In this article, the three financial services companies being discussed are engaged in the businesses of financial advisory, investment management and platform operator. Following the Royal Commission enquiry on the mismanagement taking place in Banking, Superannuation and Financial Services sector, the landscape of the industry has changed drastically with stricter norms and regulations. Meanwhile, the larger financial institutions are considering exiting the advice business, which provides substantial opportunities for the companies to access the market.

Let us now go through the three stocks to get acquainted with them.

IOOF Holdings Limited (ASX: IFL)

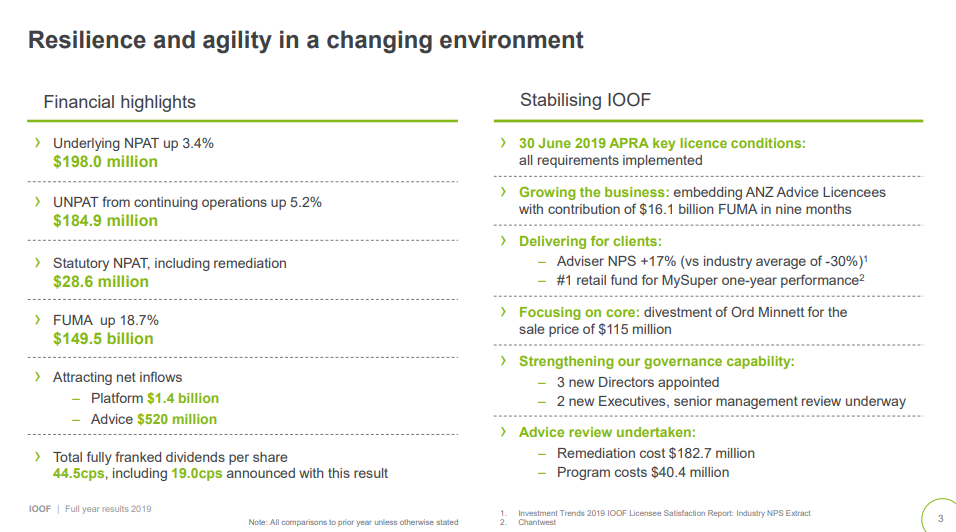

On 26 August 2019, the company came up with full-year results for the period ended 30 June 2019. Accordingly, the company generated statutory NPAT of $28.6 million in FY2019, down by 67.7% from $88.3 million in the pcp. Besides, the revenue was up by 40% to $1.06 billion for the period compared to $758 million in the previous period.

Meanwhile, the total FUMA or funds under management & advice grew by 18.7% to $149.5 billion as recorded on 30 June this year. Despite lowering profits and swelling provisions, a fully franked dividend of 19 cents per share was announced, which is payable on 27 September 2019 to the shareholders in record on 13 September 2019.

Highlights (Source: IOOF FY 2019 Results)

Among all other things that had taken a toll on the profits, the notable items appear to be the ADG remediation costs at $235.27 million, collectively impairment & amortisation on assets was over $50 million, and acquisition costs accounted for over $23 million.

Following Royal Commission, IOOF had been under pressure by the outcomes of investigations on the business conduct, and it would start to transform the business as stated by CEO â Renato Mota. The release by the company noted that the company has been working on improving governance, framework, risk management and practices. In June, the company had announced the sale of Ord Minnett for $115 million.

Reportedly, IOOF is looking to focus on core wealth management business, and integration of ANZ Advice Licensees was completed while ANZ P&I would be completed soon. By the end of 2021, it intends to be a single platform, thus simplifying the business.

Meanwhile, the company completed advice review and found inadequate business practices used by the advisors, which resulted in provision for remediation costs. Besides, the business performance saw net inflows of $1.4 billion, and awards received by Investment Division for MySuper fund performance by Chant West.

IOOF intends to maintain the dividend pay-out ratios with a target of 60-90% of Underlying Profit After Tax. Admittedly, the payments related to remediation, transformation, acquisitions & divestments would be considered. The company would review the balance sheet post ANZ P&I transaction, and it might look to capital management initiatives like buy backs or additional special dividends.

Outlook

As per the release, the company intends would work towards restoring trusts, and it would stick to the strategy of âStabilise, Transform, Prosperâ. The company also sees the opportunity in the market with increasing per capita wealth, an ageing population with large retirement income systems.

Besides, the exit of banks from the wealth management segments provides more opportunities, and IOOF would continue to consider the stakeholders to deliver robust outcome and better services.

On 26 August 2019, IFLâs stock last traded at A$4.84, down by 6.923% from the previous close.

Pendal Group Limited (ASX: PDL)

Global Asset Manager, Pendal Group is approaching to its 52-week low of $6.47. By the close of the trading session on 26 August 2019, the stock was at A$6.52, down by almost 2.541% from the previous close.

In its latest fund management update, the company was managing $101.3 billion as at 30 June 2019, up by 0.4 billion over the previous quarter. Besides, the net flows during the quarter had resulted in a decrease in annualised fee income of $10.9 million.

