After a major slump in property prices over the past few months, the Australian housing market is showcasing a steady recovery graph. Improving auction demand in the real estate industry is a sign that the silver lining in Australiaâs gloomy property cloud is finally visible and is steadily shining.

Home Auction in the Last Week of July

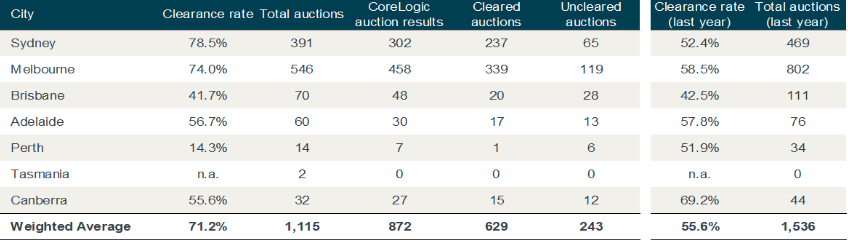

Clearance rates demonstrate the percentage of properties that are sold at an auction. According to CoreLogic, a property consultant firm, in the last week of July 2019, 1,115 properties got listed for auction in the capital cities of Australia. These properties had an average clearance rate of 71.21 per cent, representing a 40 per cent increase when compared with the same period in 2018. As clearance rates are regarded as a prime detector of the health of a countryâs property market, growth in the rates during the reported week, emerges as a good sign for the Australian economy, even though the number of properties listed for sale remained to be on the lower end.

What do the Auction Statistics Reveal?

Letâs look at the clearance rates of the two most significant cities of the country- Sydney and Melbourne. Sydney is the biggest city in Australia, and it had 391 properties auctioned in the last week of July 2019, with the preliminary clearance rates being 78.48 per cent. Melbourne is regarded as the second most populous city of the Aussie land, and it set the record of having the largest number of properties listed for auction. 546 of these auction-listed properties had a clearance rate of 74.02 per cent. In 2018, at the same time frame, there were 1,536 homes under auction across the country with a clearance rate of 55.6 per cent.

Capital City Auction Stats (Source: CoreLogic)

Capital City Auction Stats (Source: CoreLogic)

What do the experts say?

Given the auction statistics, real estate experts are confident of the fact that the property market is gradually uplifting, especially after the federal elections. However, the presence of less properties remains to be an alarming reason of discontent among buyers, toppled with the low number of total auctions.

Let us get into the pensive of the recent past, focusing on the Sydney auction during the first week of July. The relaxed lending standards by the banks and the period right post the second interest rate cut, drove the auction market to be back on track. The market was boosted with approximately 289 properties listed for auction during the first week of July 2019, made buyers believe that the market might spike on the back of the new APRA determination, as there was more positively when compared to the situation, a year back.

The Australian Property Scenario

The property market is an integral and vital component which contributes directly to the growth of an economy. In Australia, the housing stock is worth approximately A$ 6.8 trillion. The last two years have been a period of free fall for the Australian property market, following a downward trajectory driven by the adverse impacts of the global financial crisis. The decline in the housing prices was the epidemic that spread nationally in Australia, only to better recently.

Improved sentiments, RBAâs consecutive rate cut policies, coalition win and loosening lending by APRA acted as the catalyst that has driven the Australian property market to gain good health after a long time. In the March quarter, the Australian residential property prices fell by 3 per cent, with Sydney and Melbourne accounting for a decline of 3.9 per cent and 3.8 per cent, respectively. This was reversed in the following months after the building approval was improved in May 2019.

Factors surrounding Australiaâs Property Market

With the housing recovery gradually creeping into the Australian cities, experts believe that both auctions and private sales need to be strong for a complete recovery. With these getting better with time, buyers would be buoyant and confident to spend money and buy properties.

Factors that have affected the recent upliftment of the Australian property scenario are discussed below:

- The Royal Commission Era- Experts believe that the boom phase of 2012-2017 in the property market lacked the presence of Royal Commission, which is now in place- steady and hovering a hawkâs eye over the Australian economy, making necessary amendments as and when required. Incorporated in December 2017, the commission holds the responsibility to keep a check on misconduct in the banking and financial services industries, in addition to superannuation.

- Consecutive Rate cuts by the RBA- The Reserve Bank of Australia welcomed July 2019 with a further reduction in its official cash rate, lowering it to 1 per cent, with the intention to support the Australian economy and lower the stark prevailing rates of unemployment in the country. The first cut of the year was announced in June 2019. Since 2012, these back-to-back cuts were the first cuts to be introduced by the bank. Market experts are anticipating yet another rate cut by the end of the year and are looking at it as a great step towards supporting Australiaâs sustainable economic growth.

- The Reverse Mortgage Program: The Australian Securities and Investments Commission (ASIC) started the review of lending for reverse mortgages in the year 2017, with the review report expecting demand for equity release products to get affected by the increasing elderly population in Australia.

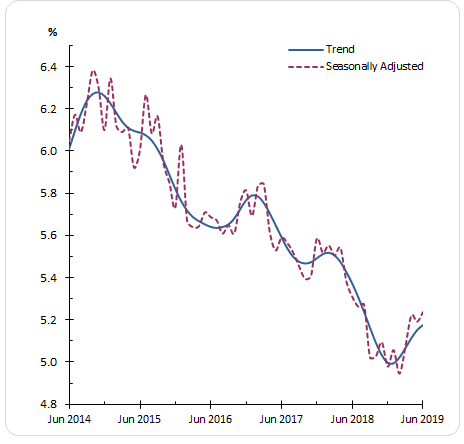

- Unemployment Rate: The unemployment rate in Australia was recorded at 5.2 per cent in June 2019. According to experts, the government should regard the unemployment issue in the list of top priorities and continue to focus on infrastructure spending and population policies, which would lower the rate of unemployment.

Unemployment Rate (Source: Australian Bureau of Statistics)

-

- APRAâs updated guidance: On 5 July 2019, the Australian Prudential Regulation Authority (APRA), the prudential regulator of the financial services industry, stated that its updated guidance on residential mortgage lending would no longer expect the authorised deposit-taking institutions (ADIs) to assess home loan applications using a minimum interest rate of at least 7 per cent. Instead, ADIs would review and set their own minimum interest rate floor for use in serviceability assessments and consider the revised interest rate buffer of at least 2.5 per cent over the loanâs interest rate. The loosening of restrictions on lending has certainly paced up the recovery of the Australian property market.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.