Consumer Cyclical Stocks â An Overview

Consumer cyclical stocks are the stocks that change according to a change in the economy. There is a direct relationship between the economy and cyclical stocks. These stocks give good returns when the economy develops and perform adversely when the economy drops. Also, consumer cyclical space comprises of airlines, construction, automotive and industrial stocks. The income of the consumer impacts the performance of these stocks as well. The stocks under discussion suffer during the recession period. However, when the economy is growing, these stocks become a number one choice of the investors.

How to invest Profitably in consumer cyclical stocks?

We all know that investing involves buying the market stocks at a lower price and selling the same at higher prices. To Invest profitably one should consider the below mentioned points:

- The investor should not select an industry that is going to disappear in a short span of time, but rather choose companies to invest in, that are ranked better than their competitors.

- Further, the investor should look at the company that has a capability of surviving the downward side of the cycle, so that it can recover and sustain itself in the market.

- The industries often witness structural alterations, which affects the investorsâ confidence in them. It is advisable to wait and also, to keep a track of the selected stock, to observe if it continues to perform well in the market.

Letâs now look go through the 3 consumer cyclical stocks as follows:

Wesfarmers Limited

Wesfarmers Limited (ASX:WES) founded in 1914, is a provider of home improvement and outdoor living, apparel merchandise, office supplies. It has businesses in fertilisers, chemical, energy and safety products. The company has a shareholder base of ~490,000. WES is headquartered in Western Australia region and counted among one of the largest listed companies of the nation.

Recent Updates

On 9 September 2019, WES notified on a briefing and operational site tour of the Wesfarmers Chemicals, Energy and Fertilisers business to take place on 3 October 2019 at 1:00 PM AEST.

On 5 September 2019, Wesfarmerâs notified that Kidman Resources Limited (ASX: KDR) stakeholders voted in favour of the Scheme or Scheme of Arrangement. Under the scheme, the company would procure 100 percent of the ordinary shares in KDR for a cash value of $1.90/share.

The company management appreciates Kidman for its strong support for the Scheme. Rob Scott, MD, WES commented, that the consent of KDRâs stakeholders was a significant landmark for WESâ proposed procurement and participation in the growth of Mt Holland Lithium Project.

Also, there are 94.65 percent votes (excluding abstentions) in favour of the Scheme, and 5.35% votes are against it. The Scheme is dependent on courtâs approval at a hearing, scheduled for 12 September 2019.

Financial Summary for FY 2019:

On 27 August 2019, WES released annual report closed 30 June 2019, the highlights of the same are as follows:

- The company reported the NPAT of $5.510 million for the FY 2019, which includes post-tax item of $3.171 million. Also, net profit after tax from continuing operations rose by 13.5% and stood at $1.940 million.

- There was a reduction in the net debt of the company and has a strong balance sheet figure.

- Cash generation from various divisions via continuing operations continued to be strong with 97%.

- The companyâs operating cash flow stood at $2,718 million which was impacted by the demerger of Coles, Divestment of Bengella and removal of associated earnings and cash flows.

Dividend

The company has declared the fully franked dividend of 78 cents per share to be paid by 9 October 2019, with a record date of 2 September 2019 and ex date of 30 August 2019.

Outlook

On the back of the diversity and resilience of the portfolio, WES continue to be in a good position for an array of economic conditions. The groupâs concentration would remain on consumers and on running businesses for the success during the long period of time value creation. Also, WES would keep building on its unique capabilities and platforms to take advantage of growth prospects of its running businesses, lately procured investments and so forth.

Stock Performance

On 11 September 2019, WESâ stock was trading at AUD 39.43, with a rise of 0.459 per cent (at AEST 3:57 PM). The company has ~1.13 billion shares outstanding, and a market cap of AUD 44.5 billion. The 52-week high and low value of the stock was noted at AUD 40.430 and AUD 29.537, respectively.

