The Australian Securities and Investments Commission (ASIC) describes managed funds, as a type of managed investment scheme. A managed fund is for people who have money and wish to invest the money; and seek the assistance of professionals who would aid in conducting investment decisions.

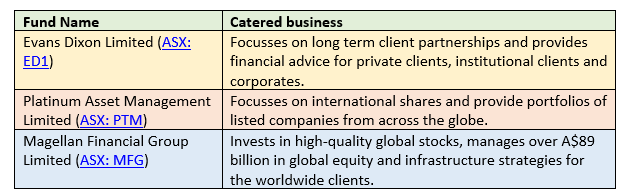

In this article, we would look at the FY Results of 3 ASX-listed managed funds, and understand their current stock stance:

Let us now look at the stocks under discussion in detail.

Evans Dixonâs FY19 Results

Evans Dixon Limited (ASX: ED1) was created in 2017 when broker Evans & Partners entered into a merger with self-managed superannuation specialists, Dixon Advisory.

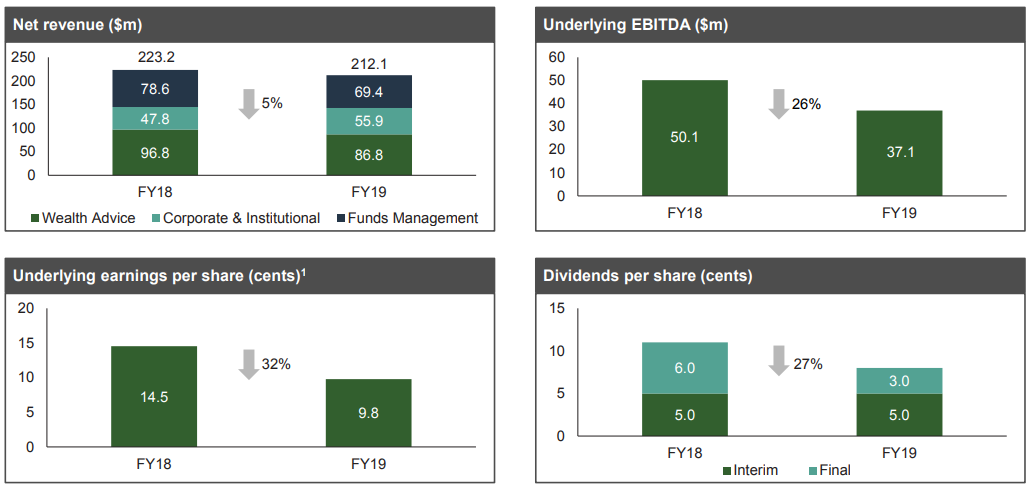

On 26 August, ED1 released its FY19 results, depicting a reduction in profitability from the prior year, catalysing a decline in the share price, with underlying EBITDA of $37.1 million, down by 26 per cent on pcp, though within the guidance of $35â38 million; and statutory NPAT of $16.8 million, 13 per cent lower than pcp. On the divisional front, the Wealth Advice division generated EBITDA of A$14.7 million, Corporate and Institutional Division produced A$21.4 million and Funds Management generated $15.9 million.

The company declared a final dividend of 3 cps (100% franked), which took the full year dividend to reach at 8 cps, compared to the 11 cps in pcp. The dividend, representing a pay-out ratio of 85 per cent, would be paid on 11 October 2019, a month before ED1âs AGM. It has a record date of 2 October 2019 and ex date of 1 October this year.

The FY19 underlying EPS was 9.8 cents, less than 14.5 cents of pcp. However, FUA was up by 10 per cent over the year to $20.1 billion and FUM was up by 21 per cent to $6.8 billion. The companyâs net client numbers were up by approximately more than 300. Strategically important funds were raised in the second half of the year, including LSE-listed US Solar Fund.

