Consumer staples sector has generated a modest return over the years and is known to be recession-proof because of the nature of the business. The business model is directly co-related to the growing population. During the recession, investors look for safe sectors along with good dividend yield stocks. We will be discussing four consumer stocks which have a healthy dividend payout ratio and aided by good stock performance in the recent past.

Freedom Foods Group Limited:

Freedom Foods Group Limited (ASX: FNP) is associated with processing and distribution of processed dairy- based and plant based nutritional products. The product segments of the company are cereal, snacks and seafood products. FNP sells its products across geographies like Australia, New Zealand, China, South East Asia and North America.

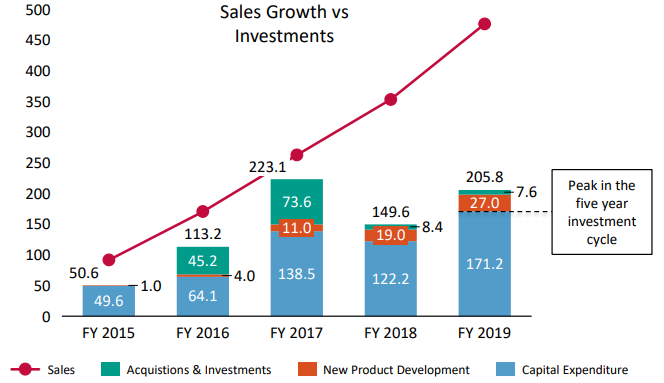

FY19 Financial Highlights: Freedom Foods Group Limited posted its yearly results for the period ended 30 June 2019 with revenue of $476.2 million, an increase of 34.9% y-o-y. Operating EBITDA came in at $55.2 million, higher by 40.9% from FY18. During the year, FNP posted its FY19 statuary net profit after tax at $11.6 million, lower by 9% on y-o-y, negatively impacted due to the addition of abnormal and non-cash expenses.

Operating results: The operating performance was marked by moderate growth across all the branded segments, well supported by distribution channels. During the year the company formed a team in SE Asia and a result of which, sales growth from the above-mentioned geography came in at robust ~178.8%. Revenue from Australia was up 37.5% over prior corresponding period, adding $103.4m in sales growth aided by ~60.7% growth across dairy & organic segments. Grocery reported a robust growth of ~37.8% y-o-y, due to (NPD) and market share. China revenue grew 37.3% at $67.4 million, driven by higher dairy volumes. One of the brands of FNP named Milklab posted tremendous response, delivering growth of 168.7%, contributing $21.9 million to the top line. Higher growth because of home channels and plant â based milk has seen increasing demand for coffee milk products. FNP launched pea protein milk in the domestic market, which turned out to be an instant hit.

The board announced an unfranked dividend of AUD 0.03250000 for each ordinary share held and is payable on 2 December 2019. The record date for the dividend is 4 November 2019.

Source: company reports

Outlook: FNP is targeting to produce more than 150 million litres during FY20. Its emphasizing on expanding footprints of dairy products and will focus on value-added protein-based consumer products during FY20. The management assumes Capital expenditures to be around $100 million in FY20 and FY21. The company will launch 2-litre formats of processed milk in FY20.

Stock Update: On 6 September 2019, the stock of FNP closed at $5.680, down 2.069% from its previous close. The stock is available at a P/E multiple of 123.670x and has a market capitalization of $1.58 billion. Dividend yield of the stock on an annualized basis stood at 0.95%. 52-week trading range of the stock is at $3.950 to $7.00 and currently, the stock is nearing the upper band of its 52-week trading range. The stock has delivered a decent return of ~12.62% and ~19.59% in the last three months and six months, respectively.

Coca-Cola Amatil Limited

Coca-Cola Amatil Limited (ASX: CCL) operates in the manufacturing and marketing of non-alcoholic and alcoholic ready-to-drink products. The company operates across six countries namely, Australia, New Zealand, Indonesia, Papua New Guinea, Fiji and Samoa. The company also process, market range of beverages, coffee and ready-to-eat food snacks. The company has a wide product portfolio of nonalcoholic sparkling beverages: water, sports, energy, fruit juices, iced tea, flavoured milk, coffee, kombucha, beer, cider and spirits.

