In recent times, businesses are pacing up at colossal rates to build steady portfolios and channelisethe profit paths. With a chunk of attention towards generating profits and coping with the dynamic drifts of the economic and business environment, the need for external management came into existence. Eventually, this business of external managers became mainstream, and currently, is a booming business altogether across the world.

What is Asset Management?

Avoiding the jargons, asset managementcan be described as management of investments on behalf of others. It includes two parties, namely the client and the asset manager. The asset manager takes charge to manage the entire or part of the clientâs portfolio. Asset managersare usually financial institutions, investment banks or even an individual. Ideally, the clients are usually government organisations, financial intermediaries and corporations or high networth individuals.

The maingoal of the asset manageris to contribute to the appreciation of the clientâs assetswhile shunning risks by determining the right investments to tap.

The most famous asset managers across the globe include BlackRock, The Vanguard Group, UBS, State Street Global Advisors, Fidelity Investments, Allianz and J.P. Morgan Asset Management.

Asset Management in Australia:

Australia has one of the worldâs largest asset management markets with a savings pool worth of over $2 trillion. This is driven by a robust superannuation fund, investment management industry and the future fund. There is an open stance for foreign investors in this regard, which is backed up by legislative refinements and regulatory policy pronouncements- The Corporations Act 2001, The Australian Securities and Investments Commission and the Australian financial services licence regime.

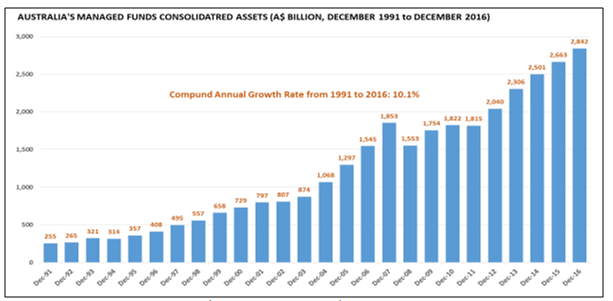

As per the Governmentâs 2017 update, Australia had the worldâs fourth-largest alternative assets under management amounting to $275 billion, and the sixth-largest managed fund assets under management amounting to $1.6 trillion. The $2.8 trillion investment management industry was deemed to be the largest in the Asian region, with FUM being 60% higher than the market cap of the equity market as a whole. FUM had doubled over the past decade, given the introduction of Australiaâs mandatory retirement income scheme in 1992.

Australiaâs MF Assets growth over the years (Source: Government Report)

The country has a mandatory pension scheme, which is domestically referred to as the superannuation. These are major investors in the domestic and global capital and investment markets. As at 30th June 2017, Australiaâs total superannuation industry assets were valued at $2.5 trillion. The 2018â19 Federal Budget placed great emphasis on âprotecting your superâ package, and subject to Federal Parliamentâs call, this was to commence from 1st July 2019.

Australiaâs superannuation asset projection (Source: Government Report)

The funds management services industry revenue is most likely to grow at an annualised 3.1% to be recorded at ~$9 billion over the five years from 2022 to 2023.

In the context of this backdrop, let us look at threeasset management firms, their recent updates and stock performance on the Australian Securities Exchange,

Platinum Asset Management Limited (ASX: PTM)

Company Profile: Accoladed with the Morningstar Australian Fund Manager of the Year 2018, PTM is one of Australiaâs most trusted managers, with the main focus on international equities. It was founded in 1994 and had ~$24 billion in total funds under management as on 31st December 2018. The Platinum International Fund has a compound return of ~12.3% per annum, since 1995. The companywas listed on the ASX in 2007 and has its registered office in Sydney.

Stock Performance: After the close of market on 19 July 2019, the companyâs stock was valued at A$4.76, down by 0.211 per cent, from its last close, with a market cap of A$2.79billion and ~586.68 million outstanding shares. With a P/E ratio of 17.12x, the YTD return of the stock is negative 1.45 per cent. In the last one, three and six months, the stock has delivered returns of +3.49 per cent, -3.06 per cent and +0.64per cent, respectively.

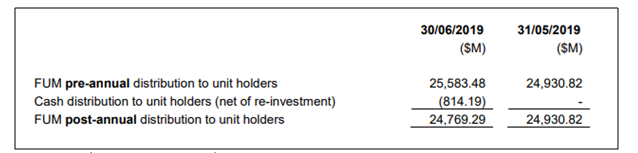

Funds Under Management: On 9th July 2019, the company provided an update regarding June 2019 FUM, stating that there were net outflows of approximately $228 million in the month, including the net outflows from the Platinum Trust Funds of approximately $151 million and excluding the impact of distribution re-investment of $487 million.

June 2019 FUM (Source: Companyâs Report)

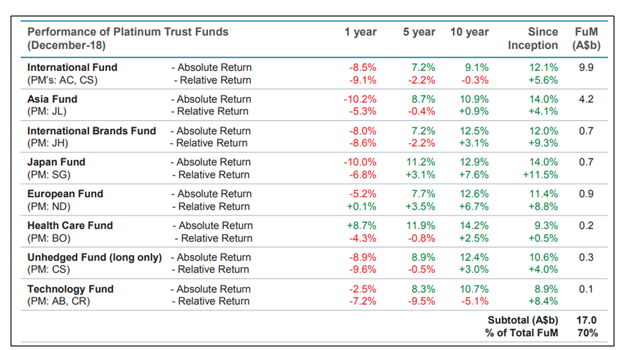

H119 Highlights: In February this year, the company released its business report for the six months to December 2018, stating that Average Dec-18 AUM was $25.2 billion. Net inflows of $0.7 billion were led by Platinum Trust Funds. Overall, profit after tax and the EPS were down by 27%. The companyâs investment performance is highlighted under:

December investment performance (Source: Companyâs Report)

Pendal Group Limited (ASX: PDL)

Company Profile:An independent, global investment management business, PDL attracts and retains superior investment talent by offering a transparent remuneration model. As at 30th June 2019, the company had $101.3 billion in funds under management, making it count amongst Australiaâs largest and most enduring pure investment managers. The company does not have a âhouse viewâ and it is operational viaa multi-boutique style business, which has a basket of investment strategies. PDL was listed on the ASX in 2007 and has its registered office in Sydney.

