portfolios, ensure that the firms are on track to achieve their goals. Both the corporate transactions allow companies to grow or downsize, with a change in the business environment and the nature of their respective business.

Mergers and acquisitions can be best understood as an amalgamation or rather alliance of firms or assets via a financial transaction. Often, these terms are used interchangeably, but there are significant differences in both these corporate actions. Let us first understand the terms, and then decipher their differences:

What is a Merger?

The transaction wherein two firms, which are in most cases of the same size, join forces and decide to move ahead, functioning as a single new entity, is referred to as a merger. Considering that the two companies, which are part of this pact, are no longer separately owned and operated, their individual stock too are surrendered, and in its place the stock of the newly formed company is issued. After a merger takes place, some companies undergo growth and success while some of them nosedive.

What is an Acquisition?

The transaction wherein one firm obtains the majority stake in the procured entity, without any change in its legal structure or nomenclature, is referred to as an acquisition. In an ideal acquisition process, a smaller firm is taken over by a bigger one. The acquiring company takes over the stocks, equity interests and assets of the company which it acquires.

What is the difference between Merger and an Acquisition?

The clearest way to understand the difference between the two activities under discussion is provided in the following hypothetical equation:

Let us assume there are two firms- Company X and Company Y, with Company X being the bigger entity.

In a merger: Company X + Company Y = Company Z, a new entity.

In an acquisition: Company X + Company Y = Company X.

Another difference among two of them is the motive. A merger takes place to increase the latent strength and financial gains of the company. An acquisition occurs usually to combat challenges of the decline of business. The agreement between the involved parties is mutual and in the best interest of both in case of a merger, whereas acquisition shadows a much more aggressive approach wherein the target firm might not be willing to be bought over.

Benefits and Potential Drawbacks:

Few advantages of mergers and acquisitions include- improved economies of scale, increased market share, better distribution potential, tax benefits, healthy competitive environment, reduced costs and enhanced talent and availability of better financial sourcing.

Few disadvantages of the process include- huge legal costs, increased risk given the dynamic nature of business, possible brink of internal conflicts, re-skilling of employees might be time consuming and expensive requirement and high cost of market penetration of new products/services.

Quick glance at the M&A process:

Even though mergers and acquisitions have their differences in the crux of their activities and motives, they follow a similar process and undergo a likewise procedure from the beginning till the end. Let us look at the procedure, as follows:

- Acquisition strategy making.

- Acquisition Criteria decision.

- Hunt for the target company.

- Acquisition planning.

- Valuation and Evaluation.

- Deal negotiation.

- Due diligence and scrutinization.

- Sale and purchase contract.

- Final financing.

Examples of Mergers and Acquisitions:

Let us now look at a couple of mergers and acquisitions from the past:

Disney and Pixar- Regarded amongst one of the most successful mergers of all times, the two entertainment companies went ahead to collaborate and had created some great movies together.

Exxon and Mobil- An old but historic example, both the oil companies merged in 1999 to form ExxonMobil, which later was labelled as the largest company of the world.

Amazon and Whole Foods Market- In a deal of approximately $13.7 billion, e-commerce giant Amazon had acquired food retail company Whole Foods Market in 2017.

Verizon and Yahoo- Yahooâs digital dominance came to a stark end when American telecom player, Verizon purchased it for approximately $4.48 billion.

Besides these, there are mergers and acquisitions which failed to meet the objectives of their respective deals. Quaker and Snappleâs acquisition, AOL and Time warner merger, Sprint and Nextelâs merger are a few examples where the companies incurred losses and went through a turmoiled business phase.

Mergers and Acquisitions in Australia:

Australia is amongst one of the most booming global powers of the world. Businesses are evolving and expanding in the country at a rapid pace. Global trade relations are the buzz of the hour and investors are eyeing companies and stocks to cherry pick the most potent ones.

