IOOF Holdings Limited (ASX: IFL) is engaged in the financial services with its operations in portfolio management, advisory, distribution and superannuation administration, investment management and trustee services.

The company today, on 13th May 2019, updated on the acquisition progress of Australia and New Zealand Banking Group Limitedâs (ANZ) One Path Pensions and Investments business (P&I Acquisition).

After the completion of the acquisition by IOOF of the ANZ Aligned Dealer Groups on 2nd October 2018, IOOF and ANZ have worked together towards the completion of the P&I Acquisition.

The successor funds transfer has been completed, which was an important criteria to distinguish the ANZ P&I business products from OnePath Life and was a condition to completion of the P&I acquisition.

The coupon rate has been reset to 2% from 14.4% per annum on the debt note subscribed by IOOF from ANZ, as per the contractual arrangements. IOOF can now redeem the note, and if they do so, then the proceeds will be applied to the balance held for transaction completion and the drawn debt.

The completion of the P&I acquisition is subject to the receipt of notices confirming no objection about the proceedings from OnePath Custodians and ANZ. IOOF continues to work with OPC and ANZ to provide the information and resources necessary to facilitate those notices being given.

From 5th July 2019, recent amendments to the Superannuation Industry Act 1993 will be implemented, which gives APRA an approval power with respect to the acquisition of controlling stakes in Registrable Superannuation Entity licensees (such as OPC). The receipt of such approval from APRA may also become a condition to completion of the P&I acquisition, depending on the timing of the receipt of any notices of no objection from OPC and ANZ.

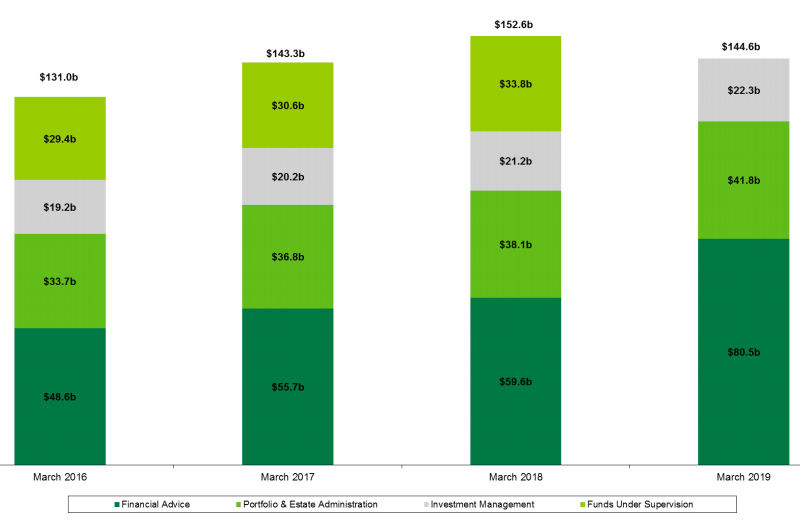

The company in the recent past has reported that it has experienced net inflows of $337 million in funds under management, administration and advice (FUMA) for the third quarter of the 2019 financial year.

Portfolio and Estate Administration reported $183 million net inflow with the prior comparative period net inflow of $346 million. The Financial Advice segment had a $263 million net inflow as compared to $736 million net inflow in the prior corresponding period. And the Investment Management reported $129 million net cash outflow for the reported period.

Funds by Segment (Source: Companyâs Report)

Funds by Segment (Source: Companyâs Report)

IOOF reiterated the expected revenue impact of approximately $3 million for the removal of exit fees in FY20 as highlighted in the presentation of the 1H19 results. Additionally, the impact from other Protecting Your Super measures is $5 million in FY20, which includes a 3% cap on fees and changes to inactive low balance accounts. The cumulative aggregate impact of Protecting Your Super legislative changes is therefore expected to be $8 million in FY20.

On the price-performance front, at market close on 13th May 2019, the stock of IOOF Holdings Limited was trading at $5.820, with a market capitalization of $2.09 billion. The stock has yielded a YTD return of 18.09% with returns of -16.57%, 11.86% and -7.62% over the past six months, three months and one-month period, respectively. Its 52-week high price stands at $9.660 with a 52-week low price of $4.195 and an average trading volume of ~1.81 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.