Commonwealth Bank of Australia (ASX: CBA) recently released its March Quarter 2019 Presentation, depicting the financial performance of the group.

Net Interest Income (NII) for the group in Q3 FY19 is at $4,567 million declined 3%, mainly on the back of the impact of two fewer days in the quarter. Volumes in home lending, household deposits and business lending (BPB) rose 2.5%, 2.8% and 2.3%, respectively. Non-interest income (fee-based income) saw a de-growth of 10%, hit by a negative DVA (derivative valuation adjustment) and higher insurance claims. Operating Expenses in the Q3 FY19 was up 1%, excluding notable items, whereas it was up 24%, including additional remediation/notable items. The initiatives taken in the form of fee removals and pre-emptive alerts improved customer outcomes.

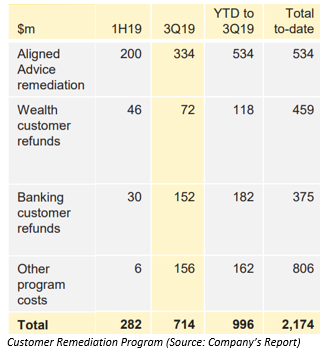

Customer Remediation Program and Regulatory Update: To ensure that all issues are identified and addressed, the bank addresses all the remediation issues impacting customers of the bank. In Q3 FY19, CBA recognised an additional pre-tax customer remediation provisions of $714 million, of which $704 million was recognised in the operating expenses and $10 million in discontinued operations.

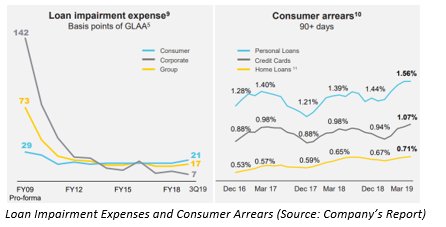

Credit Quality: Third quarter witnessed a healthy credit quality of the loan portfolio with loan impairment expense of $314 million, which came in equal to 17 bps of gross loans and acceptances against 15 bps in H1 FY19. Seasonal factors affected the consumer arrears, which continued to trend higher with a low base effect, largely on the back of subdued income growth and cost of living challenges. CBA maintained prudent levels of credit provisioning with total provisions came in at ~$4.8 billion and collective provision coverage further strengthened.

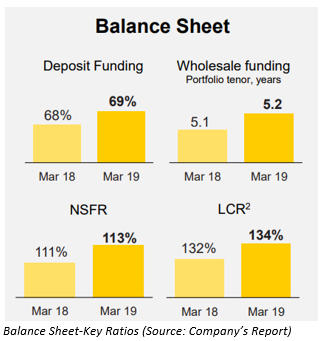

Strong Balance Sheet: The bank continued to enjoy strong funding and liquidity positions with customer deposit funding at 69%. NSFR (Net Stable Funding Ratio) at 113% was largely supported by growth in retail deposits growth. LCR (Liquidity Coverage Ratio) at 134% in Q3 FY19 was higher as compared to 131% in Q2 FY19 and 132% in Q3 FY18, backed by an improvement in customer deposit mix. Leverage Ratio for the group on an APRA basis and an internationally comparable basis came in at 5.4% and 6.2%, respectively.

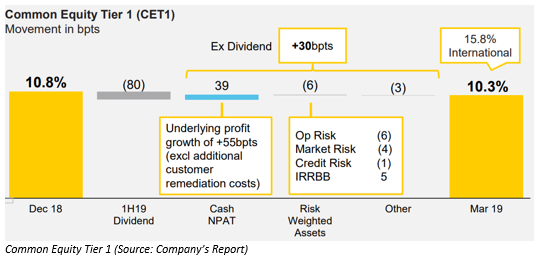

The CET1 (Common Equity Tier 1) APRA ratio for Q3 FY19 stood at 10.3%, increased 30 bpts in the quarter, driven by capital generated from earnings. To build a simpler and better bank, the group had recommended divestment of few businesses. The bank suggested that the sale of BoComm Life is subject to regulatory approvals. The management is of the view that the divestment of CMLA is likely to be completed in the second half of CY19, subject to the timing of the necessary Chinese regulatory approvals. As a result of the announced divestments, CET1 is likely to witness an uplift of ~120 bpts (subject to regulatory approvals).

RWA (Risk Weighted Assets) at $447.2 billion saw an increase 0.5% as compared to the previous quarter, mainly due to higher Operational Risk RWA (increased by 4.4%), Traded Market Risk RWA (rise of 29.5%) and Credit RWA (up 0.1%). However, the support came in the form of lower IRRBB (Interest Rate Risk in the Banking Book) RWA.

Total cash outflow and inflow for the bank stood at $121,276 million and $14,464 million, respectively, with net cash outflow at $106,812 million.

CBA shares closed the dayâs trade at $73.5 on ASX (as on 13 May 2019), down by 2.52 percent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.