In this article, we will discuss two stocks from the S&P/ASX Small Ordinaries Index. On 21 August 2019, these companies released significant updates related to their respective businesses. Concurrently, the S&P/ASX Small Ordinaries index closed trading at 2,819.0 on 21 August 2019, down by 3.5 points or 0.12%. Whereas, these two stocks were up by over 7% in the session.

Cardno Limited (ASX: CDD)

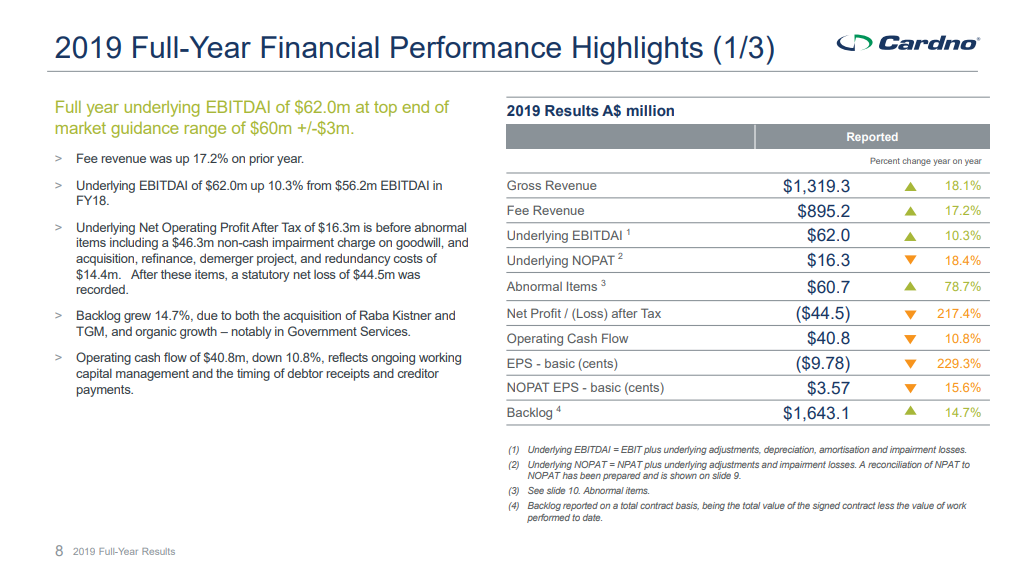

On 21 August 2019, the company released full-year results for the period ended 30 June 2019, and its intention to demerge business into two entities. Gross revenue of the company stood at $ 1,319.3 million during FY2019 compared with $ 1,117 million in FY2018. Besides, the company recorded a Net Loss After Tax of $ 44.5 million in FY2019, which has widened from $ 14 million in FY2018.

Reportedly, the company refinanced its debt facilities during FY19. The new facility of a three-year AU $ 110.8 million along with a US$ 83 million syndicated drawdown facility is scheduled to expire in December 2021. Besides, the company drew funds for the acquisition of Raba Kistner and TGM in late calendar year 2018, resulting in an increase in its net debt. In addition, the company completed the acquisition of DDAI and Trilab.

Highlights (Source: Cardno 2019 Full Year Results Presentation)

Highlights (Source: Cardno 2019 Full Year Results Presentation)

Segment Overview

Asia-Pacific: Reportedly, gross revenues were down 4.1% over pcp and EBITDA margin was down to 4.5% against 5.6% in FY18, and this was due to a lack of material projects during the period. Besides, the division had been restructured during the second half of the period to unlock growth for the future. The company completed the acquisition of TGM during the late first half of the period, and the acquisition has resulted in extended presence in major Australian regional centres.

Americas: Gross revenues from the division were up by 14.3% over pcp, while EBITDA margin improved from 4.8% to 5.1%, and this was driven by investments in business development initiatives over the past two years along with continuing operating discipline.

International Development: As per the releases, the segment recorded another strong year, and the company remains optimistic about delivering social and economic impact across the world. Some political uncertainty in the northern hemisphere resulted in an impact on the performance. Besides, the operations in Asia-Pacific and Africa had recorded resilient performance while Brexit impact was noticeable in the European operations.

Meanwhile, the company hopes that resolution in Europe and the UK would provide upside to the business, which has been impacted during the past year in the region.

Portfolio Companies: Reportedly, the company is pleased with the increase in size and performance of the group companies. Raba Kistner was acquired in the US, which unlocks a complementary business in the US market with that of Construction Sciences in Australia.

Meanwhile, results for Cardno PPI, the oil & gas quality assurance business, were pleasing and the business had recorded the strongest year in terms of financial performance and work in hand for a number of years.