Financial highlights, Source: Companyâs Report

No good news for the company, since market experts report that ED1âs clients had grown dissatisfied with the ill performance of the companyâs in-house investment products. Commenting on the results, Executive Chairman Mr David Evans stated that reduced transaction activity, fewer capital raisings for new Funds Management investment strategies along with increased corporate costs catalysed the lower Group earnings, which ED1 acknowledges and aims to address for better performance.

On the outlook front, during the first few months of FY20, ED1 was focused on operational review to deliver cost efficiencies and enhance cross business integration. The pipeline of corporate advisory transactions seems to be encouraging. The forecast of a better performance by the company is subject to market conditions, the completion rate of transactions and any potential significant changes in regulatory conditions.

Platinum Asset Managementâs FY19 Results

Platinum Asset Management Limited (ASX:PTM) was the Morningstar Australian Fund Manager of 2018 and won in the International Equity Category of the Morningstar Fund Manager of the Year in 2018.

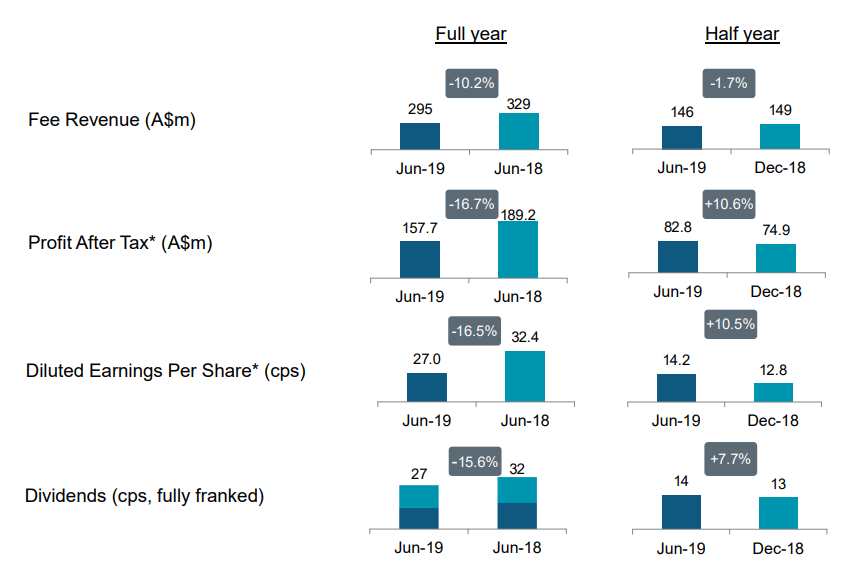

On 21 August 2019, the company released its annual report for the period closed on 30 June 2019, reporting a FUM of $24.8 billion as at 30 June 2019, including the net distribution outflow of $0.8 billion. The FUM was down by 3.6 per cent on pcp and the average FUM for the year was down by 4.1 per cent to $25.3 billion, catalysed by net fund outflows of $246 million. Even though expenses were controlled, the Management fees revenue was down by 4 per cent. However, the absolute investment return depicted an optimistic figure as it contributed $224 million to the FUM during the financial year. The profit before income tax expense was reported to be of $219.5 million, down by 1.4 per cent on pcp.

The company declared a fully-franked dividend of 14 cps, over the interim dividend of 13 cps which was paid for the half-year ended 31 December 2018. The declared dividend, of 14cps, which takes the full year dividend to 27 cps, would be paid on 20 September 2019, and has a record date of 28 August 2019. Also, the DRP is in place and has not been activated.

PTMâs Operating Results (Source: PTMâs Report)

The global equity markets faced a challenging year, impacting PTMâs performance as it experienced a decline in overall profits attributable to owners of 16.7 per cent. To top this up, the unrealised loss on PTMâs seed investments were of $988,000. With a strong start to 2019, the Trade tensions reignited in May-June 2019, where the initial impact had hit positions in technology, resources and consumer discretionary players.

The recent investment underperformance is a representation of the late cycle bull market and would urge some retail clients to react negatively in the short-term. However, the company holds a Strong position in the Australian retail market and provides highly differentiated products, and the country has an ever-increasing desire for higher foreign equity exposure, which would scale up PTMâs business.