H1FY19 Financial and operating highlights: Coca-Cola Amatil posted H1FY19 total revenue at $ 2,427.2 million, up 5% on y-o-y while the bottom-line came at $168 million, rise 6.3% on H1FY18. Statutory earnings before interest and tax came in at $273.5 million, up 4.7% y-o-y. The New Zealand and FIJI segments saw a strong all-round performance like that in FY18. Alcohol and coffee products delivered-double digit growth and constituted 9% of group earnings.

H1FY Financial Highlights (Source: company reports)

The company announced an unfrank dividend of AUD 0.25000000 for each ordinary share held payable on 9 October 2019. The annualized dividend yield of CCL stood at 4.27%.

Outlook: The companyâs capital expenditure for 2019 is likely to stand at $300 million. The management will focus on marketing strategies in Indonesia to navigate soft macro-economic conditions. Segments like New Zealand &Fiji, Papua New Guinea and Alcohol & Coffee are expected to grow as per earlier guidance given to shareholders. The management expects an EBIT loss of $12 million due to corporate and service expenses.

Stock update: The stock of CCL closed at $10.870, down 1.182% from its previous close. The 52-week trading range of the stock is $7.846 to $11.055, and currently, the stock is inching towards the upper band of its 52-week high. The stock is available at a price to earnings ratio of 26.800x. The stock has delivered stellar returns of 14.88% and 29.88% in the last three month and six months, respectively.

Treasury Wine Estates Limited:

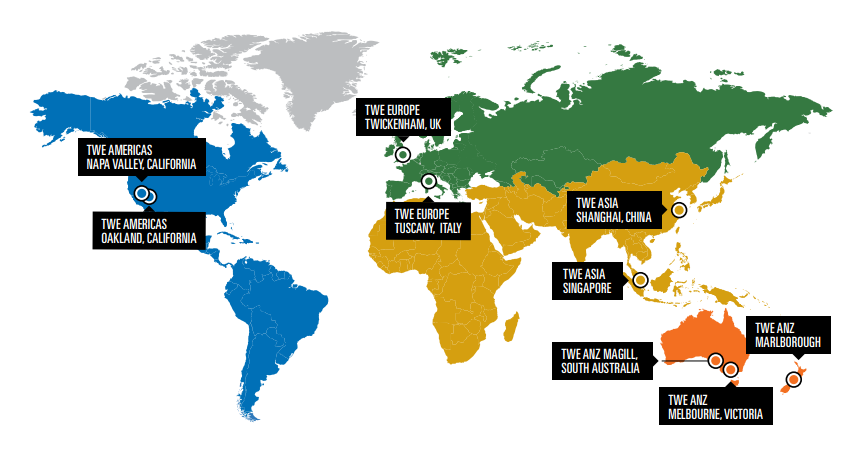

Treasury Wine Estates Limited (ASX : TWE) is a vertically integrated company that operates in growing and sourcing of grapes and manufacturing, marketing, and distribution of wine. The company operates across the markets of Australia, New Zealand, America and Europe.

Global footprints (Source: Company reports)

On 5 September 2019, TWE informed about the acquisition of 120 ordinary shares by one of the companyâs directors, Michael Anthony Clarke at a price of $18.87 per share.

Companyâs performance at a glance during FY19: Treasury Wine Estate Limited reported statutory revenues at $2,831.6m, grew 17% on y-o-y basis and EBIT of the company stood at $662.7million, up 25% on FY18. The company delivered bottom-line growth of $419.5m, higher by 16% on y-o-y basis. Cash conversion of TWE stood robust at 75.8% while the operating cash flow was higher by 36% in FY19. The company reported a cash balance of $401.8 million, plant, property and equipment at $1398.7 million followed by Net assets at $3706.1 million as on 30 June 2019. The company reported 11.6% higher receivables due by strong top-line growth. The companyâs return on capital employed stood at ~14.9%, increased by 2.3 percentage points during FY19.

