The financial services sector has been a key contributor to the countryâs economy and has maintained its profitability and competitiveness, while offering attractive dividends to its shareholders.

Let us have a look at recent updates from few stocks in the financial services industry.

Macquarie Group Limited

Macquarie Group Limited (ASX: MQG) is engaged in providing banking, financial, advisory, investment and funds management services.

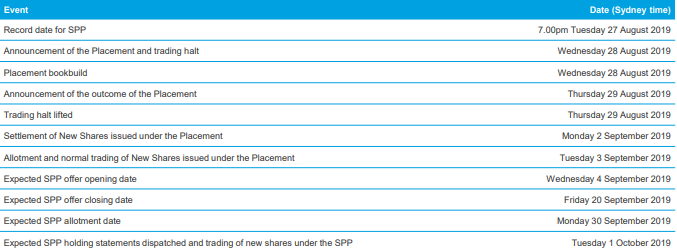

Capital Raising Update: The company recently announced that it is planning to raise an amount of A$ 1 billion through a non-underwritten Institutional placement along with an associated Share Purchase Plan. In the quarter ending 30 September 2019, the company expects to report approximately A$ 1 billion in net capital investment. The company would utilise the funds for the purpose of investments in renewables, infrastructure and technology sectors by Macquarie Capital across most regions and an expected increase in capital deployment by Macquarie Capital and Macquarie Asset Management. In 2Q20, the company expects to see an increase in capital usage of approximately A$ 1.6 billion across annuity-style and markets-facing businesses.

Offer Timetable (Source: Companyâs Report)

Outlook Update: The company disclosed that it expects financial results for FY20 to be slightly lower than FY19. The financial results for the first half of FY20 is expected to be approximately 10% above the prior corresponding period and lower than 2H19, which saw increased contributions from the markets-facing businesses.

Shareholding Update: The company recently updated that it became a substantial shareholder of CSR Limited (ASX: CSR) with a voting power of 5.89%. The company also became a substantial shareholder for Gold Road Resources Limited (ASX: GOR) with a voting power of 12.50%.

1Q20 Update: In a recent announcement, the company provided an update on its performance in the first quarter of FY20. The company notified that its operating groups were performing in line with expectations, with contributions in 1Q20 broadly in line with prior corresponding period and slightly below the performance in the previous quarter. Net profit for the quarter was in line with pcp with financial position exceeding minimum requirements.

Group capital surplus as at 30 June 2019 was reported at A$ 5.0 billion, down from A$ 6.1 billion as at 31 March 2019, owing to payment of final dividend for FY19. Bank CET1 ratio stood at 12.0%, while leverage ratio was 5.4% for 1Q20. Liquidity coverage ratio for the period was 166% and net stable funding ratio stood at 111%.

Key Business Highlights: As at 30 June 2019, Macquarie Asset Management had A$ 552.7 billion in assets under management, up 2% on AUM as at 31 March 2019. Macquarie Infrastructure and Real Assetâs equity under management was reported at A$ 120.2 billion, up 3% from A$ 116.9 billion as at 31 March 2019.

Corporate and Asset Financeâs asset and loan portfolio was valued at A$ 21.5 billion as at 30 June 2019, broadly in line with 31 March 2019. As at 30 June 2019, Banking and Financial Servicesâ total deposits stood at A$53.1 billion, down 1% on deposits value as at 31 March 2019. Fee revenue of Macquarie Capital was higher than prior corresponding period due to higher fee revenue from M&A and DCM.

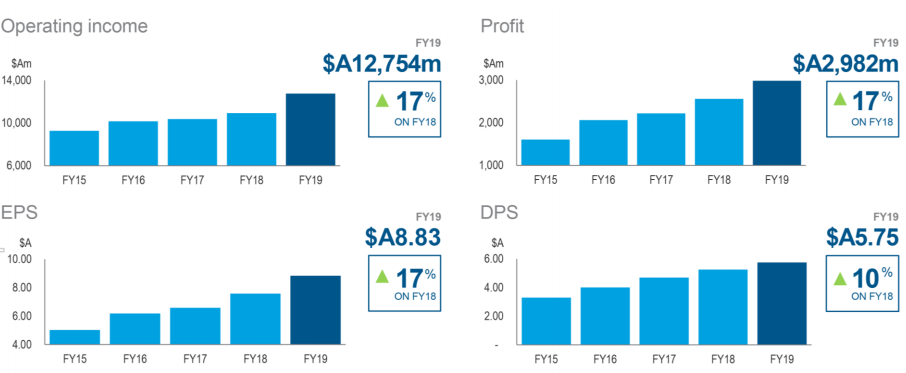

FY19 Performance Highlights: In FY19, the company generated net operating income amounting to A$ 12,754 million, up 17% on prior corresponding year. Net profit for the year was reported at A$ 2,982 million, up 17% on prior year. Earnings per share stood at A$ 8.83, up 17% on FY18.

