August 2019 has brought in an ocean of updates and announcements from ASX-listed companies. We are in the midst of the reporting season and investors and market experts have continued to hover over the recent developments in lucrative and attractive players of the Australian stock market. Let us delve into the developments of two stocks- Envirosuite Limited (ASX:EVS) and CSR Limited (ASX:CSR) and analyse whatâs keeping them in news:

Envirosuite Limited (ASX: EVS)

Company Profile: An innovative and tech-savvy company, EVS has its roots in science, consulting and engineering. The company aims to lead the charge in the digital transformation of environmental management across the globe. EVS was founded by Robin Ormerod and Kristin Zeise and was listed on the ASX in 2008, with headquarters in Brisbane.

Sales Update: The company recently provided an update to the market on the progress made in the June quarter 2019. EVS received new orders representing an additional $760,000 in its ARR, exceeding the gross ARR growth by 100 per cent and adding sales of $3.1 million in new sales. The net ARR Y-O-Y growth was recorded at 86 per cent, as the contracted Annual Recurring Revenues amounted to $5.6 million. The ARR attrition in Q4 was 1.4 per cent, well within the companyâs target range. The company is maintaining a target of $12 million contracted ARR by the end of FY20.

ARR Growth since FY17 (Source: EVSâs Report)

The country registered great results in China, Chile and North America. The digital and online marketing campaigns were undertaken and there was a better brand awareness of the companyâs offerings in its target audience, with the website traffic up by 30 per cent, compared to pcp. Encouraging enough, the total pipeline of opportunities had risen to over $14 million.

A set of initiatives were taken over the quarter, including Multi-site and Corporate level deals and Solution broadening. Like a cherry on the cake, the companyâs e-nose technology has been advancing on several fronts, and EVS believes that with time, the technology would help in identifying odour types in real time under increasingly complex situations. With regards to water, the company has been advancing its R&D efforts into the concept of water catchment modelling and management, to enhance water quality and storage management.

Perhaps the most interesting part of the update were the two biggest projects in the companyâs history that went live in Doha and Kuwait. The Doha project is focused on the cityâs sewer pipelines while the Kuwait project involves the deployment of 100 sensors across the city. Both the projects bear potential to grow further in scope in the medium term.

Stock Performance and Returns: On 16 August 2019, the EVS stock is trading at A$0.130 (as at 12:50 PM AEST) with a market capitalisation of A$48.13 million. In the last one, three and six months, the stock has delivered returns of 8.33%, -7.14% and 41.30%, respectively, and a YTD return of 106.35%.

CSR Limited (ASX: CSR)

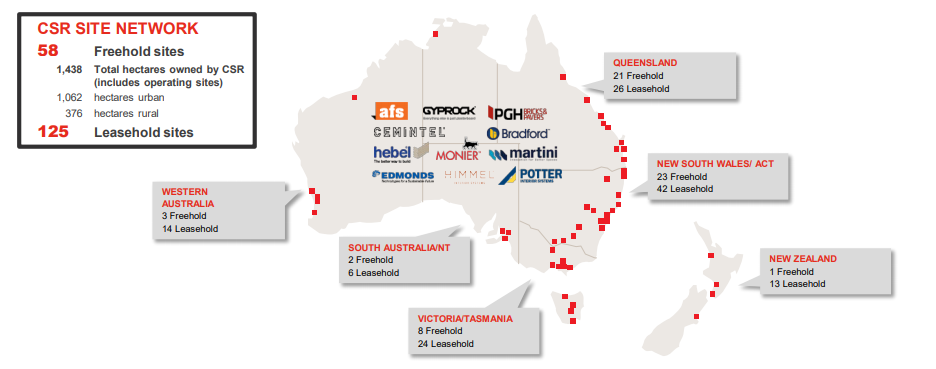

Company Profile: Provider of building products for residential and commercial construction, CSR operates low cost manufacturing facilities with a strong distribution network to cater to customers in the ANZ region. Few of its products include Gyprock⢠plasterboard, Bradford⢠insulation, AFS, Monier⢠rooftiles and PGH⢠bricks and pavers. The company is a JV participant in Tomago aluminium smelter in New South Wales. Additional earnings are generated by the company through its Property division by developing surplus former manufacturing sites and industrial land for sale.

Breadth of CSR manufacturing sites across ANZ (Source: CRSâs Report)

Daily Share Buy-back update: On 16 August, the company updated that it has brought back 77,65,095 shares till date with a total consideration of ~$27.28 million as a part of on-market buyback of up to $100 million of ordinary shares announced in February this year.

New Substantial Holder: The company recently notified on 12 August 2019 that State Street Corporation had become a substantial shareholder in CSR Limited effective 7 August 2019 with 24,909,167 securities, representing a voting power of 5%.

Property Presentation: On 28 June 2019, CSR conducted a presentation to members of the investment community in North Ryde in NSW. The company posted its 2020 outlook, stating that Volumes of the building products in the two months of the financial year ending 31 March 2020 were consistent with the final quarter of last year. As per the company, Low interest rates, improving credit availability, stable tax policies and first homeowner support were catalysts in improving the property demand and regaining consumer confidence.

In the context of property, the company notified that the quantum of earnings may fluctuate due to the timing of transactions. The Aluminium contracts were reported to be in place for 75% of alumina volumes linked to the US$ prices of aluminium, to replace the current alumina contract which is due to expire in December 2019.

Discussing its portfolio value, CSR mentioned that it undertakes independent valuations of its major property sites to inform decisions on key projects. The Western Sydney Current valuation was $600 million and its Potential rehabilitation costs amounted to $100 million.

Annual General Meeting 2019: On 26 June 2019, CSR held its AGM, and highlighted the significant milestone of the $222 million sale of the Viridian Glass business, after various challenges centred around high energy costs and unrelenting import competition, which was successfully completed in January 2019. Moreover, CSRâs total recordable injury rate was down by 25%, the lowest level in 15 years. The $4 million investment aided in energy improvement initiatives and solar projects, leading to a 2.6% decline in CSRâs CO2 emissions.

On the financial end, EBIT was reported to be $39 million, ahead of the companyâs five-year average of $31 million. A milestone would be achieved when the company would celebrate its 165th birthday in January 2020.

Stock Performance and Returns: On 16 August 2019 (1:15 PM AEST), the CSR stock is trading at A$4.000, up by 1.03% with a market capitalisation of A$1.93billion. In the last three and six months, the stock has delivered returns of 15.48% and 20.87%, respectively with a YTD return of 40.07%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.