Dividend announcement: The board announced a fully franked dividend of AUD 0.2000 against each ordinary share held, payable on 4 October 2019. The annualized dividend yield of the stock stood at 2.01%.

Outlook: As per management guidance, the company would be posting ~15%-20% growth in EBIT during FY20. The company would look for investments in French manufacturing and vineyard assets and will increase its domestic luxury winemaking capacity. TWE will focus on optimization of business models across geographies of the US and Asia by emphasizing on distribution. The company will majorly look for premiumization of its products to create value addition.

Stock update: The stock of TWE closed at $18.950, up 0.477% on the previous closing. The market capitalization of the stock stood at $13.57 billion with share outstanding of 719.74 million. The 52-week trading range of the stock stood at $13.380 to $19.900 and currently the stock is trading at the upper circuit of its 52-week trading range. The stock has delivered healthy returns of ~29.27% and ~23.35% in the last three month and six months, respectively.

Coles Group Limited:

Coles Group Limited (ASX : COL) operates in supermarket segment across Australia and have a product portfolio of food, tobacco product, groceries, liquor, fuel etc.

With a market update on 4 September 2019, the company reported that one of the companyâs directors named David Cheesewright had acquired 20,000 number of shares on 28 August 2019.

Recently, the company informed that one of its directors, Wendy Margaret Stops acquired Fully paid ordinary shares of 8090 units at a price of $13.555 per share.

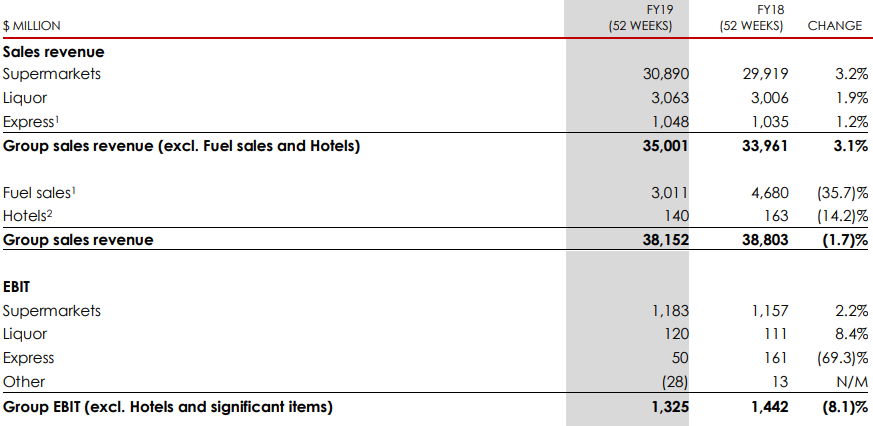

Performance Highlights: Group Sales of the company grew by ~3.1% at $35,001 million while group EBIT stood at $1,325 million, down 8.1% on y-o-y. The company reported core store sales growth of 1.2% due to falling tobacco sales offset by double-digit growth across food-to-go (FTG) categories. The FTG segment offers meals solution across its 93% stores. The company reported a total network of 714 sites at the end of FY19 with the new opening of six new sites and closing of three stores. Fuel volumes during the quarter declined by 13.7% y-o-y. During February 2019, the company tied up with Viva Energy and set the retail fuel rate. The company derives commission on the fuel volumes sold throughout the network.

FY18 Financial highlights (Source: Company Reports)

Dividend update: The company announced a total fully franked dividend of 35.5 cents per ordinary share payable on 26 September 2019.

Price Update: The stock of COL closed at $14.690, up 0.205% from its previous close. The market capitalization of the stock stood at $19.56 billion, and the stock is available at a price to earnings ratio of 13.630x. The 52-week trading range of the stock stood at $11.026 to $14.750 and currently, the stock price is trading at the upper band of its 52-week trading range. The stock has delivered positive returns of 16.05% and 29.92% in last three months and six months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.