Amcor plc

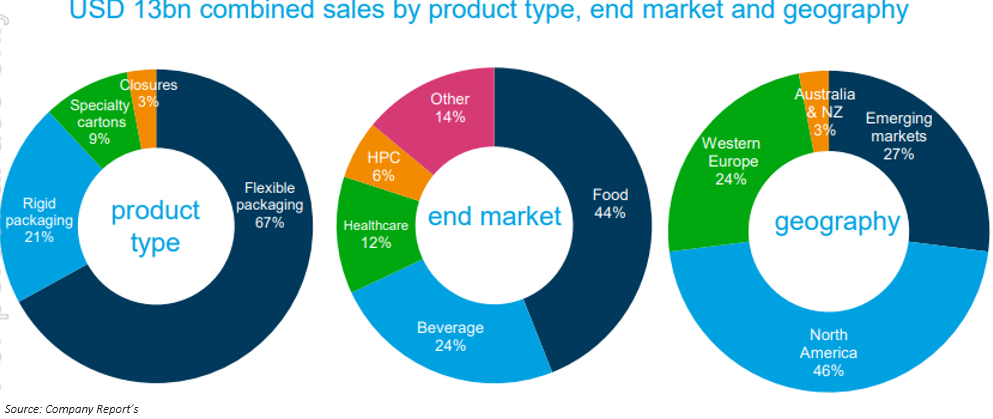

Amcor plc (ASX: AMC) is an international leader that develops and generates packing for food, beverage, personal care products, healthcare and so forth. Amcor constantly focuses on creating lighted weighted, biodegradable, and reusable substance for packaging. AMC has a presence in ~250 location in +40 countries. The company was previously known as Artic Jersey Limited and changed its name in October 2018 to Amcor plc.

Recent Updates

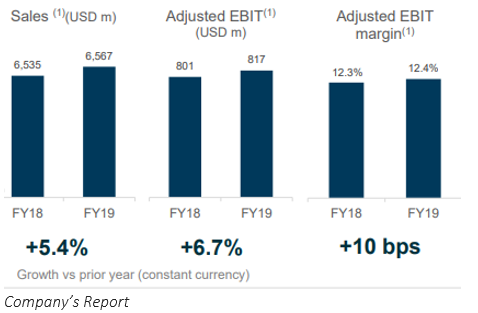

On 4 September 2019, the company had announced the financial results for FY 2019, below are the snapshot of the results:

- The companyâs net sales increased by 1.5% to $9.5 billion compared to the previous corresponding year.

- EBIT increased by 5.7% to $1,075 million from the previous year.

- EBIT margin stood at 11.4% which shows an increment of 10 bps.

- Net income of the company increased by 9% to $730 million.

- During the period, there was a solid operating cost performance and the company gained benefit via legacy restructuring.

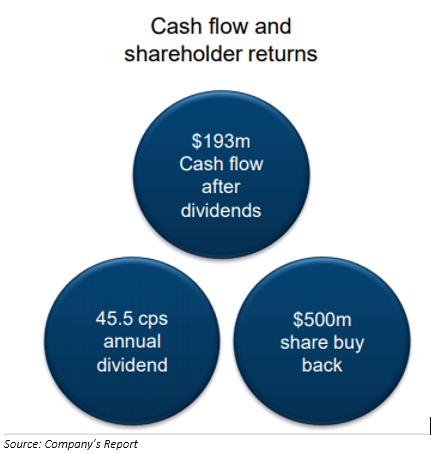

Dividends

The company announced a dividend of $0.24 and $0.22 per share in October 2018 and April 2019 and with the pro-rata unfranked dividend of $0.12 per share in May 2019.

For the period closed 30 June this year, the dividend was declared of 12 cents to be paid by 8 October this year.

Business Outlook

AMC anticipates long-term funding needs, to mainly relate to refinancing and servicing AMCâs outstanding financial liabilities to finance its growth capital expenses and payments for acquisitions that may be concluded. The company anticipates continuing funding its long-term business requisites on the same basis as done in the past. i.e. partly through cash flow provided by the operating activities that are available to the business and management of the capital of the business.

Stock Performance

On 11 September 2019, AMCâs stock was trading at AUD 14.620, with a rise of 4.131 per cent (at AEST 3:59 PM). The company has ~1.63 billon shares outstanding, and a market cap of AUD 22.83 billion. The 52-week high and low value of the stock was noted at AUD 16.740 and AUD 12.665, respectively.

