Highlights

- Raiden has identified a potential epithermal feeder structure at the Vuzel Gold Project.

- Assays are pending to confirm the grade and nature of the mineralisation.

- Assays from five new drill holes confirm consistent near-surface gold mineralisation.

- Recent drilling has intercepted gold mineralisation ~600m east of the last reported drill holes, significantly expanding the project's footprint.

- Phase 2 drilling program doubled to 4,000m to target additional high-potential zones.

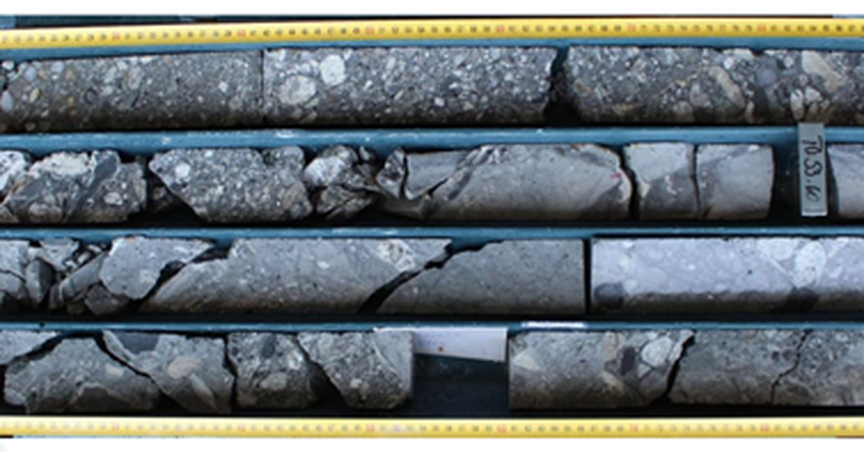

Raiden Resources Limited (ASX:RDN, DAX:YM4) has announced an encouraging update from the ongoing 2025 Phase 2 diamond drilling campaign at the Vuzel Gold Project, located in south-eastern Bulgaria. A visually distinct zone has been intersected during drilling, currently interpreted as a potential epithermal feeder structure. Assay results are pending and will confirm the grade and nature of the mineralisation.

The identification of this potential epithermal feeder structure, combined with continued drilling success, further supports Raiden’s exploration model at Vuzel. Furthermore, the results support the belief that the project hosts an extensive, near-surface gold system with the potential of a high-grade component.

Phase 2 Drilling Program Update

Raiden has expanded its Phase 2 drilling program from 2,000m to 4,000m to further extend the mineralised footprint along strike and explore targets within the 3–4 km mineralised corridor. The expanded program also aims to refine targeting of additional epithermal feeder structures.

Assay results have now been received from five additional holes, all of which successfully intersected near-surface gold mineralisation. Notable intercepts include:

- Hole VZ2520: 19.6m at 0.54g/t Au from surface, including a higher-grade interval of 2.0m at 2.61g/t Au from 12m.

- Hole VZ2523: 4.1m at 1.25g/t Au from 78.6m, including 1.2m at 3.60g/t Au from 80.3m.

Notably, recent drilling has intersected gold mineralisation approximately 600m east of previously reported drill holes, significantly broadening the known mineralised zone at the project.

RDN shares were trading at AUD 0.005 per share at the time of writing on 19 June 2025.

Bottom of Form