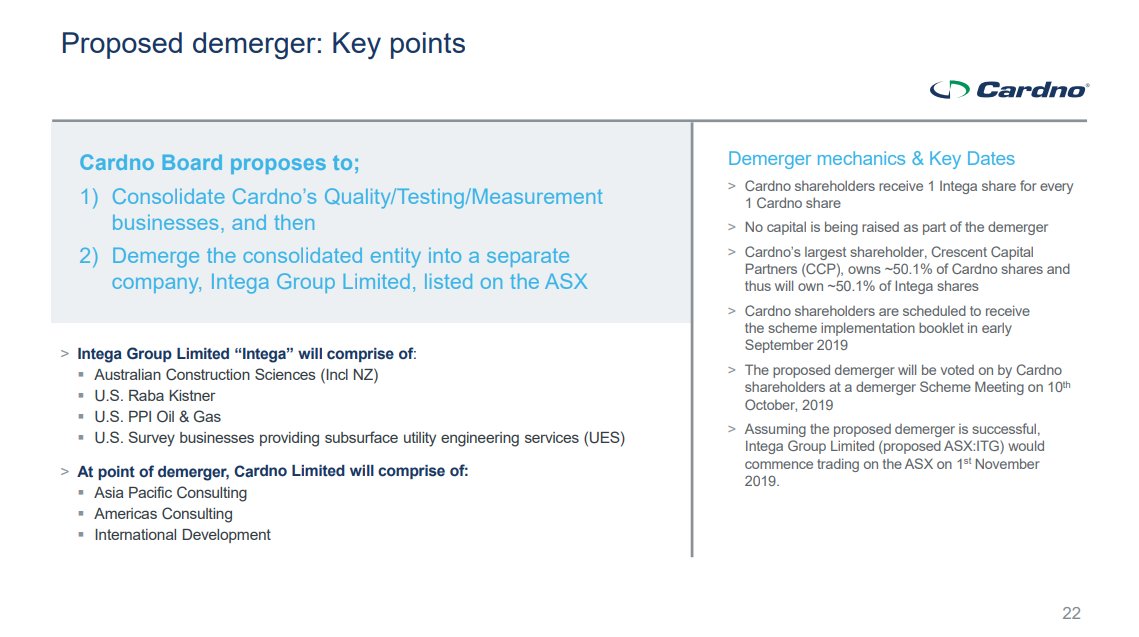

Demerger: The company intends to demerge into two separate listed entities. It was reported that the consulting business and the quality, testing and measurement business would be operated independently, subject to shareholder approvals, and other requirements.

Cardno Limited: This entity would be responsible for the existing environmental, infrastructure and development consulting business.

Intega Group Limited: This entity would be engaged in quality, testing and measurement business (QTM), providing construction material testing, subsurface utility engineering services, and quality assurance for energy companies.

Key Points (Source: Cardnoâs Presentation)

Key Points (Source: Cardnoâs Presentation)

Background: In 2017, the company had separated most of the QTM business from the consulting business into âPortfolio Companiesâ. It was noted that, following the separation, the QTM business had delivered resilient performance, which it has grown organically and through acquisitions.

Meanwhile, the QTM business accounted for ~44% of the total EBITDA of the company on a pro-forma basis in the year FY2019. Admittedly, the perception of the board is that both businesses are self-sufficient to operate independently. The separation allows the businesses to emphasise on independent competitive position while also concentrating on specific growth prospects.

Besides, the separation would enable the companies with greater transparency and improved access to capital and debt markets to follow strategic objectives with increased performance accountability.

Cardno Post Demerger: Cardno Consulting operates with around 4,482 employees in 124 permanent locations as of 30 June 2019. It has three divisions - Asia Pacific, the Americas, and International Development. Besides, the company would be led by Chief Executive Officer and Managing Director, Ian Ball and Chief Financial Officer, Peter Barker.

Environmental Consulting: The company provides services such as environmental assessment, permitting, restoration, remediation and environmental management in both Asia-Pacific and the Americas.

Infrastructure Consulting: Under this, the company provides civil engineering, asset management, planning, structural engineering and military master planning. The business ensures that the built environment is designed and planned efficiently and consistently with necessary regulations.

International Development: The company provides developing & managing development solutions for the Australian Department of Foreign Affairs and Trade (DFAT), the United States Agency for International Development (USAID), the United Kingdom Foreign and Commonwealth Office (FCO) and the Department for International Development (DFID). Besides, it also provides services to other public bodies, non-government aid organisations and private sector clients.

