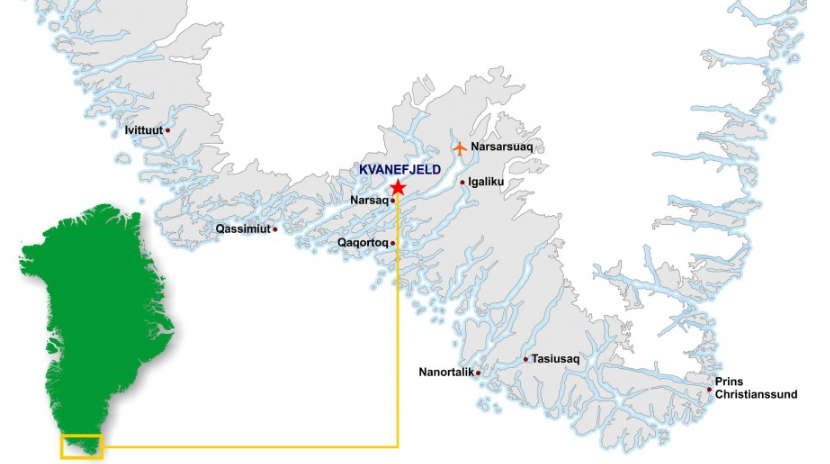

Australia-based Greenland Minerals Limited (ASX:GGG) is an exploration and development company advancing its high-quality flagship asset â The Kvanefjeld Rare Earth Project (100%-owned) hosting significant uranium, rare earth elements, and zinc mineral resources, within the northern Ilimaussaq Intrusive Complex in southern Greenland, and includes several large-scale multi-element resources (Kvanefjeld, Sørensen and Zone 3).

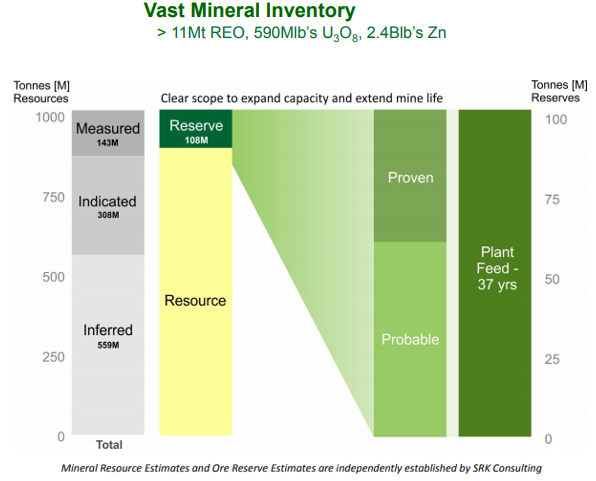

So far, the company has identified a JORC 2012 compliant resource base of 1.01 billion tonnes (with a significant exploration upside) for the project with an ore reserve estimate of 108 million tonnes to sustain an initial 37-year mine life.

Source: July 2019 Investor Presentation

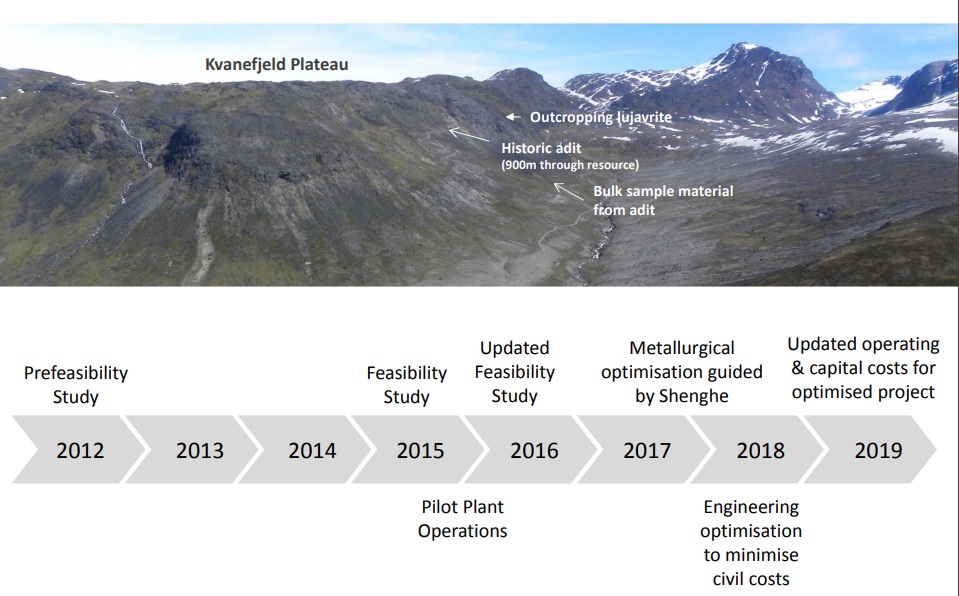

A pre-feasibility study (PFS) was finalised in 2012, followed by a comprehensive feasibility study completed in 2015 and pilot plant operations in 2016. The studies demonstrate the potential to develop Kvanefjeld as a long-life, low cost, and large-scale producer of rare earth elements, which are key enablers to the electrification of transport systems. A mining license application for the initial development strategy has been under review by the Greenland Government through the latter part of 2016 and throughout 2017.

