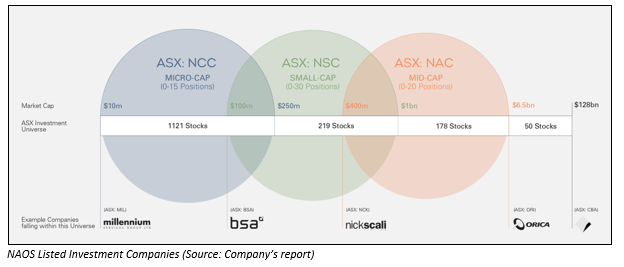

NAOS Small Cap Opportunities Company Ltd (ASX: NSC) is a specialist fund manager, headquartered in Sydney. NSC aims at Australian listed small cap companies, to give genuine and concentrated exposure to the companies which are outside of the ASX-50. NAOS Asset Management Limited has three investment companies listed under it. These are NAOS Emerging Opportunities Company Limited (ASX:NCC), NAOS Ex-50 Opportunities Company Limited (ASX:NAC) and NAOS Small Cap Opportunities Company Limited (ASX:NSC).

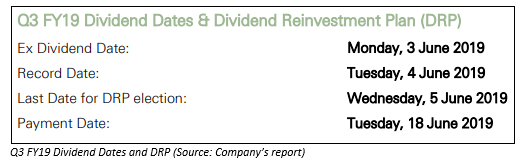

On Friday 17th May 2019, NAOS Small Cap Opportunities Company declared a fully franked quarterly dividend of one cent per share for the 3-month period ending 31st March 2019.

The company announced Dividend Reinvestment Plan. The DRP gives shareholders the right to elect and receive their dividends in shares rather than in cash. These shares would be acquired on the market after the post-tax NTA value is greater than the share price as at the record date. This would avoid any possibility of dilution to the Companyâs NTA and assist with closing the share price discount to NTA.

To participate in the DRP, shareholders were notified to submit their respective DRP election, not later than 5:00 PM on 5th June 2019.

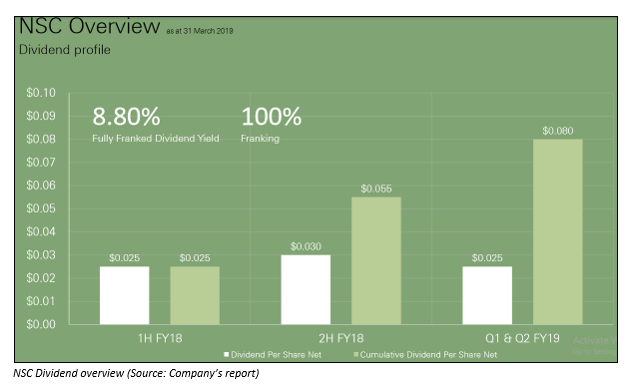

The Annual dividend yield of NSC is currently at 10.57%.

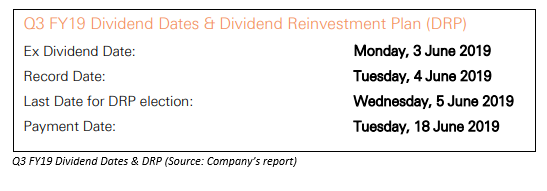

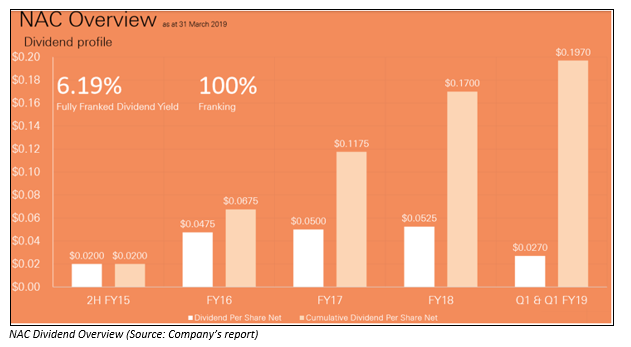

Further, NAOS Ex-50 Opportunities Company Limited (ASX: NAC) too announced fully franked dividend of 1.35 cents per share for the three-month period ending 31 March 2019. The company announced DRP and to participate in same, shareholders were notified to submit their respective DRP election, not later than 5:00 PM on 5th June 2019.

The Annual dividend yield of NAC is currently at 7.8%.

Additionally, on 20th May 2019, NAC announced an on-market buy-back of up to 10% of its ordinary shares on issue. A total of 52,536,889 shares are in issue. The Buy-back program would most likely start from 5th June 2019 and go on, up to a period of 12 months. The board considers this program to be an effective utilisation of the capital and beneficial for shareholders, as it is at a discount accretive to NTA per share. The directors together hold over 7.5 million shares in the company.

Share Price Information:

NAC:

The shares of NAC closed the dayâs trade at A$0.875 on ASX (as on 20 May 2019), up by 4.167% as compared to its previous dayâs close price. The market capitalisation of the company is A$44.13 million. The 52-week high and low of the share was A$1.040 and A$0.795 respectively. In the past one year, the stock has delivered a return of -16.00%, and the YTD return is at -5.62%.

NSC:

The shares of NSC closed the dayâs trade at A$0.610 on ASX (as on 20 May 2019), down by 0.813% as compared to its previous dayâs close price. The market cap of the company amounts to A$103.64 million. In the last one year, the stock has delivered a return of -25.90%, and the YTD return stands at -6.82%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.