Offer Timetable (Source: Companyâs Report)

Outlook Update: The company disclosed that it expects financial results for FY20 to be slightly lower than FY19. The financial results for the first half of FY20 is expected to be approximately 10% above the prior corresponding period and lower than 2H19, which saw increased contributions from the markets-facing businesses.

Shareholding Update: The company recently updated that it became a substantial shareholder of CSR Limited (ASX: CSR) with a voting power of 5.89%. The company also became a substantial shareholder for Gold Road Resources Limited (ASX: GOR) with a voting power of 12.50%.

1Q20 Update: In a recent announcement, the company provided an update on its performance in the first quarter of FY20. The company notified that its operating groups were performing in line with expectations, with contributions in 1Q20 broadly in line with prior corresponding period and slightly below the performance in the previous quarter. Net profit for the quarter was in line with pcp with financial position exceeding minimum requirements.

Group capital surplus as at 30 June 2019 was reported at A$ 5.0 billion, down from A$ 6.1 billion as at 31 March 2019, owing to payment of final dividend for FY19. Bank CET1 ratio stood at 12.0%, while leverage ratio was 5.4% for 1Q20. Liquidity coverage ratio for the period was 166% and net stable funding ratio stood at 111%.

Key Business Highlights: As at 30 June 2019, Macquarie Asset Management had A$ 552.7 billion in assets under management, up 2% on AUM as at 31 March 2019. Macquarie Infrastructure and Real Assetâs equity under management was reported at A$ 120.2 billion, up 3% from A$ 116.9 billion as at 31 March 2019.

Corporate and Asset Financeâs asset and loan portfolio was valued at A$ 21.5 billion as at 30 June 2019, broadly in line with 31 March 2019. As at 30 June 2019, Banking and Financial Servicesâ total deposits stood at A$53.1 billion, down 1% on deposits value as at 31 March 2019. Fee revenue of Macquarie Capital was higher than prior corresponding period due to higher fee revenue from M&A and DCM.

FY19 Performance Highlights: In FY19, the company generated net operating income amounting to A$ 12,754 million, up 17% on prior corresponding year. Net profit for the year was reported at A$ 2,982 million, up 17% on prior year. Earnings per share stood at A$ 8.83, up 17% on FY18.

FY19 Financial Performance (Source: Company Presentation)

Stock Performance: The stock of the company generated returns of 2.24% over a period of 3 months. The stock last traded on 27 August 2019 at a market price of $123.510 and has been put on a trading half upon managementâs request.

Magellan Financial Group Limited

Magellan Financial Group Limited (ASX: MFG) provides international investment funds to high net worth and retail investors in Australia and New Zealand.

Institutional Placement: The company recently completed its fully underwritten $275 million institutional placement. The placement involved issue of approximately 4.98 million new Magellan ordinary shares to institutional investors for a per share consideration of $55.20. The company appointed Macquarie Capital (Australia) Limited as the underwriter to the issue.

Launch of Magellan High Conviction Trust: The company updated on 13 August 2019 that one of its subsidiaries, Magellan Asset Management Limited is planning to float an initial public offering for ordinary units in a new investment trust on the ASX platform, the Magellan High Conviction Trust. The trust aims to deliver a Target Cash Distribution of 3% per annum to investors, while investing in high quality global companies. Costs pertaining to the offer will be paid by the company in cash to equalise the opening cash net asset value per unit with the application price of $1.50 per unit.

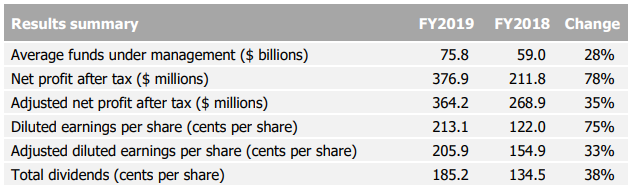

FY19 Financial Highlights: During the year ended 30 June 2019, the company reported adjusted net profit after tax amounting to $364.2 million, up 35% from $268.9 million in prior corresponding period. Average funds under management as at 30 June 2019 were reported at $75.8 million, up 28% from the prior corresponding period value of $59.0 million. The company declared a dividend of 111.4 cents for six months to 30 June 2019, up 24% from the same period a year ago. Total dividends for the year went up by 38% to 185.2 cents per share.