In 2017-18, Greenland Minerals continued to undertake technical work programs and closely working with major shareholder and strategic partner Shenghe Resources Holding Co Ltd to optimise the project.

Kvanefjeld Project Setting; Source: Companyâs Website

The company had a productive start to 2019 and continued the same into the June Quarter (three months to 30 June 2019 Q2 2019), for which the activities report has been recently disclosed.

June 2019 Quarter Highlights

Optimised Feasibility Outcomes âGreenland Minerals completed the optimisation of the Kvanefjeld Project, that had been underway through 2017-18, with a focus on metallurgical performance and civil design and engineering. These studies built on the 2016 Kvanefjeld Feasibility Study, following the commencement of cooperation with Shenghe. The company concluded the outcomes of the studies in the second quarter of 2019.

Advanced Project Status; Source: July 2019 Investor Presentation

The key outcomes of the optimisation studies include-

- Capital cost reduced by 40% to USD 505 Million, indicating a transformational milestone for the project, which now has the lowest capital intensity amongst the emerging ASX-listed rare earth projects.

- Operating costs also down 40%, resulting in unit costs of less than USD 4/Kg of REO

- Project has a smaller footprint and lower impacts, while producing more rare earths.

- Reduced reagent consumption, with savings in the power consumption.

The Improvements to the flowsheet also comprised a major enhancement to flotation performance (the production of smaller volumes of higher-grade concentrate), the development of a simpler, more efficient refinery circuit and improved rare earth recoveries (see table below).

In addition, the revised civil costs stand at USD 175 million, including indirect costs and contingency with a multi-disciplinary team of specialist engineering firms - Nuna Logistics, Tetra Tech, PND Engineers and China Communications Construction Co, having contributed to an updated civil design.

Permitting Update â By end of June this year, the company formally lodged an application with the Mineral License and Safety Authority (MLSA), Government of Greenland (GoG) for an exploitation (mining) license with supporting documents being - An environmental impact assessment (EIA), a social impact assessment (SIA), and a navigational safety investigation study (MSS) for the Project.

The next agenda in the permitting process would be a period of public consultation regarding the Application., whereby interested stakeholders may provide feedback on the same over 8-12 weeks, either directly to the GoG or in public forums.

Strengthening Local Community Ties - In March 2019, Greenland Minerals signed a Memorandum of Understanding (MoU) with the Kommune and the Kujalleq Business Council that aims to establish a participation agreement for community capacity development for Kommune workers and businesses. Subsequently, after submitting the Application, a few company representatives along with the lead SIA consultant, conducted a series of meetings in Kommune Kujalleq (the Kommune), and the key findings of the EIA and SIA (prepared by independent professional consultants) were presented to the Mayor of southern Greenland and members of the Kommune.

Strategy Meetings with Shenghe- With the completion of the main phase of optimisation work, a team of senior representatives from Shenghe, headed by Shenghe Chairman Mr Hu Zesong, visited Perth to review the outcomes of the feasibility optimisation work and discuss on establishing a road map to market and the accompanying commercial development strategy.

The company spent around AUD 1.02 million on operating activities during the quarter, and the cash and cash equivalent stood at ~AUD 4.74 million as at 30 June 2019. The company estimates a cash outflows of ~AUD 1.26 million in the upcoming quarter.

Capital Raising

On 31 July 2019, Greenland Minerals announced to have received firm commitments from Australian institutional and sophisticated investors to raise AUD 7.0 million before costs via placement of 58,333,333 shares at an issue price of AUD 0.12 each, representing a 20% discount to the 20-day VWAP of GML shares trading on the ASX up to 26 July 2019.

The proceeds from the placement have been indicated to be directed towards progressing the technical development of the Kvanefjeld project, expediting the mining licence application through public consultation and impact benefit agreement negotiations, continued development of downstream processing and path to market strategy, and project commercialisation.

Rare Earth Elements (REEs) Market Outlook

Rare earth elements (REEs) find wide applications with the most notable being the creation of the worldâs strongest permanent magnets. With the growing use of high-powered magnets in electric cars, renewable energy sources such as wind turbine, along with many commonplace electrical applications, GML is at the forefront of a strategic evolution in rare earth supply.

China is looking to cap primary production in 2020, while the demand is set to surge, which presents an excellent opportunity for Greenland Minerals to be a large, stable supplier at prices that are readily sustainable to end-users globally.

The company is diligently working to develop the Kvanefjeld Rare Earth Project as a cornerstone of future rare earth supply.

Key Features of Kvanefjeld Rare Earth Project:

Stock Performance

Greenland Minerals has a market capitalisation of around AUD 136.96 million with ~ 1.19 billion shares outstanding. On 9 August 2019, the GGG stock closed the market trading at AUD 0.130, zooming up 13.04 % by AUD 0.015 with approximately 3.35 million shares traded.

Besides, the GGG stock has delivered positive returns of 85.48% in the last six months and 59.12% YTD.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.