We would discuss three stocks from diverse sectors with recent updates on them. The Australian benchmark index ASX 200 was at 6,818, up by 0.6% or 41.3 points from the previous close, as on 25 July 2019.

Automotive Holdings Group Limited (ASX: AHG)

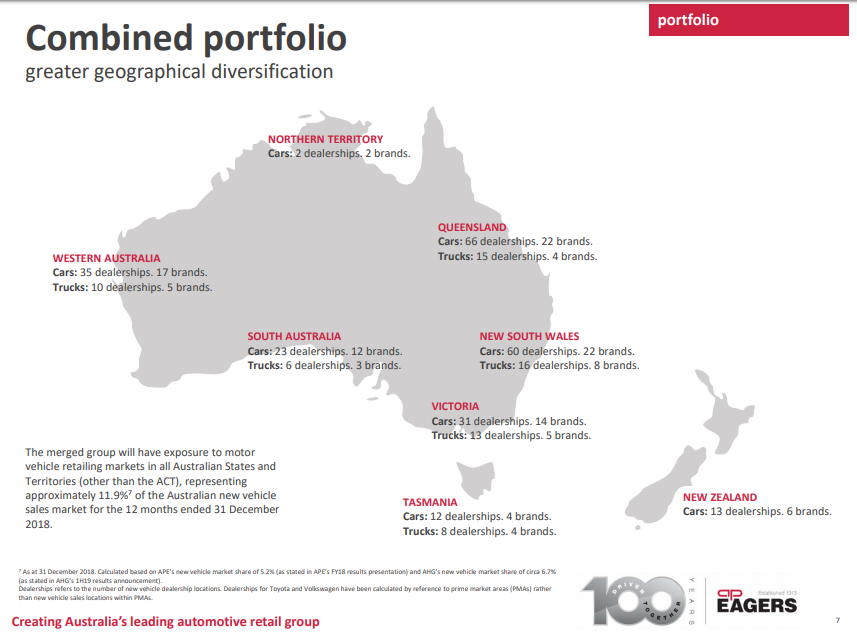

Automotive Holdings Group Limited (ASX: AHG) operates in Australia and New Zealand region, and is an ASX-listed entity with business interests in diversified automotive. Besides, it is equipped with divisions of retail and logistics. Recently, it divested its motorcycle business - KTM Sportmotorcycles and HQVA, and it leverages a few subsidiaries to operate in the Australian market.

On 25 July 2019, the company announced that the competition regulator of Australia has given a nod to the proposed acquisition of AHG stock by A.P. Eagers Limited (ASX: APE). Nevertheless, the Australian Competition and Consumer Commission (ACCC) had demanded an undertaking by A.P. Eagers Limited to divest the Kloster Motor Group.

Combined Portfolio (Source: Investor Presentation, April 2019)

Reportedly, the AHG Board has maintained the recommendation to accept the offer, considering the absence of a superior proposal (as announced on 7 May 2019). Also, the Board asserted to accept the proposal once AP Eagers has waived the No Material Adverse Change bid condition. Further, APE has claimed to waive the No Material Adverse Change bid condition concurrently with merger authorisation.

Recently, it has been reported that the merger authorisation is anticipated by 16 August 2019, which would consider that no sufficiently interested other parties apply for a limited review of the ACCCâs determination until 16 August 2019.

According to ACCC, the approval has been granted following an undertaking from A.P. Eagers to sell the existing new car dealerships in the Newcastle and Hunter Valley to a third party. The competition regulator noted the fact that the merger in Melbourne, Sydney and Brisbane was not alarming due to the enough competition available in the region. Notwithstanding, the fact that AHG is APEâs closest competitor in the Newcastle and Hunter Valley region, and concerns were raised, subsequently. Besides, in line with the court enforceable undertaking, AP Eagers divestment must be sold to an approved independent purchaser by ACCC.

ACCC Commissioner, Stephen Ridgeway, said that the combined entity would operate half of the seventy-eight dealerships in the Newcastle and Hunter Valley area, and the composition in the metropolitan Newcastle was even more skewed towards the combined entity that would sell the top ten car brands. Besides, the approval in this area would have resulted in subdued competition leading to higher prices for new cars to be paid by customers. Importantly, AP Eagersâ divestment means that there would be more dealer concentration in the area.

