Why Dividends Matter to Investors?

In equity investment, dividends are the primary source of income for the shareholders. It could also said to be as a return on investment excluding the capital gain. Besides dividends, companies could also choose other ways to distribute income, which could be - return of capital and on-market share buyback.

Sometimes, receiving dividend from the investments done in the companies is a primary objective of the investors. Globally, the respective governmentâs fixed income securities of some of the developed countries are yielding in negative terms, while most of the countries, including Australia, are yielding close to one or just above.

Meanwhile, the sovereign bond yields in the emerging markets are relatively attractive. However, the escalated uncertainty in global trade has only pushed them lower.

In such a scenario, it appears quite justified for the investors to look out for high-yielding dividend (high annual dividend yield) stocks. Dividends provide investors with a stream of income, excluding the capital gains/loss from the investments.

Companies follow specific procedures before announcing any dividend, which includes an in-depth review of potential capital requirements, dividend policies, contingent liabilities, provisions etc. Besides, the main source of dividends for the companies is profit, and if companies are not making profits, it is highly unlikely that any dividend would be paid by them.

Some companies follow policies that direct them to maintain high pay-out ratios along with growth. Pay out ratio refers to the amount of income distributed to shareholders relative to the total profits of the company.

Definition of Dividend Yield

The dividend yield is the percentage of dividends distributed by the company relative to its stock price. Hence, it should be noted that skyrocketing stock price results in lowering the annual dividend yield of the stock. Conversely, when the stock prices are crashing, the annual dividend yield on those crashing stocks inches up higher.

Letâs take an example, consider the stock of ABC Limited closed at a price of $10, and annual dividend distributed by the company was $1, which equates to an annual dividend yield of 10% (1/10*100). Now, if on the next day, the stock price of ABC Limited closes at $12, while there is no change in the annual dividend, the annual dividend yield at a stock price of $12 would be of 8.33% (1/12*100).

Dividends You Should not Miss

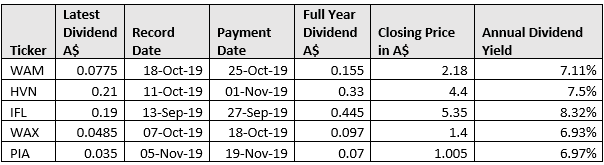

The stocks have recently announced dividends, and the record dates of these dividends have not passed as of now. The details are mentioned below, as on 4 September 2019.

WAM Capital Limited (ASX: WAM)

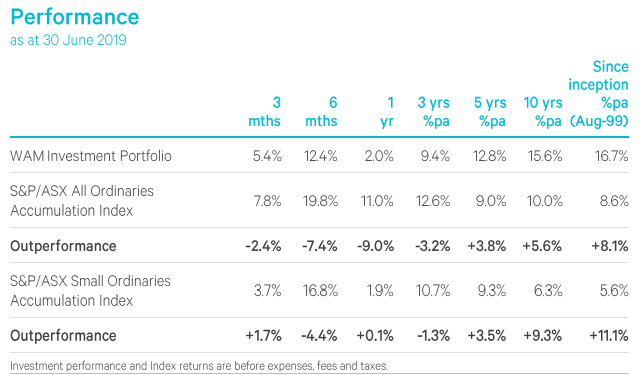

WAM Capital Limited is a listed investment company, managed by Wilson Asset Management. On 20 August 2019, in its full-year results for the period ended 30 June 2019 the company has recorded operating revenue of $25.79 million, down 86.3% over the previous corresponding period due to the subdued performance of financial investments.

Performance (Source: WAMâs Full Year Results)

Reportedly, the company generated net profit after income tax standing at $14.53 million for the period, which was down 88.4%. WAM declared a fully franked dividend of 7.75 cents per share to be paid on 25 October 2019 to the shareholders, with a record date of 18 October 2019.

Meanwhile, the full year dividend for the year was 15.5 cents per share, which equates to an annual dividend yield of ~7.11% at current market price.

On 04 September 2019, WAMâs stock last traded A$2.18, flat from the previous close.

