Investing â A continuing process

Mastering the art of investment requires active involvement in a day-to-day dynamic environment of the investments/companies. An investor should pursue the latest development and implications of that development in the investments.

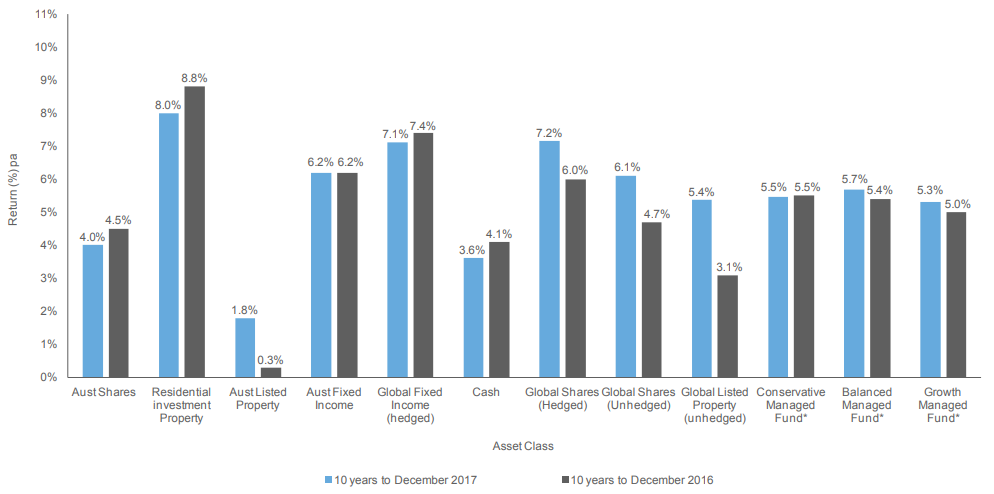

As per the Russell Investments/ASX Long-term Investing Report published for the year 2018, the Australian residential property has been the best performer in terms of returns among all the other asset classes in the period of the past 10 and 20 years to December 2017.

Source: 2018 Russell Investments/ASX Long Term Investing Report

Source: 2018 Russell Investments/ASX Long Term Investing Report

Investments in real asset have certainly fared better than the rest of the asset classes in the past ten or twenty years to 2017. However, the investments in such asset class also require huge figure cheques.

Meanwhile, the rest of the asset classes have also posted decent returns over time. These asset classes, as shown in the image above, include the Australian equity, Australian fixed income, global equity, global fixed income, and funds that invest in similar asset classes.

Investing may seem volatile at times, but the patience of the investors pays off in future. Besides, there would be moments in the markets when they will be headed south, and it is inevitable. At the same time, there would be enough moments when markets are headed north.

Intelligent investors often buy sound companies more when markets are heading south. Even a highly rated company can crash 20% in a day when the markets are going through heavy selloffs backed by some disruptive systematic risks.

Considering the current market scenario with prevailing negative yields on the safe investments (sovereign bonds) in some developed nations, and others having yields in sovereign bonds that range to maximum of 1.746 (Singapore), as of 10 September 2019. Investors have to look for investments that are yielding well above the real interest rate (effective rates - CPI) to provide sufficient cover.

Now we discuss four such equity investments that provide a recurring income, opportunities to grow money and benefit from the market developments.

Dividend Stocks

An investorâs high yielding investment search in the equity domain might end up with these stocks. Dividend stocks or income stocks carry a history of paying dividends to the investors. At the same time, it becomes necessary for a company to earn profits in order to distribute dividends.

Dividends are distributed to the shareholder from the retained earnings or profits of the company. Meanwhile, retained earnings are the previous profits of the company kept aside for future purposes. At the outset, profit-making companies pay dividends; however, it doesnât mean that every profit-making company would pay dividends.

Companies with demonstrated and diversified revenue streams have a better ability to pay dividends in the long run. Besides profits, cash flows of the company play an important role while declaring the dividends.

Dividend pay-out ratio measures the amount of the income distributed by the company in dividends relative to the net income of the company. Maintaining a dividend pay-out ratio is often dependent upon the dividend policy of the company. Nevertheless, capital management of the company also weighs in while the company is distributing dividends.

Companies with stable and mature business are likely to pay better dividends compared to the companies at growing stages. As there is capital outgo on the growth prospects such as the construction of a new building, buying new machinery and so forth.

Dividend yield refers to the percentage of dividend distributed by the company relative to its current price. Suppose a company paid an annual dividend of $5, and the current market price of the companyâs stock is $50. This equates to an annual dividend yield of the 10%.

Abnormal Income

Companies may generate abnormal income at times, that could be an outcome of increased sales revenue due to any abnormal development, profit on the sale of a part in companyâs business, acquisition highly-EPS accretive business etc.

In these cases, companies tend to distribute abnormal income as a special dividend or maybe through conducting a market share buy-back program. Investors should monitor these events carefully, as these developments could pay a reward, and companies often make it clear on how the proceeds from the sale would be utilised.

At times, the market goes through abnormal development. An example of the record dividends paid by one of the established iron ore company BHP Group Limited (ASX: BHP), was during the time, when prices of the iron-ore jumped, following the supply shock in the industry. As a result, the companies recorded substantial growth in revenues leading to a better dividend for the shareholders.

Earlier this year, Woolworths Group Limited (ASX: WOW) had conducted a gigantic off-market buy-back program to distribute the proceeds from the sale of its petrol business. Interestingly, the market buy-back program included an A$24.15 dividend component.

Growth Companies

Growth companies are companies in the process of continuous development and growth. Some attributes of these companies include strong cash flows through revenues, attractive revenue growth, an innovative product, a disruptive product, and anything which differentiates these companies from their peers.

Generally, these companies are in a new to a business environment, or the existence of the company is relatively new in the industry. Growth companies burn more cash than the other companies, as there are many projects to fund, and capital expenditure to accommodate expansion.

Meanwhile, these companies do not pay dividends, and even if they do, the level of dividend amount is likely to be relatively lower. This is because these companies have substantial growth, which needs funding. Therefore, retained earnings are generally invested in growth prospects.

As a growing company, there are substantial opportunities for investors to grow their money along with the company.

Event-Driven Investments

At times some structural changes, policy interventions, and new technologies drive growth in companies that is associated with the similar industry, which could be impacted or have been impacted by such changes.

In the UK, the claims management companies have capitalised very well on the opportunities provided by the PPI complaints and refunds associated with those complaints. Banking companies in the UK have noted the role of these claims management companies in bringing up a number of complaints. Besides, it also means that there is a possibility of abnormal revenue for such claims management companies in the UK.

In Australia, we have seen how gold producing companies have performed this year, following the increase in gold prices. Besides gold, if we look at the cannabis, and lithium scenario, there are similar structural changes, which have sustained increased investments in such growing prospects of the industry.

In addition, the rare earth metal industry is just beginning to go through an interesting phase.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.