Retirement denotes withdrawal from an occupation, profession or active working life. Also, it is the inevitable part of an individualâs life. A person can attain retirement when the source of living is not required to be earned, or the amount of savings of an individual is adequate to pay off the bills.

So, how can retirees survive in a low real interest rate environment?

Real interest rate is the rate post the exclusion of the impact of inflation. Thus, it provides a real interest rate to be earned on the investment considering the inflationary trends. For Instance, if the 10 Year Government Bond is offering a 5 per cent interest, and the prevailing inflation rate is 3 per cent; it means that the investment can fetch a real interest rate of 2 per cent. However, the rate of inflation depends upon the factors like consumer behaviour, market dynamics and so forth.

Retirees are recommended to park all their savings in a government bond or term deposits. Generally, government bonds are considered risk free investments, the reason why retirees are recommended to invest in these government bonds. A low interest environment also moderates the growth of capital in provident funds/superannuation funds, as these funds considerably invest in government securities.

It is a very unfavourable circumstance for the retirees when the interest rates are low, and inflation is above the prevailing interest rate. Contrary to the low interest rate environment, a high interest environment can also drag the market value of bonds to lower levels due to the inverse relationship between interest rates and prices of the bonds.

Besides, developed economies do not offer a high interest rate in a long-term bond, and it could be as low as 1% or maybe negative. Gone are the days, when these securities used to fetch 8% to 9% interest rate in the developed economies of the present time.

Further, retirees can look towards cutting the expenses and pay-off debt when the interest rates are low. Specifically, paying-off high interest rate loans like auto loans, credit card balances etc. would substantially reduce the interest payments of the retirees. Subsequently, it leads to lesser amount of money going out of pocket on the interest payments, which could be utilised towards solving other purposes of life.

Nevertheless, the retirees can also invest in various asset classes to achieve an inflation-adjusted return. A considerable portion of savings could be invested in such asset classes along with diversification to achieve a balanced portfolio. Meanwhile, the government bonds are not the only ones available in the market; it also hosts corporate bonds, high-yield bonds and so forth. Investors must assess their risk appetite prior to investing and allocate the capital accordingly.

Current Scenario in Australia

Inflation

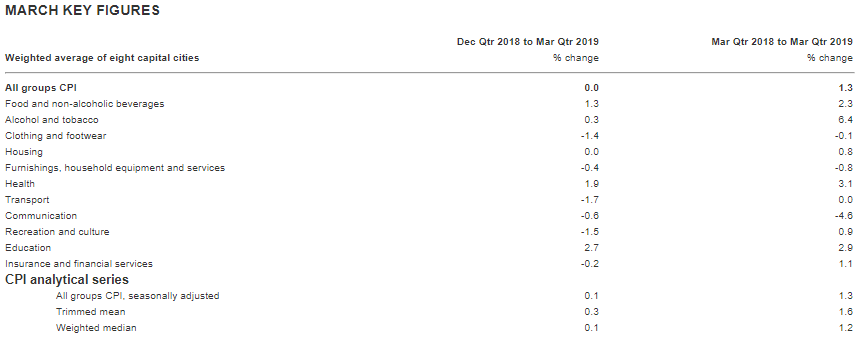

In April 2019, Australian Bureau of Statistics (ABS) released the data on Consumer Price Index (CPI) for the quarter ended March 2019. Accordingly, the CPI grew by 1.3% in March 2019 when compared to March 2018. Notably, food and non-alcoholic beverages increased by 2.3% in March 2019 against the prior corresponding period and spending on health recorded an increase of 3.1% against March 2018. Further, recreational and culture recorded an increase of 0.9% from March 2018.

Source: ABS

Term Deposit Rates

According to National Australia Bank Limited (ASX: NAB), the bank is offering an interest rate of 1.10% per annum to 1.75% per annum in deposits between $5k to $499,999 for terms starting at 30 Days to 12 months. Besides, the bank is offering term deposits for 24 months at the rate of 1.65% per annum, 36 months at the rate of 1.65% per annum, 48 months at the rate of 1.65% per annum and 60-month deposit standing at 1.75% per annum.

So, it appears the term deposits are offering interest rates below 1.75%. Now, taking 1.75% from the 12 month deposit, and the given CPI at 1.3% gives us a real interest rate of 0.45%. This represents that value of the term deposit would increases by 0.45% in purchasing power terms.

Letâs look at some possible of the asset classes, which might deliver the inflation-adjusted returns:

Preferred Stocks â These securities are called preferred due to the rights attached to these securities; the holders of preferred stock are paid prior to the common stock/ordinary shareholders at the time of liquidation of the company. Further, these stocks have rights to receive dividends before ordinary shareholders. It is considered a safe investment, along with a prolonged stream of income. In addition, preferred stocks could be redeemable or callable, which means the company could buy-out the holdings from the investors. Investors must consider few things prior to investing, including financial health, financial stability of the company, history of dividend payments and the growth in the dividend of the company.

High Yield Dividend Stocks â There are a lot of companies with a solid history of paying dividends along with the growth on those dividends. The yield is defined in the percentage term, and it depicts the percentage of annual dividend paid relative to the price of the stock. Generally, these companies have large businesses, established market position and diversified portfolio to offset the risk within the business.

Index Funds â Index funds track a benchmark index and replicate the performance of the benchmark, excluding the fees and expenses. Usually, these are passively managed funds with moderate growth in terms of return, which is consistent with the market return. Index funds provide diversification in the portfolio of investors, while also paying dividends from the income earned by the underlying companies in the portfolio of the funds. Further, these funds might offer international exposure to the investors. Each fund enlists an investment objective, and it provides a clear picture of the focus of the funds along with a plan to achieve that objective. Some important things to consider before investing include the fees and expense charged, history of previous returns, dividend paying history of the funds and maybe track record of the company managing the funds.

Driven Investments â At times, the disruptions in the industries cause increasing interest in some of the asset class. For Instance â the lithium industry is picking up the pace due to the emergence of e-vehicles. Lately, investors are preferring lithium stocks; in the companies engaged in the production of lithium. One more example of this could be the cannabis industry; the cannabis industry is also marching ahead at a good pace. Investors may allocate some of the capital in such industries to grow alongside the industry.

Growth Stocks â These companies are small in size, new to the market and may be equipped with disruptive trends or technology. Usually, these are the companies in the early stage of the business, that do not pay dividends, though these companies tend to invest the income to grow the business. Some of the risks associated with these stocks include high valuation, high volatility and cyclical risk.

Commodity/Precious Metals â Investors prefer to invest in these asset classes due to the uncertainty and volatility persisting in the market. Some of the most common assets in this includes gold and silver. Historically, gold has been favoured by the investors and the price of gold itself depicts the value created by the asset over the long term horizon. It should be noted that the companies involved in the production of gold tend to benefit from the increase in the value of gold.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.