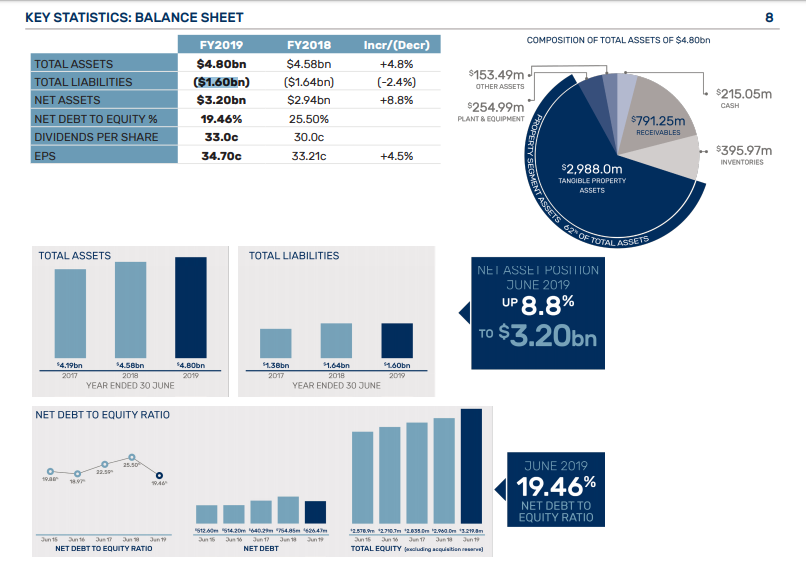

Harvey Norman Holdings Limited (ASX: HVN)

Harvey Norman is an Australian retailing company, which operates under the franchise system. It operates a few brands in the country, and it primarily consists of integrated retail, property, franchise, and digital enterprise.

During its full-year results release last month, the company had announced a fully franked dividend of AU 21 cents per share to be paid on 1 November 2019 to the shareholders on record as on 11 October 2019.

Balance Sheet Statistics (Source: HVNâs Presentation of Results for FY19)

More importantly, the latest dividend took the total dividend for the year to 33 cents per share, equating to an annual dividend yield of ~7.5% at the current market price.

On 4 September 2019, HVNâs stock last traded flat at A$4.4.

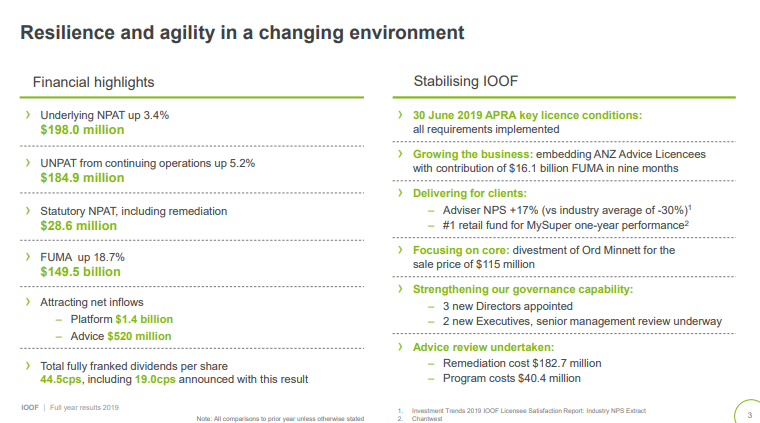

IOOF Holdings Ltd (ASX: IFL)

IOOF Holdings is a financial services company engaged in financial advisory, portfolio administration, investment management and wealth management.

In August 2019, the company had released full-year results for the period ended 30 June 2019. Despite increasing provisions, the company had distributed the income of 44.5 cents per share in FY2019.

Full Year Highlights (Source: Investor presentation - IOOF FY 2019 results)

Meanwhile, the latest 100 percent franked declared dividend of 19 cps has a payment date of 27 September 2019 for the shareholders on record on 13 September this year.

At the market close, IFLâs stock was at A$5.35, up by 1.518% relative to the previous close. At this price, the annual dividend yield of the stock equates to ~8.32%.

CSR Limited (ASX: CSR)

CSR Limited is a building products manufacturer in both Australia and New Zealand regions. Some of its products include Gyprock⢠plasterboard, Monier⢠rooftiles, PGH⢠bricks and pavers, and Bradford⢠insulation.

In its full-year results (ended 31 March 2019) released in May this year, the company announced a dividend of 13 cents per share, which was paid on 2 July this year.

Dividends (Source: CSR Limited Results Presentation, May 2019)

More importantly, CSR Limited had distributed a total income of 26 cents per share in FY2019.

On 4 September 2019, CSRâs stock last traded at A$3.71, down 6.549% relative to the prior close. At this price, the annual dividend yield equates to ~7.0%.

Pendal Group Limited (ASX: PDL)

Pendal Group is an investment management company based in Australia. It offers a range of managed funds to the Australian investors.

In its half year results (ended 31 March 2019) release in May 2019, the company had distributed 10% franked dividend of 20 cents per share, which was paid on 26 June 2019.

