Rare earth metals are drawing investorâs attention amid its usage in the automotive sector and clean energy. The global market is forecasted to phase out the internal combustion engine with time and promote electric vehicles, which for greater efficiency, torque, and longer-range use rare earth metals in it.

Rare earth permanent magnets are highly sought after in the automotive and renewable energy industry for its ability to increase the efficiency of the products.

The latest drive of global energy to shift towards the zero-emission economies is fuelling the renewable energy industry, which, in turn, is providing a cushion to the demand for rare earth metals.

In the renewable energy industry, precisely the demand for rare earth metals permanent magnets is coming from the wind energy sector, as wind turbines use between 400 and 500kgs of the permanent magnets per megawatt.

While the wind turbines use such vast quantity, the push from global economies on the renewable energy such as Chinaâs stance to add gigawatt-level offshore wind capacity annually from 2018, and growth in Europeâs offshore wind projects in line with Euro-6 emission standards, are estimated to fan the demand for rare earth metals.

China is the worldâs largest supplier of rare earth metals used in significant industries such as EV, renewable energy, military, etc. The copious reserves of rare earth metals in China make other nations to rely on China, and China is freezing the supply for many rare earth metals except those which offer and comes with value addition such as a motor or a car.

The high reliance of global economies on China and Chinaâs time to time behaviour of squeezing the supply chain could also lead the Malaysian government to renew the Lynas Corporation (ASX: LYC) licence.

Lynas or LYC is among the very few large-scale suppliers of rare earth metals outside China, which in turn, keeps the company among the top of the investorsâ list in the rare earth metals space.

Lynas Corporation Limited (ASX: LYC)

LYC-an Australian Securities Exchange-listed rare earth metals explorer and miner has been operating in Malaysia since 2012 by inputting rare earth metals from its Western Australia- Mt Mount operations despite being shackled over the low-level radiation waste produced by its Kuantan Plant.

The Malaysian unit of the company produces two solid waste namely iron phosphogypsum (or WLP), which is a very low level radioactive material (IAEA Guidelines) and a magnesium-rich gypsum (or NUF), which is a non-radioactive and non-toxic scheduled waste under the Malaysian regulations and is regulated by the DOE (Department of Environment).

The company applied for licence renewal and is working with the Malaysian government to address the residual waste issue and to seek agreement on the conditions for the restoration of the operating license. Lynas previously agreed on a pathway for the NUF residue management; however, the pending renewal of the companyâs operating licence postponed the finalisation of the NUF disposal solution, which included a commercialisation option.

On 9 July, the Deputy Minister of MESTECC stated in the Malaysian parliament that the condition and decision over the Lynas renewal would be decided by the Cabinet and to be announced in mid-August 2019.

Chinaâs dominance boosts Lynas:

During a press conference on 1 August 2019, the Malaysian Prime Minister- Mahathir Mohamad confirmed that Lynas would not have to find a way to export WLP, which in turn, provided hope of licence renewal to the Malaysian unit, which is expiring on 2 September 2019.

The decision from the Malaysian government brought some respite signs to the company; however, LYC mentioned that the company would wait for an official notification from the Malaysian government regarding the conditions for licence renewal.

Meanwhile, the company is prudently conducting preliminary work on the outcome that has been the subject of the media speculation, and the preparatory work includes the work on the location for a Permanent Disposal Facility, which LYC proposed for the permanent disposal of its low radioactive residue- WLP.

LYC previously received approval for the Permanent Disposal Facility from the AELB in 2014 post the consent secured by the company from the Pahang State Government over the establishment of the Permanent Disposal Facility in Pahang State.

Rare Earth Miners Progress:

Lynas Corporation Limited (ASX: LYC)

During the June 2019 quarter, the company produced around 1,500 tonnes of Neodymium (Nd) Praseodymium (Pr) or NdPr, and the production of total rare earth oxides during the June 2019 quarter stood at 4,651 tonnes.

LYC managed to sell more than it produced during the June 2019 quarter, and the total rare earth oxide sales for the quarter stood at 4,723 tonnes.

However, the prices of NdPr averaged lower at the quarter-end, which in turn, led towards a small inventory build of 323 tonnes at the end of the quarter, which would be used by the company to support the growth of the strategic customers.

