Australia?s economy carries an enviable record of steady and uninterrupted growth, underpinned by its strong regulatory institutions, diversified services-based economy and its response to global changes. As per Austrade?s recently released 2019 Benchmark Report, the Australian economy is likely to become 5th largest in the Asian region and 14th largest in the world in 2019. The country has continued to enjoy a strong economic performance in comparison to the other developed economies for the last many years.

As per Austrade, Australia is likely to attain average annual real GDP growth of 2.7 % between 2019 & 2023, which is highest amongst the key advanced economies and above an average growth rate of 2.6% witnessed between 2014 and 2018. However, few market experts believe that the ongoing trade tensions between the United States and China might affect the Australian economy adversely to a great extent.

Effect of US-China Trade Conflict on Australia

The escalating trade dispute between the two largest economies of the world might shake the global economic balance in the future. The International Monetary Fund in its recently released World Economic Outlook has lowered its forecast for global growth by 0.1 percentage point for both 2019 and 2020, owing to a bilateral dispute between the US and China.

IMF has also downgraded China?s economic growth from 6.3 per cent to 6.2 per cent in 2019, while it has upgraded its forecast of US growth from 2.3 per cent to 2.6 per cent. According to the IMF, the growing battle between the US and China over the trade negotiations is hurting China more than the US.

A recently released report by the Reserve Bank of Australia mentioned that the Australian economy would also be adversely affected by a shock to Chinese growth. This is so because Australia shares a close relationship with China, with China being its largest trading partner. The report mentioned that a decline in Chinese growth would lower the demand for several Australian products as China is the second-largest source of Australian imports. As per the report, the Australian GDP is likely to be 2.5% lower than it would have otherwise been after three years.

Although RBA expects a slowdown in the Australian economy driven by a slump in the Chinese economy, the extent of the downturn is still uncertain. Also, Australia?s possess an exceptional nature of resilience to economic cycles that ranks it among the most business-friendly economies of the world.

Indicators of Australia?s Economic Health

Though the external factors affect the state of an economy considerably, one cannot ignore the major influence of internal factors. Taking this into consideration, let discuss some factors affecting the internal state of the Australian economy:

Labor Market Performance

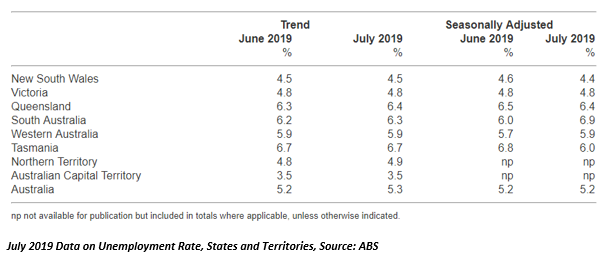

The unemployment rate is the key indicator of labor market performance that reflects the state of an economy. When the unemployment rate of an economy is high, the contribution of the nation to the GDP growth gets affected. The labor market conditions have deteriorated in Australia in the last few months, compelling the RBA to reduce the interest rates to 1 per cent. The seasonally adjusted unemployment rate rose to 5.2 per cent in April this year and has remained steady since then.

Labor Market Statistics

As per the recently released figures by the Australian Bureau of Statistics, while Australia?s unemployment rate remained unchanged at 5.2 per cent in July 2019, the number of persons employed in the country have improved by 41,100 persons. Surprisingly, the rise in job creation surpassed the projection of economists in July 2019. The increase of 41,100 persons included a rise of 6,700 persons in part-time employment and a rise of 34,500 persons in full-time employment.

The largest increase in employment was seen in Queensland, followed by New South Walesa and Victoria, while the largest decrease was seen in Western Australia in seasonally adjusted terms. On the other hand, the unemployment rate increased in South Australia and Western Australia by 0.9 per cent and 0.2 per cent, respectively.

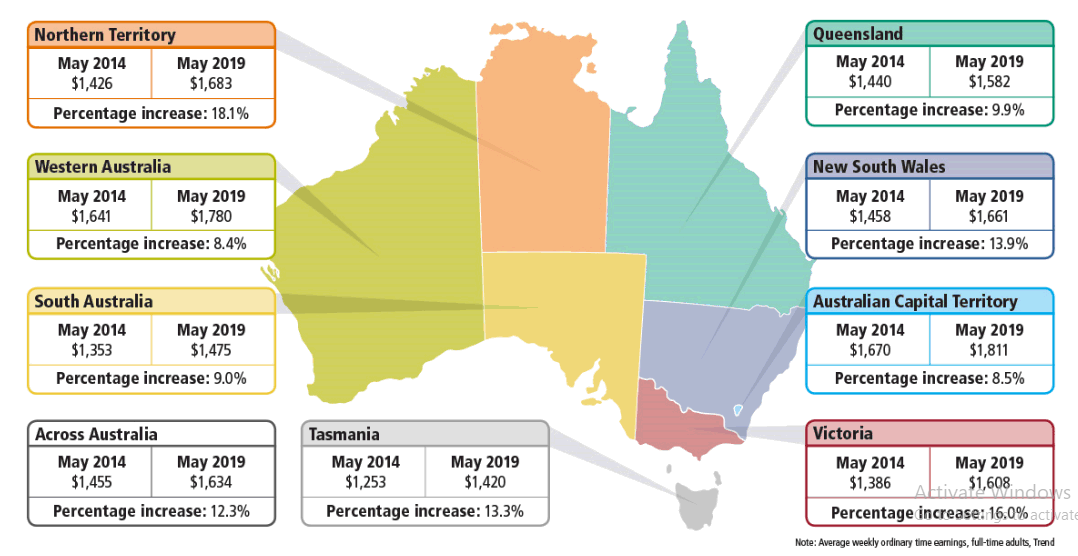

Along with unemployment rate statistics, ABS has also recently released the statistics for average weekly earnings in Australia in May 2019. As per the data, the full-time average weekly ordinary time earnings in Australia stood at $1,634 in trend terms in May 2019, representing a rise of 3 per cent from May 2018.