FY19 Financial Performance (Source: Company Presentation)

Stock Performance: The stock of the company generated returns of 2.24% over a period of 3 months. The stock last traded on 27 August 2019 at a market price of $123.510 and has been put on a trading half upon managementâs request.

Magellan Financial Group Limited

Magellan Financial Group Limited (ASX: MFG) provides international investment funds to high net worth and retail investors in Australia and New Zealand.

Institutional Placement: The company recently completed its fully underwritten $275 million institutional placement. The placement involved issue of approximately 4.98 million new Magellan ordinary shares to institutional investors for a per share consideration of $55.20. The company appointed Macquarie Capital (Australia) Limited as the underwriter to the issue.

Launch of Magellan High Conviction Trust: The company updated on 13 August 2019 that one of its subsidiaries, Magellan Asset Management Limited is planning to float an initial public offering for ordinary units in a new investment trust on the ASX platform, the Magellan High Conviction Trust. The trust aims to deliver a Target Cash Distribution of 3% per annum to investors, while investing in high quality global companies. Costs pertaining to the offer will be paid by the company in cash to equalise the opening cash net asset value per unit with the application price of $1.50 per unit.

FY19 Financial Highlights: During the year ended 30 June 2019, the company reported adjusted net profit after tax amounting to $364.2 million, up 35% from $268.9 million in prior corresponding period. Average funds under management as at 30 June 2019 were reported at $75.8 million, up 28% from the prior corresponding period value of $59.0 million. The company declared a dividend of 111.4 cents for six months to 30 June 2019, up 24% from the same period a year ago. Total dividends for the year went up by 38% to 185.2 cents per share.

FY19 Results Summary (Source: Company Reports)

Revenue: During the year, the company generated management and services fees revenue amounting to $472.5 million, up 22% from the prior corresponding period value of $385.8 million. Performance fees revenue amounted to $83.6 million, up 110% from a revenue of $39.8 million posted in the year-ago period. Total adjusted revenue for the year stood at $577.3 million, increasing 28% in comparison to the FY18 adjusted revenue of $452.6 million.

Stock Performance: The stock of the company generated returns of 46.63% over a period of 6 months. The MFG stock closed the dayâs trading at a market price of $52.160, up 2.455% on 28 August 2019, with a market capitalisation of $9.27 billion.

Suncorp Group Limited

Suncorp Group Limited (ASX: SUN) is engaged in the provision of insurance, banking and wealth products to retail, corporate and commercial customers in Australia and New Zealand.

Change in Directorâs Interest: The company provided updates on the acquisition of ordinary shares by few directors on its Board. Lindsay Tanner has acquired 1,900 ordinary shares worth $13.15 per share. Another director, Simon Machell, completed the acquisition of 10,000 ordinary shares at a per share value of $13.33. Sally Herman took over 4,000 ordinary shares for a consideration of $13.84 per share and Ian Hammond acquired 5,000 shares valued at $13.50 per ordinary share.

FY19 Results: The companyâs cash earnings for the 12 months ended 30 June 2019 were reported at $1,115 million, increasing 1.5% on prior corresponding period cash earnings of $1,098 million. Net profit after tax for the period was reported at $175 million, representing a decline of 83.5% in prior corresponding period value of $1,059 million. FY19 Group UITR ratio stood at 12.3%, as compared to 10.6% in prior corresponding period.

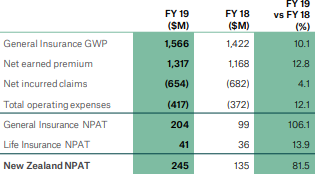

Due to strong performance in New Zealand, the companyâs PAT from ongoing functions witnessed an increase of 1.0%. In New Zealand, the company reported profit after tax amounting to $245 million, depicting an increase of 81.5% on prior corresponding period. In FY19, $1.6 billion was earned in gross written premium, representing an increase of 10.1% in comparison to FY18.

FY19 Results Summary (Source: Company Reports)

Revenue: During the year, the company generated management and services fees revenue amounting to $472.5 million, up 22% from the prior corresponding period value of $385.8 million. Performance fees revenue amounted to $83.6 million, up 110% from a revenue of $39.8 million posted in the year-ago period. Total adjusted revenue for the year stood at $577.3 million, increasing 28% in comparison to the FY18 adjusted revenue of $452.6 million.

Stock Performance: The stock of the company generated returns of 46.63% over a period of 6 months. The MFG stock closed the dayâs trading at a market price of $52.160, up 2.455% on 28 August 2019, with a market capitalisation of $9.27 billion.

Suncorp Group Limited

Suncorp Group Limited (ASX: SUN) is engaged in the provision of insurance, banking and wealth products to retail, corporate and commercial customers in Australia and New Zealand.