The shares of the company ended the dayâs session today on ASX at A$2.20, up by 7.874 per cent from its previous close.

Greenland Minerals Limited (ASX: GGG)

June 2019 Quarter Highlights:

GML completed an optimised Feasibility Study over the Kvanefjeld project during the June 2019 quarter, which in turn, suggested lower capital and operating cost. The capital cost has been reduced by 40 per cent to stand at US$505M, including the cost of a refinery circuit.

Greenland reduced the operating cost to less than $4 per kg of the rare earth oxide or by 40 per cent during the June 2019 quarter.

The company confirmed the status of Kvanefjeldâs as one of the most significant emerging rare earth metal project with a large estimated output of Neodymium, Praseodymium, Dysprosium, and Terbium.

Kvanefjeld Project:

The wholly-owned project of the company hosts the JORC-code compliant resource of over 1 billion tonnes with an estimated ore reserve of 108 million tonnes to sustain an initial 37-year mine life. The prospect of the company is anticipated to the largest global producers of key magnet metals.

The company improved the flowsheet, including a significant improvement in the flotation performance along with the development of a simple and more efficient leaching circuit. The growth in the flowsheet resulted in the betterment in rare earth metals recoveries, which in turn, inched up the anticipated commercially import rare earth metals.

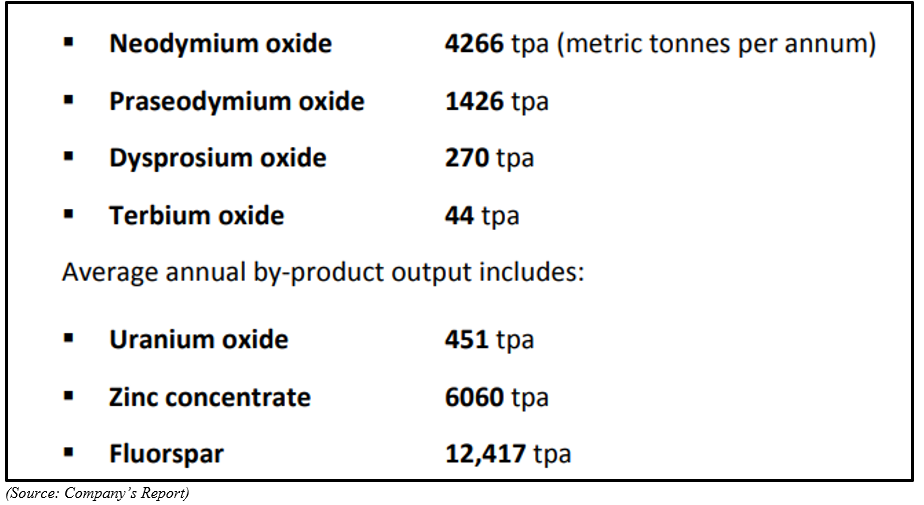

The anticipated increase in the commercial levels are as depicted:

The shares of the company ended the dayâs session today on ASX at A$0.135, down by 3.571 per cent from its previous close.

While the rare earth space is riding on the demand push from the EV and renewable energy sectors, there are few miners on ASX, which are also hoping to secure high sales amidst the EV wave.

Once such miner in Independence Group NL (ASX:IGO), and the company is expecting high EV penetration to support the nickel demand over the long-run.

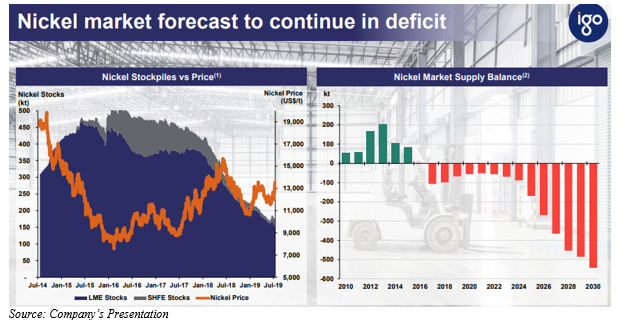

IGO is betting high on nickel, and the company anticipates that during the EV wave, nickel would experience a global deficit, which in turn, would support the prices of the metal.

IGO is also estimating that the use of nickel is getting intensive in the battery chemistry and the company mentioned that over 50kg of nickel is present in the Tesla S model electric vehicle.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.