AHG also updated the Seventh Supplementary Bidderâs Statement by APE on ASX, which acknowledges the stance of the AHG Board on the merger, merger authorisation, divestment of Kloster Motor Group and the fact that APE Board had unanimously passed and approved the Seventh Supplementary Bidderâs Statement.

On 25 July 2019, AHGâs stock last traded at A$2.94, up from 1.379% from the previous close. Over the past one year, the return of the stock has been +7.55%. The performance of the stock over the past three months and one month has been +16.8% and +4.01%, respectively.

IOOF Holdings Ltd (ASX: IFL)

Founded in 1846 as a friendly society, now among ASX top 200 company, IOOF Holdings Ltd (ASX: IFL) has been a provider of financial products, services and advice. It operates through the major metro regions of Australia, with a customer base of close to half a million, according to the latest available information.

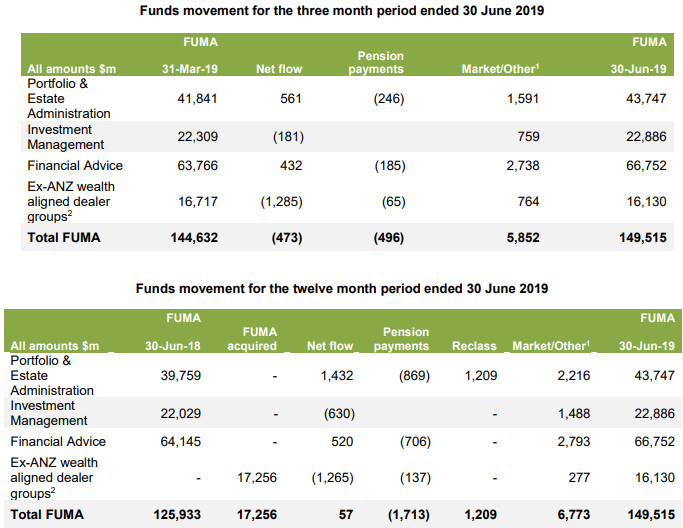

On 25 July 2019, the company reported on the Funds Under Management, Advice & Administration (FUMA) as on 30 June 2019. Accordingly, FUMA was recorded of $149.5 billion (as on 30 June 2019). Also, it represents an increase of 18.7% or $23.6 billion on pcp and an increase of $7.5 billion or 5.9% after excluding the acquisition of dealer group funds under advice from ANZ Wealth.

Reportedly, the company also witnessed a strongly positive market reaction to the recently launched IOOF Insignia Wrap range (BT badge). Also, the range of funds continued to attract strong inflows and reached over $5.6 billion in funds under advice since its launch eight months ago. Besides, EX-ANZ wealth dealer group witnessed a departure of one practice acquired by the third party, and the funds under advice stood at $1.3 billion, which does not significantly impact the licensee revenue. Further, the Investment Management witnessed net outflow due to the redemptions associated with pension payments, and to some extent, these were partially offset by gains from new advice relationships.

Net Flows

As per the release, the net flows through the segment for the quarter ended 30 June 2019 were as below:

- Portfolio & Estate Administration: the segment saw a net inflow of $561 million against a net inflow of $666 million in the prior comparative period.

- Financial Advice: the segment witnessed a net inflow of $432 million compared to 2.5 billion in the prior comparative period, which included a large client transfer of approximately $2 billion.

- Investment Management: the segment recorded net outflow of $181 million against a net inflow of 130 million in the prior comparative period.

Funds Movement (Source: Companyâs Report)

On 25 July 2019, IFLâs stock last traded at A$5.87, up by 6.922% from the previous close. Over the past one year, the return of the stock has been -39.26%. The performance of the stock over the past three months and one month has been -17.73% and +2.07%, respectively.

Abacus Property Group (ASX: ABP)

Established in 1996, an ASX 200 index constituent, Abacus Property Group (ASX: ABP) is a diversified property group. It invests in the real estate sector to achieve desired returns, which is backed by the successful track record in real estate investing through active management, capital appreciation and strong income.