Change in Directorâs Interest: The company provided updates on the acquisition of ordinary shares by few directors on its Board. Lindsay Tanner has acquired 1,900 ordinary shares worth $13.15 per share. Another director, Simon Machell, completed the acquisition of 10,000 ordinary shares at a per share value of $13.33. Sally Herman took over 4,000 ordinary shares for a consideration of $13.84 per share and Ian Hammond acquired 5,000 shares valued at $13.50 per ordinary share.

FY19 Results: The companyâs cash earnings for the 12 months ended 30 June 2019 were reported at $1,115 million, increasing 1.5% on prior corresponding period cash earnings of $1,098 million. Net profit after tax for the period was reported at $175 million, representing a decline of 83.5% in prior corresponding period value of $1,059 million. FY19 Group UITR ratio stood at 12.3%, as compared to 10.6% in prior corresponding period.

Due to strong performance in New Zealand, the companyâs PAT from ongoing functions witnessed an increase of 1.0%. In New Zealand, the company reported profit after tax amounting to $245 million, depicting an increase of 81.5% on prior corresponding period. In FY19, $1.6 billion was earned in gross written premium, representing an increase of 10.1% in comparison to FY18.

Performance â New Zealand (Source: Company Reports)

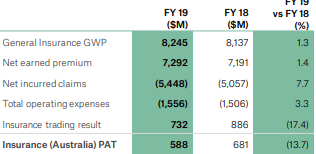

Profit after tax in case of Insurance (Australia) stood at $588 million, down 13.7% in comparison to prior corresponding period. The segment earned a gross written premium amounting to $8.2 billion, rising 1.3% in comparison to prior corresponding period.

Performance â New Zealand (Source: Company Reports)

Profit after tax in case of Insurance (Australia) stood at $588 million, down 13.7% in comparison to prior corresponding period. The segment earned a gross written premium amounting to $8.2 billion, rising 1.3% in comparison to prior corresponding period.

Performance â Insurance Australia (Source: Company Reports)

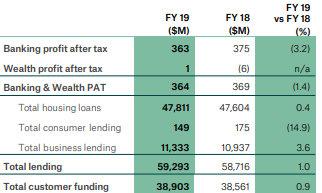

PAT for the Banking & Wealth segment amounted to $364 million, falling 1.4% in comparison to prior corresponding period. Gross loans and advance pertaining to the segment stood at $59.3 billion, up 1.0% on prior corresponding period.

Performance â Insurance Australia (Source: Company Reports)

PAT for the Banking & Wealth segment amounted to $364 million, falling 1.4% in comparison to prior corresponding period. Gross loans and advance pertaining to the segment stood at $59.3 billion, up 1.0% on prior corresponding period.

Performance â Banking & Wealth (Source: Company Reports)

Dividend: A fully franked special dividend of 8 cents per share was paid by the company on 03 May 2019. The company declared a fully franked final ordinary dividend amounting to 44 cents per share, taking full year ordinary dividend to 70 cents per share and a payout ratio of 81.2% of cash earnings.

Outlook: In FY20, the company is expecting to continue with the strong performance in New Zealand, with growth expected to return to lower single-digit levels. FY20 natural hazard allowance will be increased from $720 million to $820 million. The group has also purchased an additional stop loss for $45 million. Cost pertaining to stop loss cover and increase in natural hazard allowance is expected to impact the companyâs target to achieve at least 12% underlying ITR in FY20.

Stock Performance: The stock of the company generated negative returns of 0.59% and 0.74% over a period of 1 month and 3 months, respectively. The stock closed the dayâs trading at a market price of $13.580 on 28 August 2019, up 0.593% from its previous close.

Performance â Banking & Wealth (Source: Company Reports)

Dividend: A fully franked special dividend of 8 cents per share was paid by the company on 03 May 2019. The company declared a fully franked final ordinary dividend amounting to 44 cents per share, taking full year ordinary dividend to 70 cents per share and a payout ratio of 81.2% of cash earnings.

Outlook: In FY20, the company is expecting to continue with the strong performance in New Zealand, with growth expected to return to lower single-digit levels. FY20 natural hazard allowance will be increased from $720 million to $820 million. The group has also purchased an additional stop loss for $45 million. Cost pertaining to stop loss cover and increase in natural hazard allowance is expected to impact the companyâs target to achieve at least 12% underlying ITR in FY20.

Stock Performance: The stock of the company generated negative returns of 0.59% and 0.74% over a period of 1 month and 3 months, respectively. The stock closed the dayâs trading at a market price of $13.580 on 28 August 2019, up 0.593% from its previous close.

Disclaimer This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.