Intega Post Demerger: Reportedly, the business operates with around 1,957 employees in 101 permanent offices as of 30 June 2019. The business is primarily conducted in Australia, the United States, Canada and New Zealand, under four brands - Construction Sciences, Raba Kistner, T2 Utility Engineers and PPI. The new entity would be led by Chief Executive Officer and Managing Director, Matt Courtney and Chief Financial Officer, Shael Munz.

Meanwhile, the business provides conformance tests on construction materials to test the standards of construction materials, subsurface utility engineering services, environmental testing services, geotechnical engineering services, and quality assurance on critical components for energy companies.

On 21 August 2019, the CDD stock settled at A$ 0.905, up by 7.101% from the previous close. It has a market cap of A$ 375.41 million and approximately 444.27 million outstanding shares.

Select Harvests Limited (ASX: SHV)

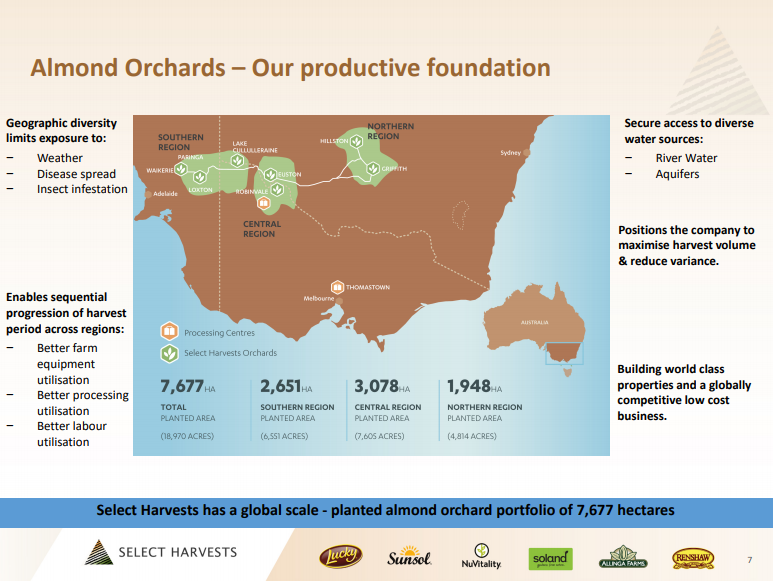

In an announcement dated 21 August 2019, the company released its 2019 crop update. According to the company announcement, the 2019 yields are above the industry standard and exceed its earlier forecast. Besides, the continued improvement in the companyâs almond yields depicts the benefits of the emphasis on high-quality horticulture programs, and additional investments in risk mitigating frost fans.

Reportedly, the Carina West processing facility has processed crop at higher rates of efficiency compared to the previous year, backed by new sorting technology and escalated focus by staff on processing line performance. Besides, the company has processed 95% of the crop, and it is forecasting a crop volume of 22,200 - 22,500 MT. In addition, the remaining 5% consists of the tail end of the crop, which is mostly of lower yield and poorer quality.

Almond Orchards (Source: PAC Partners 2019 AgFood Round Table, June 2019)

Almond Orchards (Source: PAC Partners 2019 AgFood Round Table, June 2019)

As per the release, the company has been witnessing a spurt in demand from traditional export markets and domestic customers. The demand from China has grown significantly, which is a new market for the company.

Besides, the increased global demands for almonds, a weaker AUD against USD, and the lower than expected objective estimate for the 2019 USA crop have seen the market price for almonds remain firm. The company expects the prices to remain constant unless there is a significant alteration in the US supply outlook.

Meanwhile, the company completed a marketing campaign in Asia, and current contracted sales, actual sales and internal commitments equate to approximately 80% of the forecast crop at an estimated pool price of A$ 8.6-A$ 8.7 per kg. The company is fully hedged with AUD/USD rate below 0.71c.

Reportedly, the performance of the food division remains challenging but promising, and strong demand for the industrial product is supported by the export market. Whereas, the domestic market is adversely impacted by the increased prices of all tree nuts in the consumer and industrial segments.

Besides, the company remains consistent with the strategy to grow its brands internationally and domestically, and the returns from these investments would be fruitful to the business in the coming years.

Paul Thompson, Managing Director of Select Harvests, stated that the performance of the orchards had exceeded the most recent forecast, and it depicts the quality of the companyâs portfolio, orchard maturity profile, risk mitigation initiatives and investments in its horticulture program.

Mr Paul said that capital investments in the Carina West Processing Facility and orchards have improved productivity, yield and crack-out levels while reducing the costs per kg. These factors coupled with strong global almonds market would enable the company to deliver health FY2019 financial results.

On 21 August 2019, SHV last traded at A$ 7.810, up by 10% from the previous close. It has a market cap of A$ 679.73 million and approximately 95.74 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.