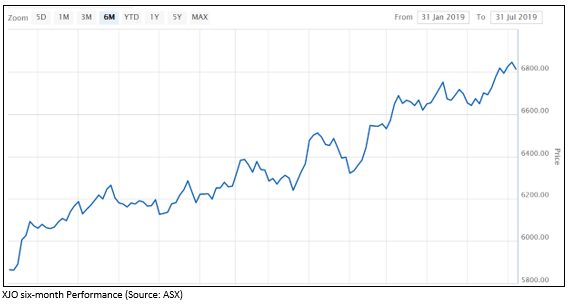

At a time where the Australian equity market is performing at higher levels, reaching to record high in recent times, some analysts are worried that it is a period of higher risk.

S&P/ASX 200 (XJO) index ended the dayâs trade at 6,812.560 points, as on 31st July 2019. It is currently trading at 6796.8 points (as at 1:32 PM AEST, 1 August 2019).

As per several market analysts, investors are putting a lot of money on high yielding blue stocks. A Melbourne-based stockbroker with establishment broking house, Baillieu Holst and chairman of the globally acknowledged Melbourne Mining Club, Mr. Richard Morrow recently mentioned in an interview that the investors are currently investing more money into blue-chip high yielding stocks as they have got no alternative but to look at property and equity market.

Amidst lower interest rate in Australia (recently reduced to 1%) and global trade concerns, the investment in high yielding blue-chip stocks is viewed as a less risky and simpler way for earning decent returns by investors. Blue-chip stocks are the stocks of well-established companies with strong fundamentals and financials and decent dividend paying history. Blue-chip stocks are less volatile in nature, due to which there is a less chance that the investors will earn greater returns in a short period. Investors generally invest in these stocks, keeping in mind the long-term return. Generally, Blue-chip stocks pay their shareholders regular dividends which is a major source of attraction for these stocks.

In a current scenario of the Australian economy, high yielding blue-chip stocks are being viewed as hot deals.

Let us now look at few Blue-chip stocks trading on ASX-

All the top four banks of Australia (in terms of market cap) comes under this category. These banks have been providing sustainable dividends to their shareholders despite facing significant head winds in the recent past.

National Australia Bank Limited (ASX:NAB)

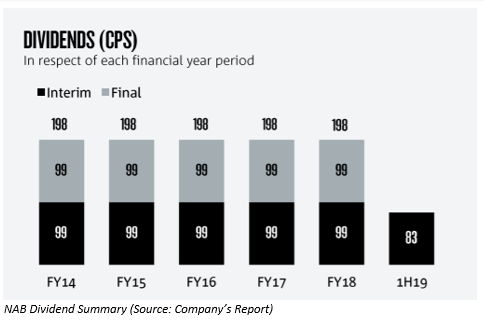

National Australia Bank Limited (ASX: NAB) currently has a market capitalization of circa $82.19 billion, with shares trading at a price of $28.710, up 0.7% as on 1st August 2019 (2:12 PM AEST). The stock of NAB is trading at a PE multiple of 13.900 and currently has an annual dividend yield of 6.38% (as per ASX).

Although the bank had reduced the first half dividend by 16% to 83 cents per share, NAB is still one of the highest dividend stocks on ASX.

Under the new leadership of Mr. Ross McEwan as CEO, the bank is planning to transform its operations and culture. The bank also recently announced the appointment of well-seasoned industry veteran, Susan Ferrier as the new Group Chief People Officer.

In the past six months, NABâs shares have increased by 19.49% and provided a year till date return of 20.65%.

Westpac Banking Corporation (ASX:WBC)

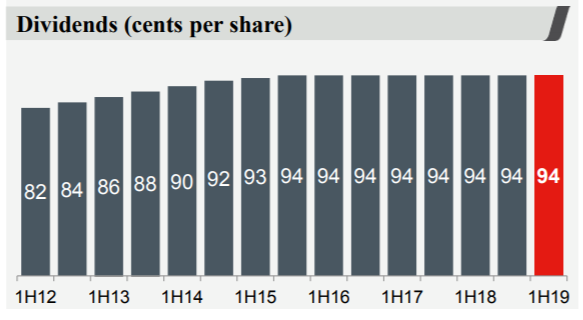

Provider of range of consumer, business and institutional banking and wealth management services, Westpac Banking Corporation (ASX: WBC) currently has a market capitalization of circa $99.99 billion with stock trading at a price of $28.845, up by 0.68% as on 1 August 2019 ( 2:12 PM AEST). WBCâs stock has a P/E multiple of 13.900 and an annual dividend yield of 6.56% (as per ASX).

In the first half of FY19, the bank earned a reported net profit of $3,173 million with cash earnings of $3,296 million and cash EPS of 95.8 cents.

For the half year period, the bank declared a dividend of 94 cents per share in line with pcp.

WBC Dividend Summary (Source: Company reports)

In the past six months, WBCâs shares have edged up by 16.70% and provided a year till date return of 17.03% as on 31 July 2019.