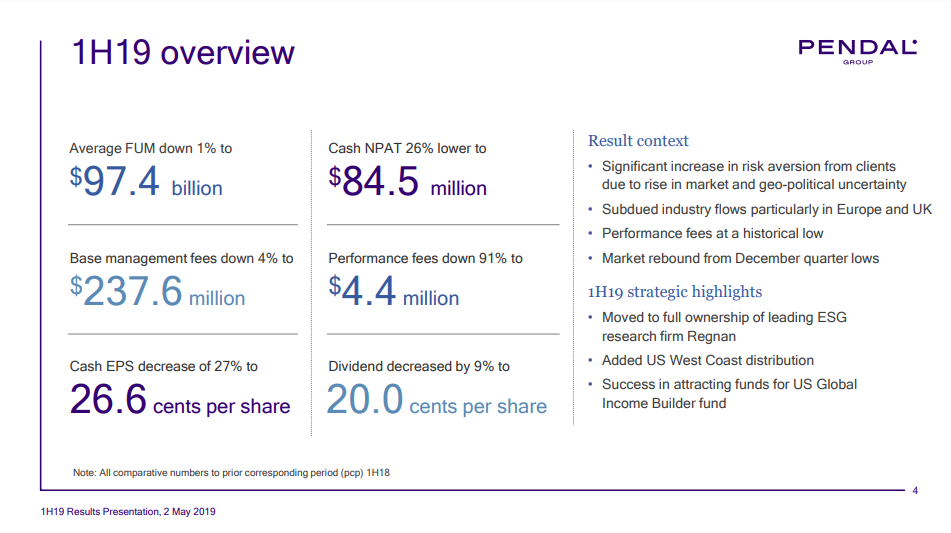

First Half Highlights (Source: PDLâs Presentation, May 2019)

Since the release half-year results, the stock of the company has seen sharp declines. In May 2019, the company had reported the interim results (half-year) for the period ended 31 March 2019. Evidently, the performance revenues were down by 91% to 4.4 million in 1H19 compared to $47.6 million in 1H18. The total fees revenue was down 18% to $243 million in the first half of 2019 against $296.5 million in the previous corresponding period.

Reportedly, the initial half of the year saw volatile markets globally with a decline in the December quarter and some recovery in the March quarter. Besides, the Brexit uncertainty had impacted the investor sentiment in Europe. Meanwhile, the statutory net profit after tax was down 37% to $69.6 million for the period compared to $110.1 million in the previous corresponding period.

Funds Under Management

Reportedly, the group witnessed resilient net inflows in the Australian business during the period; however, the fund flows were impacted by Brexit uncertainty in the UK/European OEICs. Also, $1.7 billion of net outflows were recorded in the OEICs, which were led by European equities. Meanwhile, Asian equities also saw net outflows. Whereas, Australian equities, cash, and fixed income record net inflows during the period.

Outlook

The company had acknowledged the challenging first half in 2019 with weak investment performance in the December quarter. Admittedly, the March quarter had depicted the signs of recovery while an increased uncertainty impacted the investor sentiments.

Meanwhile, the company was positioned to capitalise on opportunities to expand the presence in the global market, which is backed by a strong balance sheet with no debt and sound cash flows. Besides, the company remains focused on expanding investment and distribution capabilities.

Over the past three months, the stock of the company has delivered a return of -14.78%.

Netwealth Group Limited (ASX: NWL)

Recently, the group has disclosed full-year results for the period ended 30 June 2019. The revenues were up by 18.6% to $98.77 million in FY2019 compared with revenues of $83.26 million in FY2018.

Besides, the company generated a statutory profit of $34.3 million in FY2019, up by 64.7% from $20.8 million in FY2018. Meanwhile, the underlying NPAT was $36 million for the period, up by 23.9% compared to $29 million in FY2018.

Highlights (Source: NWL 2019 Results Presentation)

Following the Royal Commission, the company conducted comprehensive reviews back to the date when superannuation license was granted to the company. Subsequently, the company made non-recurring payment of $1.1 million for client rectifications and legal expenses.

Reportedly, the fund under administration (FUA) increased to $23.3 billion by the end of FY2019, and the FUA growth in the past three years was in excess of $1 billion per quarter. In FY2019, the FUM grew by a record $5.4 billion.

Besides, the company operates in the Australian Retail Platform market, which has a size of $859 billion. In the 12 months preceding March 2019, the market share of the company had increased to 2.5%. During FY19, the company had invested in its platform technology & functionality, which included a new portal for advisors and clients, annuities were added to the platform and ongoing improvements in the reporting suite.

FUA Growth

As per the release, the FUA growth has been driven by existing clients (financial intermediaries), which accounted for 75% of the FUA growth in FY2019. These clients added new member accounts to the platform, and at year end, the company had 2,579 financial intermediaries. Meanwhile, the company added 308 new financial intermediaries, which contributed to 25% of the FUA increased in FY2019.

Funds Under Management

Reportedly, the funds under management were $3.9 billion as of 30 June 2019, up by 38.7% or $1.1 billion from 30 June 2018. The increase was attributed to net inflows of $0.9 billion, and $0.2 billion in market movement.

Outlook

Reportedly, the company intends to maintain the increase in investment in IT infrastructure, people and software for FY2020, and theses strategic investments would maintain technology leadership and scalability.

Meanwhile, by June 2020, it expects to exceed $7 billion in FUA net inflows and $30 billion in FUA. Besides, the company anticipates a contraction in EBITDA margin compared to the FY2019, owing to pricing strategies and increase in investments.

On 26 August 2019, NWL last traded at A$7.35, down by 4.421% from the previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.