Coles Group limited

Coles Group Limited (ASX: COL) operates an Australian retailer company with ~2500 retail outlets in the country. COL is a full-service market retailer operating in more than 800 supermarkets. Coles Supermarkets, Coles Online, Coles Liquor & Coles financial service are some the segments of the company.

Recent Updates

On 10 September 2019, the company notified that one of the directors of COL, Abigail Pip Cleland changed interest in the company. On 4 September 2019, the director acquired 18,000 fully paid ordinary shares at a consideration of $14.1455 average price/share.

Also, on 4 September 2019, the company announced the change in one of the directors, David Cheesewrightâs interest in the company. On 28 August 2019, the director acquired 20,000 ordinary fully paid shares at a consideration of $13.4412 average price/share.

On 30 August 2019, the company also announced the change in Wendy Margaret Stops interest in the company. The director held 5,000 direct and 6,000 indirect fully paid ordinary shares prior to the change. On 27 August 2019, the director acquired 8,090 fully paid ordinary shares at a consideration of $13.555 average price/share.

Financial Summary for the year FY 2019:

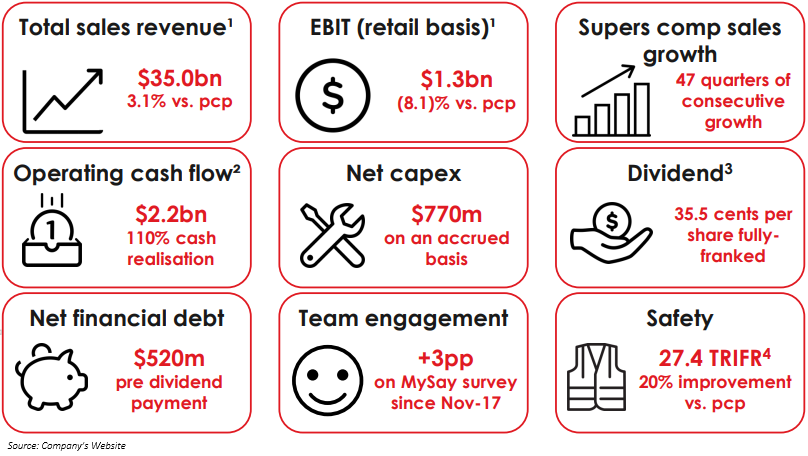

On 22 August 2019, COL declared full-year report closed 30 June 2019. The highlights of the same are as follows:

- Total sales increased by 3.1% to $35.0 billion compared to the previous corresponding year.

- The companyâs EBIT (retail basis) surged to 8.1%.

- Further, the companyâs sales have grown continuously in the last 47 quarters.

- Operating cash flow stood at $2.2 billion.

- Net Capex of the company was at $770 million on an accrued basis.

Business Highlights for FY 2019:

- The company was listed on ASX last year after a demerger from WES.

- The company has strategic partnerships with Witron, Ocado, Optus & SAP.

- The new partnership during FY 2019 period was between Viva Energy and Queensland Liquor JV with Australian Venue Co.

- The group has contributed ~$115 million to community and charity partners.

Dividend

The company declared a fully franked total dividend of 35.5 cents per share for the period closed 30 June 2019, including a final dividend of 24.0 cps. COL also announced a special dividend of 11.5 cents per share for the period from 28 November 2018 to 30 June 2019.

The dividend of 35.5 cps has a payment date of 26 September 2019, with a record date of 29 August 2019 and an ex date of 28 August this year.

Outlook

As per Q1 FY 2020 trading update, Little Shop 2 resonated with the consumers and is making solid engagement. The comparable sales growth in comparison to last yearâs extremely successful Little Shop Campaign would be tough on the back of competitor activity in the market. The companyâs growth in fuel volumes is impressive; however, some more time is required to build volumes to target levels and as a consequence, COL anticipates increase in earnings under the New Alliance Agreement to continue to be subdued in FY20 period.

The companyâs smart selling initiatives in FY20 are expected to provide annualised benefits in surplus of ~$150 million.

Stock Performance

On 11 September 2019, COLâs stock was trading at AUD 14.81, with a rise of 0.271 per cent (at AEST 3:58 PM). The company has ~1.33 billion shares outstanding, and a market cap of AUD 19.7 billion. The 52-week high and low value of the stock was noted at AUD 14.850 and AUD 11.026, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.