Australia And New Zealand Banking Group Limited (ASX:ANZ)

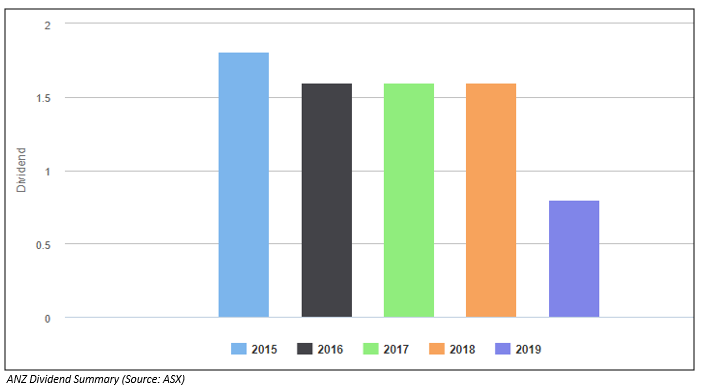

Australia And New Zealand Banking Group Limited (ASX: ANZ) currently has a market capitalization of ~$79.11 billion with stock trading at a price of $28.065 as on 1 August 2019 (2:11 PM AEST). ANZâ stock currently has an annual dividend yield of 5.73% and a PE multiple of 12.740 (as per ASX).

In the first half of FY19, ANZ earned a Statutory Profit after tax of $3.17 billion with cash earnings per Share of 124.8 cents. For the half year period, the bank determined an interim dividend of 80 cents per share (fully franked), equating to $2.27 billion. The dividend was paid on 1st July 2019.

During the half year period, the bank undertook various Business initiatives which are as follows:

- The bank introduced single home loan origination system for all channels in Australia to improve the application and assessment process;

- The bank also increased the number of dedicated home loan assessors in Australia in order to assist with enhanced verification;

- ANZ grew home loans and retail deposits in New Zealand by 6%;

- During the half year period, ANZ successfully maintained its leading market position in Australia and New Zealand and retained number one position for overall relationship quality in Asia for the second consecutive year.

In the past six months, ANZ shares increased by 11.51% and have provided a year till date return of 16.97%.

Commonwealth Bank of Australia (ASX:CBA)

Commonwealth Bank of Australia (ASX: CBA) currently has a market capitalization of circa $145.69 billion with shares trading at a price of $82.215 as on 1st August 2019 (2:41 PM AEST). CBAâs stock currently has a PE multiple of 16.040 and an annual dividend yield of 5.24% (as per ASX).

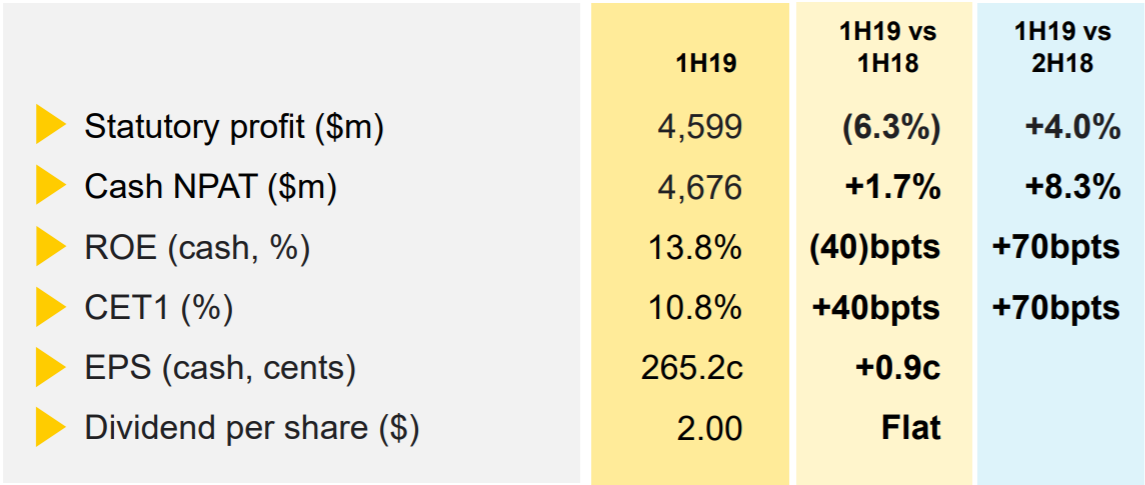

CBA, in its FY19 first half, reported a statutory profit of $4,599 million which was 4% higher than previous half as well as a Cash NPAT of $4,676 million which was 8% higher than pcp. For the half year period, the bank paid a dividend of $2 per share, which was flat on pcp.

In the March 2019 quarter, the bank was able to produce sound fundamentals in a challenging environment. It sustained growth in core markets by delivering a volume growth of 2.5% in business lending, 2.8% in household deposits and 2.3% in business lending. At the end of the March quarter, the bank had an NSFR ratio of 113% and LCR ratio of 134%.

In the past six months, CBAâs shares increased by 17.72% and provided a year till date return of 15.96% as on 31st July 2019.

ALSO READ: Dividend Stocks Amidst Low Interest Rate Regime â BBN, COL, FMG, KGN

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.