The average full-time earnings have remained highest in the Australian Capital Territory over the past five years, followed by Western Australia while it remained lowest in Tasmania, followed by South Australia.

The below figure demonstrates the percentage increase in average full-time earnings in Australia?s states and territories over the last five years:

Source: ABS

The Australian economy also witnessed a steady growth in its wage rate during June 2019 quarter, backed by strong public sector growth. During the quarter, the seasonally adjusted Wage Price Index improved by 0.6 per cent while the trend index rose by 0.5 per cent. In original terms, the highest index rise at an industry level was recorded in Health care and social assistance and Electricity, gas, water and waste services.

Housing Market Performance

The Australian property market has remained largely in discussions in 2019 due to solid fluctuations in the market in terms of housing prices, dwelling approvals and mortgage lending. The falling housing prices and declining dwelling approvals have remained a major cause of concern for the economy.

Housing Market Statistics

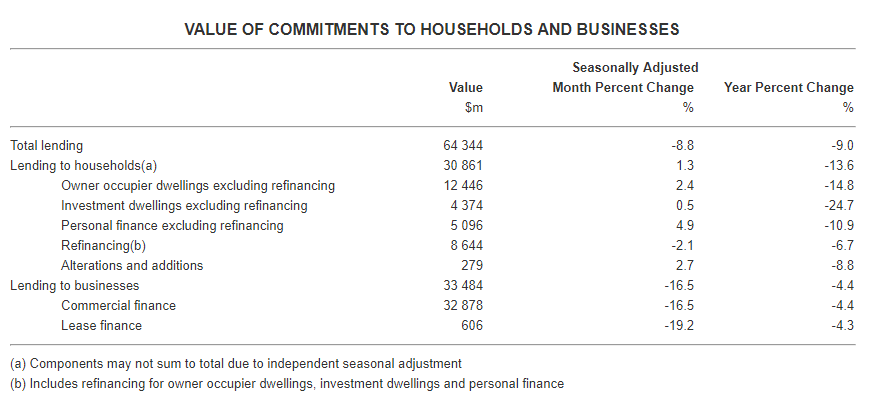

The recently reported figures by the ABS indicate that the total dwellings approved in Australia in June 2019 have fallen by 1.2 per cent in seasonally adjusted terms, driven by a 6.5 per cent fall in private sector dwellings excluding houses. However, the value of total building approved has improved by 2.0 per cent, backed by a rise of 9.6 per cent in the value of non-residential buildings.

Although dwelling approvals fell in June, the value of new lending commitments to households improved by 1.3 per cent in June 2019 in seasonally adjusted terms. The rise in lending commitments followed a fall of 1.6 per cent observed in May 2019. The lending commitments for owner occupier dwellings increased for all states but declined for the Australian territories.

Source: ABS

The housing prices are also rebounding along with the lending commitments to households, indicates the recently released statistics by a property consultant CoreLogic. The data reported by the consultant showed that the housing prices improved across all capital cities in July 2019 except for Adelaide, Canberra and Perth. Melbourne and Sydney?s housing values reported their second month-on-month rise in July, rising by 0.2 per cent each.

The recovery in the housing market is in line with the expectation of economists that had forecasted a modest rise in the market by the second half of 2019.

Consumer Price Index

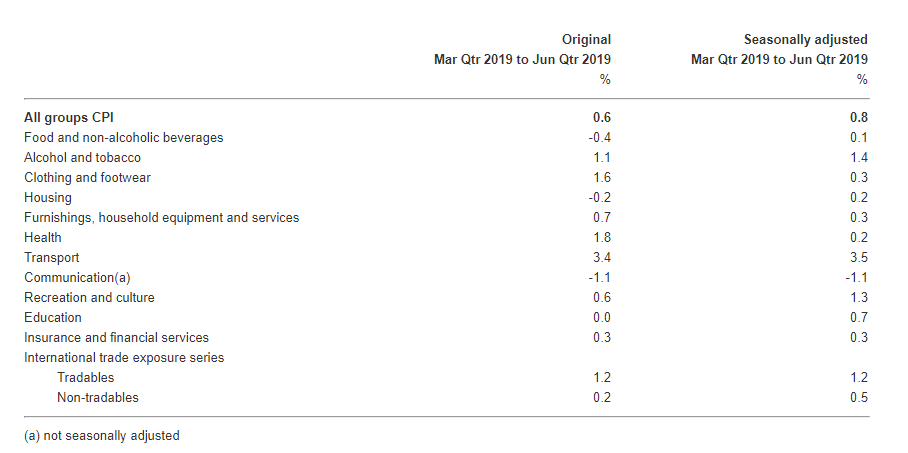

A major determinant of an economy?s health is the inflation rate that unexpectedly improved in Australia during the June 2019 quarter, following no movement in the prior quarter. The inflation rate rose by 0.6 per cent in June quarter, driven by a significant rise in the prices of automotive fuel, international holiday, travel and accommodation, and medical and hospital services.

CPI June 2019 Quarter, Source: ABS

Regardless of the fact that the Australian economy is showing some signs of recovery, the market experts are still expecting a further rate cut by the RBA soon to support its employment growth and subdued inflation. RBA?s Governor has also signalled for another rate cut, staying firm on the bank?s inflation targeting regime. Not to forget, the bank has already reduced interest rates by 25 basis points each in two consecutive months this year, taking it to a historic low level of 1 per cent. Whether the bank will move forward with its rate cut regime or will adopt other measures to stabilise the economy would be an interesting watch.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.