BHP Billiton (ASX:BHP) smashed its own previous dividend records with another bumper dividend for the second half of the financial year 2019. After distributing US$8.6 billion in the first half of the financial year 2019 (ended 31 December 2019), the miner is all set to distribute another set of a fully-franked dividend of US$0.78 in the second half for the financial year 2019.

The independent analysts such as Citi and UBS anticipated the dividend to reach US$0.79 and US$0.82 a share, respectively, for the second half of the financial year 2019.

BHP shattered the previous year total dividend distribution of US$1.24 per share with an interim dividend for the half-year ended 30 June 2019 of US$0.78, which in turn, took the total dividend for the financial year 2019 to US$1.33.

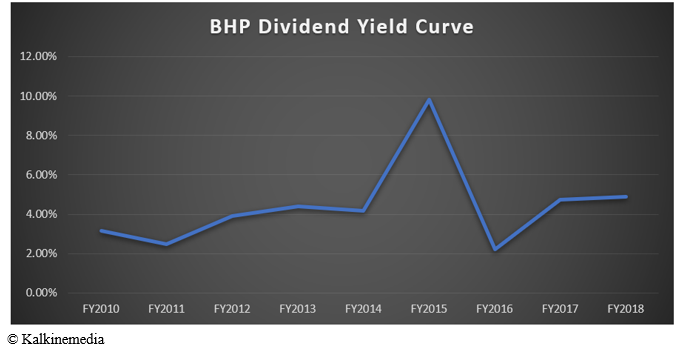

The Dividend Growth Story:

The companyâs dividend yields as per yesterdayâs closing price stood at 4.6 per cent. Albeit, Mr Andrew Mackenzie seems to have crossed another checkbox of delivering sector-leading shareholder returns, the dividend yields are not being able to climb the 2015 highs.

The profits of the company remained almost flat in the financial year 2019.

BHPâs FY2019 Highlights:

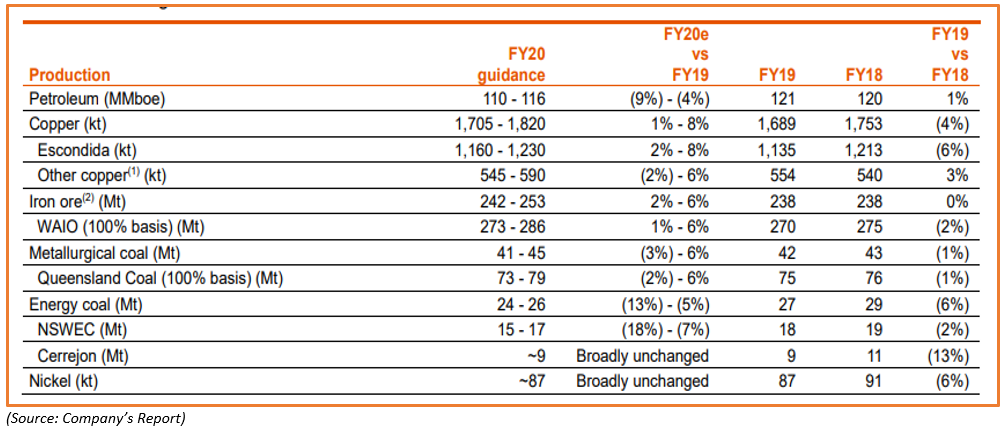

Production:

The production from different businesses of the company observed a fall in FY2019; however, the revenue remained steady amid higher realised price of the commodities produced by the companyâs operations.

The copper production witnessed a 4 per cent fall in FY2019 as compared to FY2018; however, BHP kept the FY2020 copper production guidance 1 to 8 per cent higher from FY2019.

The iron ore production of the company remained unchanged at 238 million tonnes in FY2019, and the company increased the FY2020 iron ore production guidance by 2 to 6 per cent.

The metallurgical coal business production witnessed a 1 per cent decline in FY2019, and the company kept the coal production guidance for FY2020 3 per cent low at the lower end of the production guidance, while keeping the same 6 per cent high from the current production at the upper end of the guidance range.

Nickel production for FY2019 stood at 87 million tonnes, down by 6 per cent from the previous corresponding period production level of 91 million tonnes. BHP kept the nickel production guidance unchanged at 87 million tonnes for FY2020.