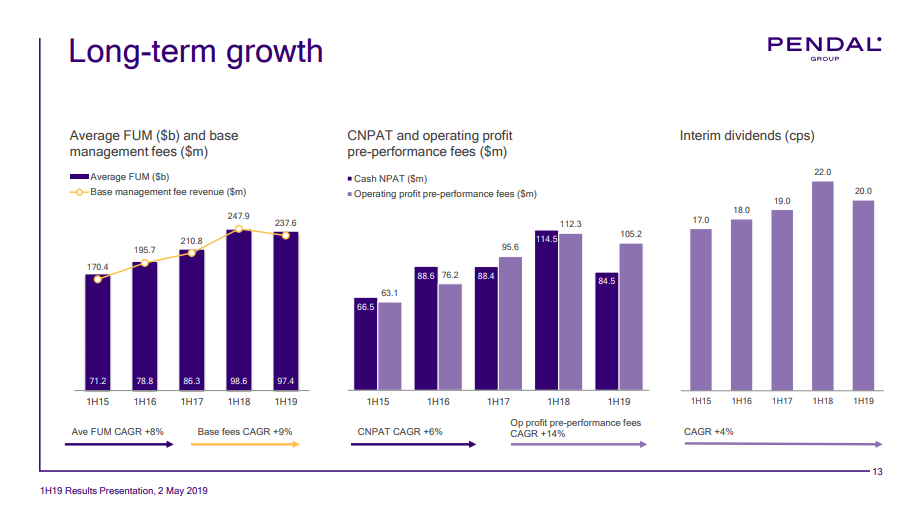

Yearly Growth (Source: PDLâs 2019 Interim Profit Announcement, May 2019)

Meanwhile, in FY2018, the company had distributed 52 cents per share for the full year equating to an annual dividend yield of ~7.85% at current market price.

On 4 September 2019, PDLâs stock last traded at A$6.62, down by 1.341% relative to the prior close.

WAM Research Limited (ASX: WAX)

WAM Research is a listed investment company, managed by Wilson Asset Management.

In its full year (closed 30 June 2019) results released last month, the company had depicted lower performance compared to the previous years, due to subdued performance of financial investments.

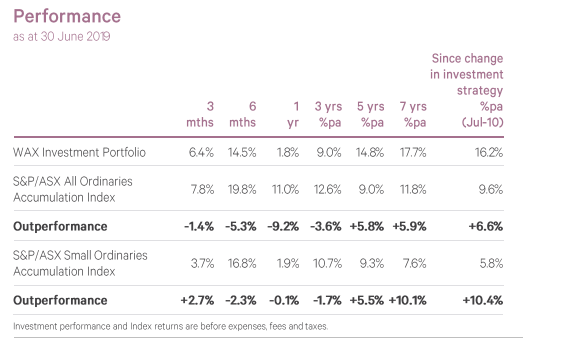

Fund Performance (Source: WAXâs 2019 Full Year Results)

Meanwhile, WAX had announced a dividend of 4.85 cents per share payable on 18 October 2019 to the shareholders, in records on 7 October 2019.

Besides, the company had distributed 9.7 cents per share for the full year 2019, which equates to an annual dividend yield of 6.93% at current market price.

On 4 September 2019, WAX last traded at A$1.4, up by 1.449% relative to the previous close.

Pengana International Equities Trust (ASX: PIA)

Pengana International Equities Trust is a listed investment company of Pengana Capital Group Limited (ASX: PCG). The trust actively manages the core portfolio of thirty to fifty ethically screened companies across developed and developing international markets.

In its full-year results (ended 30 June 2019) release, the company had depicted lower performance compared to the previous, primarily attributing to subdued performance of financial investments.

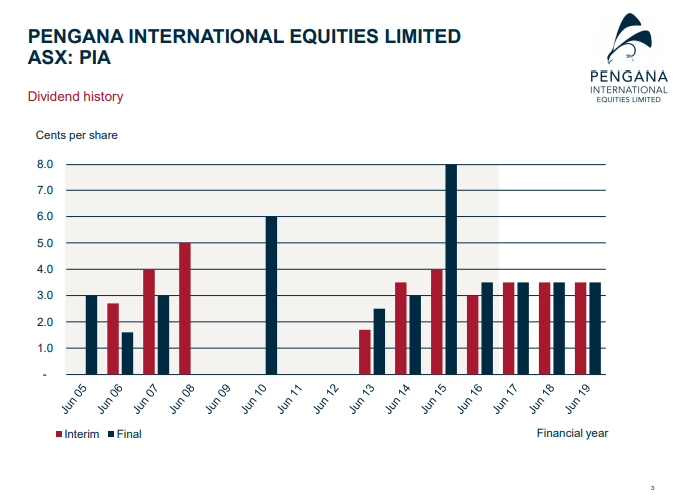

Dividend Growth (Source: Shareholder Presentation PIA Results 30 June 2019)

Meanwhile, PIA had announced a dividend of 3.5 cents per share (67.14% franked) to be paid on 19 November 2019 to the shareholders, and in records on 5 November 2019.

More importantly, in FY2019, the company had distributed a total income of 7 cents per share, equating to an annual dividend yield of ~6.97% at current market price.

On 4 September 2019, PIAâs stock last traded at A$1.005, down by 0.495% relative to the previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.