Stock Performance: After the close of market on 19 July 2019, PDLâs stock was valued at A$7.44, up by 1.918 per cent, from the previous close, with a market cap of A$2.32billion and ~318.01 million outstanding shares. With a P/E ratio of 14.17x, the YTD return of the stock is negative 4.95 per cent. In the last one, three and six months, the stock has delivered returns of +2.24 per cent, -16.09 per cent and -5.81 per cent, respectively.

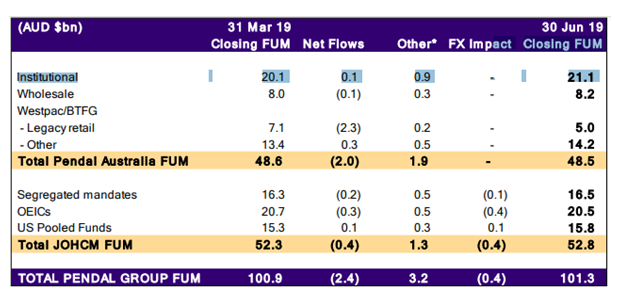

Funds Under Management: On 11th July 2019, the company released its Funds Under Management update for the quarter ended 30th June 2019. The FUM for the period was up by $0.4 billion. The net outflows amounted to $2.0 billion, driven by the Westpac redemption worth of $1.5 billion. JOHCM witnessed net outflows of $0.4 billion for the period, driven by net outflows of European OEICs worth $0.5 billion and emerging markets strategies outflow of $0.4 billion in the institutional channel.

PDLâs FUM (Source: Companyâs Report)

As an outcome of the net flows, during the period, PDLâs revenue declined to an annualised fee income of $10.9 million. The strengthening of the Aussie dollar, relative to the British Pound amidst the weakening of the US Dollar, affected the FUM by -$0.4 billion.

Looking at the performance fees of the company for the quarter in discussion, approximately $1.6 million in revenue had been realised compared to $6.9 million for FY2018.

Keeping an open eye towards PDLâs prime upcoming events, the company will be announcing its full year results on 6th November 2019 and conduct its Annual General Meeting on 13th December 2019.

Pinnacle Investment Management Group Limited (ASX: PNI)

Company Profile: Consisting of affiliated boutiques to provide access to a portfolio of investment managers, PNI has various complementary investment styles. The company believes that investment management requires a âboutique environmentâ topped with âinstitutional resourcingâ. Its business model considers various investment managers under one âumbrellaâ, which is believed to make the model robust when compared to single investment managers. With its registered office in Brisbane, the company was listed on ASX in 2007.

Stock Performance: After the close of market on 19 July 2019, the companyâs stock was valued at A$4.45, up by 0.225 per cent from its prior close, with a market cap of A$811.94 million and ~182.87 million outstanding shares. With a P/E ratio of 29.21x, the YTD return of the stock was of4.47 per cent. In the last one, three and six months, the stock has delivered returns of -13.62 per cent, -22.24 per cent and -9.76 per cent, respectively.

Market update regarding Blue Sky Alternative Investments Limited: On 25th April 2019, the company notified the market that it had affirmed to the assertions made by Blue Sky against few former Blue Sky employees, and that Pinnacle and Riparian Capital Partners Pty Ltd(who had no assets under management) had teamed up to the proceedings as respondents. The respondents will defend themselves.

Later, on 7th June 2019, the company notified that the proceedings of the above issue had been resolved in confidential terms by all the involved parties.

Rapid Insights Conference:On 30th May 2019, PNI presented at the Rapid Insights Conference, stating that its FUM at 30th April 2019 was $52.1 billion compared to the $46.7 billion at 31st December 2018. The company deems itself to be the countryâs âmulti-affiliateâ investment firmand pays importance to the succession planning within Affiliates.

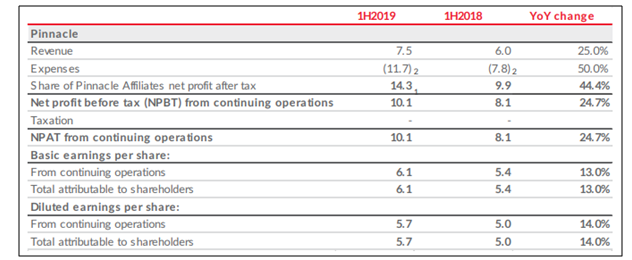

As recorded on 22nd February 2019, the companyâs share of Affiliatesâ NPAT amounted to $14.3 million, which was up by 44% from $9.9 million in pcp. In the first half of FY19, PNI acquired a 40% interest in Omega Global Investors. The financial summary of the company is provided under:

PNIâs Financial Highlights (Source: Companyâs Report)

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.