The high commodity prices during the last quarter of the financial year 2019 along with the disposal of the US Shale assets were rightly anticipated by the market participants to have provided with the needed cushion to the revenue, which remained steady despite fall in the production level of various commodities.

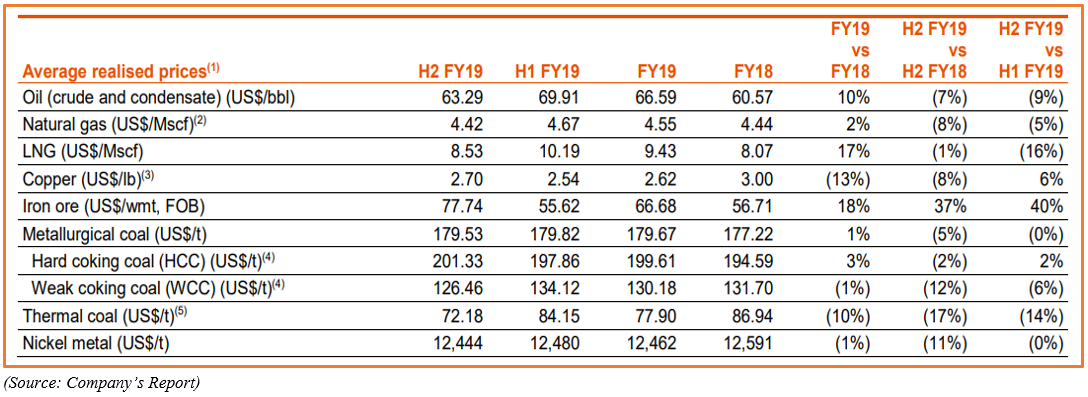

Realised Price:

BHP achieved higher prices for most of the commodities it is into, which in turn, provided some support to the bottom line of the P&L.

BHP recognised a 10 per cent rise in the oil realised price and a 17 per cent increase in LNG realised-price for FY2019.

The iron ore business witnessed an 18 per cent increase in the realised price, and the company recognised US$66.68 per wet metric tonne on Free-on-Board (or FOB) basis.

Financial Performance:

The revenue from the continuing operations stood at US$44,288 million in FY2019, slightly up as compared to the previous corresponding period revue of US$43,129 million. The total profit after taxation from both continuing and discontinued operations stood at US$9,185 million in FY2019.

The total assets of the company slightly declined to stand at US$100,861 million as compared to US$111,993 million in FY2018.

The total liabilities of the company also witnessed a decrease, and in FY2019, the total liabilities of the company stood at US$49,037 million as compared to US$51,323 million in FY2018.

Further, the net assets of the company declined to US$51,824 million in FY2019 against the net assets of US$60,670 million in FY2018.

A Peek Over Financial Metrics:

The underlying attributable profit for total operations stood at US$9.1 billion, in which the net attributable profit stood at US$8.3 billion.

The underlying basic earnings per share witnessed a 5 per cent increase to stand at US176.1 cents.

However, the underlying EBITDA from continuing operations remained unchanged and stood at US$23.2 billion. The underlying attributable profits from continuing operations remained at US$9.5 billion in FY2019, down by 2 per cent as compared to the previous corresponding period.

Cash Generation:

The operating cash flow witnessed a decline in FY2019 amid loss of the US Shale business; however, the divestment of the US shale business increased the free cash flow of the company substantially in FY2019 as compared to FY2018.

The company passed on the sales proceed to the investors through a special dividend, and BHP distributed an additional dividend of US$7.0 billion in FY2019.

The Samarco Failure and BHP:

BHP faced a US$5 billion lawsuit in the Samarco Dam failure previously; however, in its annual report BHP extended its support to the Renova Foundation, which would further support the recovery of communities and ecosystems affected by the # failure.

Impact on the Share Prices:

The share prices of the company moved into a red zone during the opening of the session. BHP started the dayâs session today on ASX at A$35.890, down by 1.40 per cent from its previous close.

The stock traded slightly negative at the onset to reach the level of A$35.640; however, by the end of the session, the share prices of the company, which previously experienced the twin-shock, recovered to end the dayâs session at A$36.300, marginally up by 0.138%.

Return Profile:

As per todayâs closing price, the shares of the company delivered a total return of 108.34 per cent in over the last ten years and a total return of 60.635 in over the last five years.

Over the short-term, the YTD total returns delivered by the company stands at 20.841 per cent; however, the further shorter period returns are negative amid a recent drop in the share prices of the company.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.