Commodities market grappling with COVID-19 seems to be winning with price rebounds after constant falls since the start of the year. Some economists believe that the market will start riding its chariot from June 2020 and may reach hilltop in 2021.

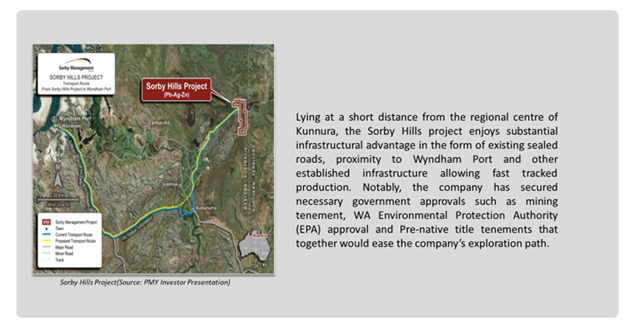

Pacifico Minerals Limited (ASX:PMY) appears to be in the right spot for savouring the burgeoning prospects that accompany the market movement. Jointly held with Chinese Henan Yuguang Gold & Lead Co. Ltd, Pacifico Minerals holds 75 per cent stake in the Sorby Hills Lead Silver Zinc Project which opens its exploration avenue for potentially attractive commodities.

In the milieu of the market upbeat, it is worth mentioning that apart from poster-boy commodities like gold or economic indicator-Copper, Lead is expected to grow with CAGR of 6.74% between 2018-2022 (Global Lead Market Analysis, Trends & Forecasts 2018-2022 by Business Wire). Also, with the advent of EVs, demand for Lead is likely to outpace supply in 2023 without new capacity addition from mine side.

Pacifico Minerals with its Lead-centric project seems to be well-positioned to tap this emerging opportunity in the attractive commodities space.

Market Opportunities Encircling The Sorby Hills Project

Lead batteries with unrivalled sustainability credentials are the primary enabler of rechargeable energy storage worldwide. However, the challenge surrounding the lead supply in the face of its impending supply deficit presents a vast range of market opportunities for the exploration companies.

Meanwhile, Start-Stop technology Vehicles (SSVs) that have been gaining momentum utilise a significantly higher amount of lead.

Hence the commodity demand-supply dynamics seems to be providing excellent prospects for Lead projects which are expected to commercialise in the near term. Furthermore, the presence of silver - an ally of lead mineralisation along with zinc in the project poses significant opportunity in lowering down the cash costs.

Strategic Developments Aligned with Exploration Goals

Pacifico seems to be undertaking various corporate initiatives to leverage the growing market opportunities through positive developments in its project-related activities.

The appointment of highly experienced mining executive Mr Gary Comb as the Executive Chairman of the company comes as a strategic move towards further advancing the Sorby Hills Lead project. The company identified the wealth of Mr Comb’s experience in different areas of the project to bolster its progress in advancing its flagship project.

The company has also issued 13 million Performance Rights to Mr Comb, to be converted into equivalent Ordinary Fully Paid PMY shares upon the achievement of certain performance hurdles, and the exercise of that right.

Examining The Report Card Of The Operational Performance

The exploration operations continue to progress at the Sorby Hills Project, advancing its mineral resource estimate. Pacifico Minerals had been lately extensively engaged in the drilling operations alongside the mining studies. A large, shallow depth anomaly was confirmed by the recent Wildcat Exploration Drilling to the west of the existing deposits.

The company received robust intersection results in its Phase III drilling program, during which targeting of historic intercept led to the discovery of a new, large, shallow depth anomaly for future testing.

Continuity across several minor deposits forming Omega deposit has been confirmed through the Pacifico’s Drilling program. Some of the significant intercepts of the drilling program include:

Omega Deposit

- 20.0m at 7.3% Pb, 56 g/t Ag 0.4% Zn from 11m (ACD046)

- 11.7m at 10.8% Pb, 105 g/t Ag 0.4% Zn from 75.7m (AF005)

- 14.0m at 13.0% Pb 89g/t Ag 1.0% Zn from 24m (ACD080)

- 23.0m at 9.0% Pb, 88g/t Ag 1.2% Zn from 59m (ACD071)

- 21.0m at 5.0% Pb, 21g/t Ag 0.5% Zn from 23m ((ACD056)

- 22.0m at 8.8% Pb 52g/t Ag 0.3% Zn from 68m including 16m at 11.7% Pb, 68g/t Ag 0.37% Zn from 63m (ACD082)

- 10.0m at 7.16% Pb, 383 g/t Ag and 0.43% Zn from 110m (SHPDA31)

B Deposit

- 11.0m at 6.9% Pb, 26g/t Ag 0.1% Zn from 29m ((AB050)

Upcoming Activities

In Q2 2020, the company would undertake Optimised PFS and Ore Reserve Estimate, Strategic Financing and Offtake Update as well as Phase IV Expansion and Infill Drilling. The Definitive Feasibility Study would be conducted in Q1 2021.

PMY stock last traded on 7 April 2020 at $0.003 per share.

.png)