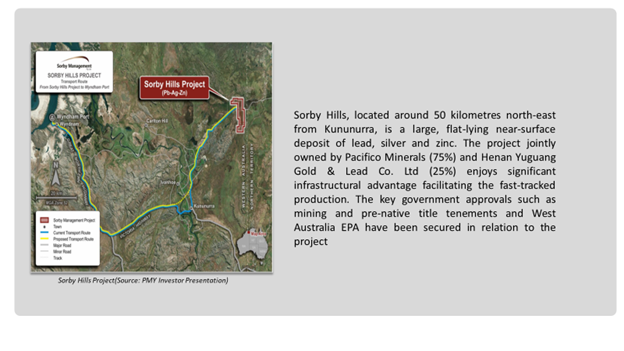

Advancing its exploration endeavours in full swing, Pacifico Minerals Limited (ASX:PMY) continues to deliver robust project performance in the face of Covid-19, while the activities remain uninterrupted at its flagship Sorby Hills Project.

Notably, the Lead-Zinc-Silver project promises substantial commercial value backed by growing demand for Lead as the worldwide focus on ‘clean energy transition’ kicks off.

ALSO READ: Sorby Hills Project Living Up to The Exploration Goals of Pacifico Minerals

Amidst the coronavirus induced market volatility, PMY stock has delivered whopping return of 75% in the last one month, closing at A$0.006 on 21 May 2020. The dedicated focus of Pacifico Minerals and the continued delivery of outstanding project developments seem to be strengthening investors’ sentiments.

The recent success of the drilling campaign with robust intersections unlocked critical potential for new, large, shallow deposit. Meanwhile, execution of Native Title, Heritage Protection and Mineral Exploration Agreement for recently acquired ‘Eight Mile Creek’ has added another notch on Pacifico’s belt. The expansion of the project area to the south, which has a high prospect to become a new mining district, is solidifying long-term future for the company.

In addition, Pacifico is keenly eyeing upcoming Mineral Resource Estimate and Optimised Prefeasibility Study (PFS) results that would provide strong momentum to its exploration objectives.

Burgeoning Mineral Resource Prospects

Significant resource upgrade in Q4 2019 resulted in Global Resource Update of 36 Mt at 4.9% Pb equivalent (3.7% Pb and 39g/t Ag) in addition to 0.5% Zn lying merely 20 metres below the surface and open along strike and down dip.

Besides, the robust intersections during Phase III drilling offered extensions to current mineralisation, while also confirming the potential for a new shallow deposit. The significant intercepts included:

Omega Deposit

- 18 metres at 5.08% Pb, 36 g/t Ag and 0.2% Zn from 10 metres

- 10 metres at 7.16% Pb, 383 g/t Ag and 0.43% Zn from 110 metres

- 6 metres at 9.53% Pb, 55 g/t Ag and 0.32% Zn from 47 metres

- 10 metres at 4.73% Pb, 34 g/t Ag and 0.46% Zn from 25 metres

B Deposit

- 9.0 metres at 4.26% Pb, 37 g/t Ag and 0.80% Zn from 36 metres

Furthermore, Pacifico completed a high-level review on the perceived Phase III drilling data impact along with ongoing refinements to the geological model on the MRE.

Localised tonnage raises are possible to be seen where new drilling fills gaps in the current model or extends the shapes of current Mineral Resource. Greater confidence to Mineral Resource Estimate is added through the updated density dataset and refined geological models for the weathering profiles.

Within the reported Mineral Resource, Pacifico is unlikely to witness a material decrease in the grade. At the same time, the re-domaining of drill hole samples could show a possible minor increase or decrease in reported global grades.

As a result, CSA commissioned by Pacifico is expected to complete the MRE update soon.

Advancing Well on Optimised PFS

While October upgrade justified plant throughput increase from 1.0Mtpa to 1.5Mtpa, Pacifico has affirmed that an increase of 50% in the plant throughput still allows at least eight years of project life.

Moreover, PFS conducted in March 2019 produced compelling economics with modest CAPEX and fast payback, with key highlights including:

- LOM Lead Metal Production- 249 kt

- LOM Silver Metal Production- 9.35 Moz

- CAPEX- A$95.4 million

- Average Cashflow NET- A$60M P/A

- Capital Payback Period- 16 Months

- NPV8- A$243M

- IRR- 62%

Concerning the increase in the plant throughput, the company is accessing two options- ‘Whole Ore’ option and ‘DMS’ option. The former involves direct treatment of mined ore by flotation at 1.5Mtpa, while in DMS, low low-grade ore is beneficiated by Dense Media Separation (‘DMS’) followed by blending of the upgraded product with high-grade ore for feeding flotation plant at 1.5Mtpa.

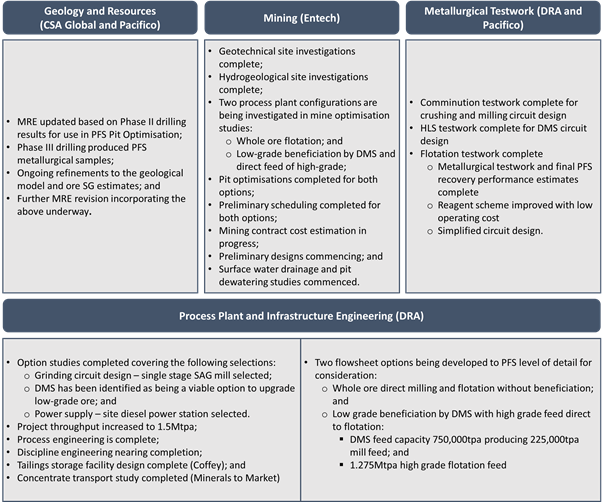

As a component of Optimised PFS, below figure represents progress to date across key study areas-

Current Project Status

- Simple process plan design completed; cost estimation and engineering of plant design are progressing well.

- Latest metallurgical testwork validates improved lead recovery estimates.

- Excellent HLS testwork results on low-grade ore.

- Mine scheduling and open pit optimisation has been completed.

- Optimised PFS remains on track and is likely to be completed by June 2020.

- Resource Update underway backed by enhanced confidence gained from Phase III drilling.