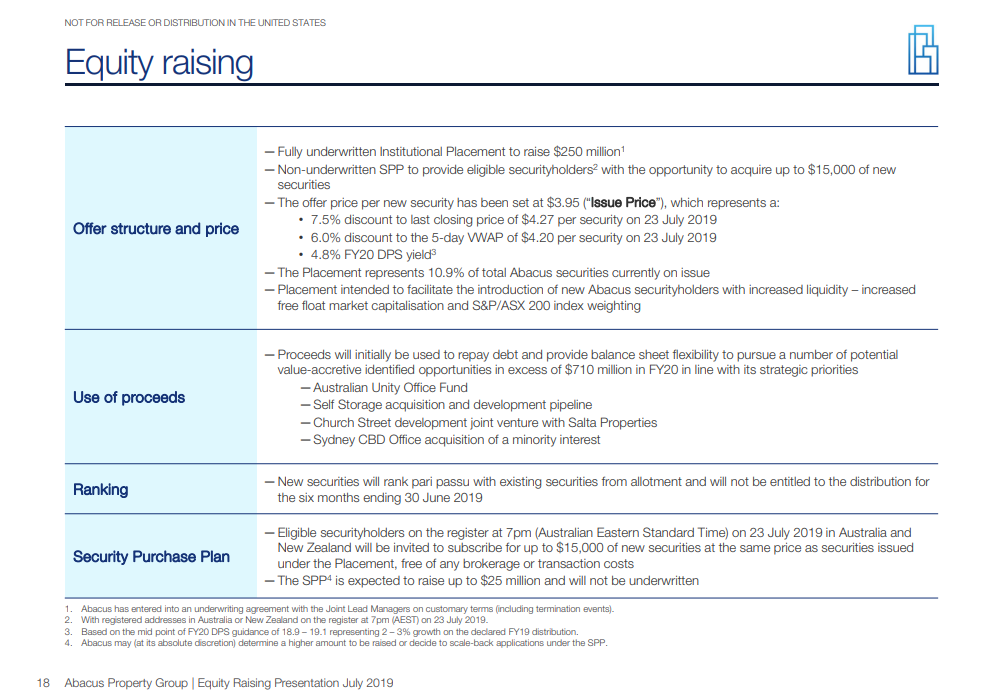

On 25 July 2019, Abacus Property Group reported that the fully underwritten institutional placement was completed. Subsequently, it raised $250 million through the issue of approximately 63.3 million new ordinary stapled securities priced at $3.95 per stapled security.

Placement

Reportedly, the proceeds would be utilised to pursue value accretive identified opportunities for over $710 million, consistent with strategic priorities and focus on office & self-storage. Also, the issue price depicts a 7.5% discount against the last closing price on 23 July 2019, and new securities are expected to settle on 29 July 2019. Besides, the allotment and normal trading to commence on 30 July 2019, and the placement is within the existing 15 per cent capacity, consistent with ASX Listing Rule 7.1, which does not require securityholder approval.

Security Purchase Plan (SPP)

Besides Placement, Abacus intends to offer a non-underwritten security purchase plan to the eligible shareholders on record at 7:00 PM AEST, on 23 July 2019, the securityholders are required to have registered address in Australia or New Zealand. Accordingly, it provides an opportunity to acquire up to $15,000 of stapled securities at a price offered to institutional offer at $3.95 per stapled security. Currently, it intends to cap the SPP at 25 million, and it might raise the cap bar or scale-back application under SPP. In addition, the information related to the SPP would be mailed to eligible shareholders on or around 5 August 2019.

Equity Raising (Source: Equity Raising Presentation, July 2019)

Steven Sewell, CEO & MD, stated that the company appreciated the strong support received for the placement, and it was progressing towards the strategy to transform into a more annuity-style and strong asset business. He acknowledged that the placement enables the company to pace up the transformation and places it to tap future growth and identified opportunities.

On 25 July 2019, ABPâs stock last traded at A$4.14, down by 3.044% from the previous close. Over the past one year, the return of the stock has been +14.48%. The performance of the stock over the past three months and one month has been +16.35% and -1.84%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.