On the mergers and acquisitions front, Australia had witnessed a rapid change in the recent times, with a deeper involvement of legal and strategic bodies like The Takeovers panel, Australian Securities Exchange and Australian Securities and Investments Commission. Compared to most western authorities, Australia offers a much favourable environment regarding the M&A stances.

Recent Events in the Aussie land:

Looking at the developments in this field last year in 2018, colossal tech player DXC technology bought the Australian Oracle cloud partner, M-Power Solutions, System Partners and Microsoft partner Sable37.

VentralP welcomed more customers by acquiring three companies (Spiderweb Hosting, On A Cloud and Boot Domains). Consulting giant, Deloitte, bought CloudTrek and Mexia. A stirring news which embarked discussions in the global telecom sector was when TPG and Vodafone Australia, which are amongst the largest telcos of the country, planned to merge, which was deemed to be âa merger of equalsâ.

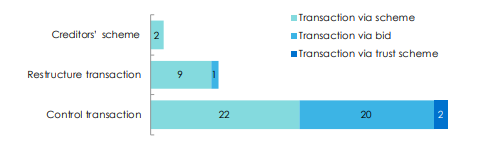

Related to a report on mergers and acquisitions published by the Australian Securities and Investments Commission (ASIC) in March 2019, the period between 1 July 2018 to 31 December 2018 witnessed an increase in the number of independent control transactions commenced to 44, which was 29 in the previous period. Restructuring of transactions went up to 10, from 2 in the previous corresponding period.

Independent control and restructure transactions (July to December 2018) (Source: ASIC)

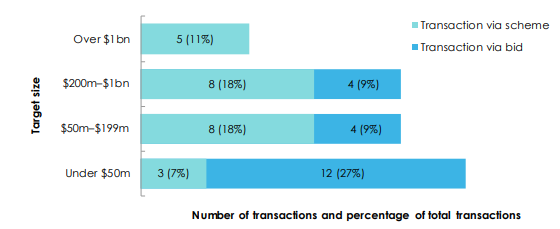

The ASIC also stated that larger control transactions were generally undertaken via a scheme, depicted in the image below:

Control transactions by implied target size (July to December 2018) (Source: ASIC)

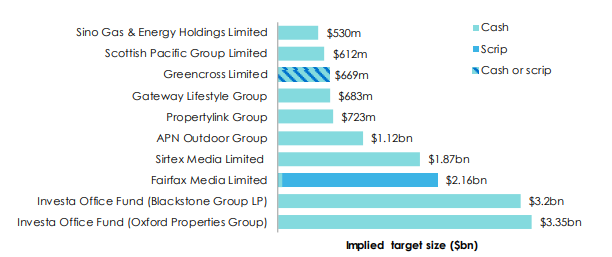

Considering the foreign and domestic offerors, Foreign bidders or acquirers were behind 78% of all deal value. Also, the largest control transactions during this period were, in most cases, offers of cash, rather than scrip, as consideration.

Largest control transactions size (July to December 2018) (Source: ASIC)

M&A in 2019:

Market experts and industry researchers believe that 2019 will carry ahead the baton of mergers and acquisitions in Australia. Australiaâs mid-market is expected to grow, driven by private equity and foreign investments. Sectors of technology, media and telecommunications and consumer and financial services are expected to inculcate the M&A activities. North America, North Asia and Japan along with the UK are amongst the most lucrative areas from where international M&A could take place.

The Australian Competition and Consumer Commission (ACCC) presented the below mentioned most recent acquisition requests that came by the last month:

Firstly, Wesfarmers Limited (ASX: WES) proposed to acquire Catch Group Holdings Limited, which is under scrutiny by the ACCC. Secondly, Emergent Cold Pty Ltd proposed to acquire AB Oxford Cold Storage Company, which too is under the consideration of the ACCC.

Market participants are keenly observing how the merger and acquisitions space unfolds this year for the corporate sector and broader economic landscape.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.