PTM notified that the ASX Quoted Managed Funds were gaining traction, with net inflows of A$201 million, during FY19, with more than 10,000 investors on the register. The company was aiming towards building its digital presence with clients and believes that it was substantially repositioned for the growth.

Magellan Financial Groupâs FY19 Results

Known as highly rated fund manager of global equities and global listed infrastructure in Australian and abroad, Magellan Financial Group Limited (ASX:MFG) announced its FY19 Results in the midst of the reporting season, on 13 August 2019.

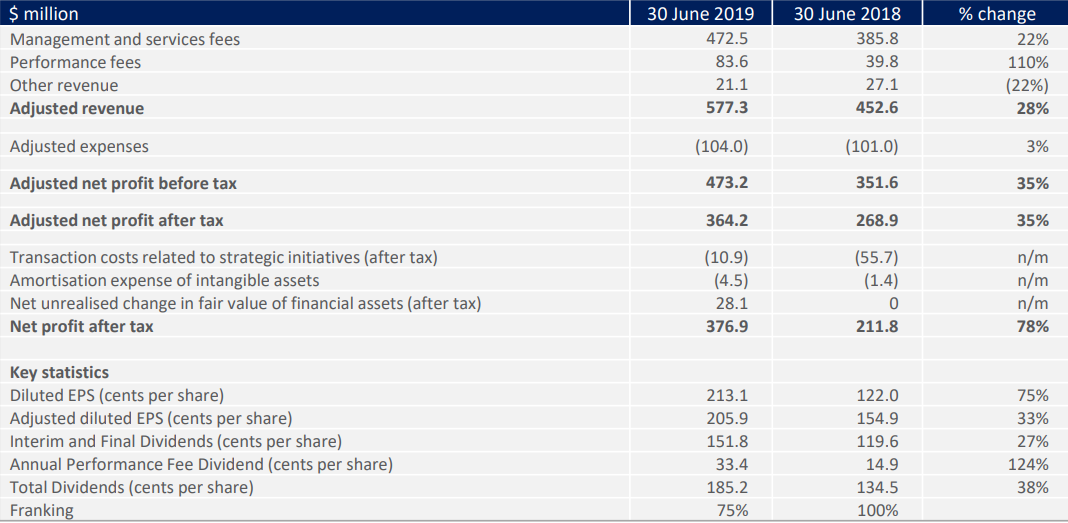

The average FUM stood at $75.8 billion, up by 28 per cent and adjusted NPAT was $364.2 million, up by 35 per cent. The companyâs Board declared a dividend for six months to 30 June 2019 of AUD 111.4 cps, up by 24 per cent and taking the Total dividends for the year to 185.2 cps, up by 38 per cent. The declared dividend would be payable to shareholders on 29 August 2019. It has an ex date of 16 August 2019 and record date of 16 August 2019.

MFGâs FY19 Results (Source: MFGâs Report)

The two big highlights of the result were - the Announcement to launch the Magellan High Conviction Trust and an institutional share placement of $275 million.

An IPO of the Magellan High Conviction Trust, which is an ASX listed investment trust or offer was notified to the market. The Trust would invest in MFGâs 8 to 12 top ideas and duplicate an investment strategy that had delivered more than 16 per cent per annum net of fees ever since 1 July 2013 up until 31 July 2019. The offer would proceed via a priority as well as general offer, wherein eligible applicants (underlying investors in Magellan, the Magellan High Conviction Fund and the Magellan Global Trust). Under the priority offer, eligible applicants could apply for up to $50,000 of units and receive loyalty units worth 7.5 per cent. Under the general offer, applicants would receive IPO Foundation Units of 2.5 per cent.

Besides this, MFG announced a fully underwritten institutional placement with the aim to raise $275 million, comprising of an issue of 4.98 million new MFG shares, which represent approximately 2.7 per cent of the expanded issued capital, at a price of $55.20 per share. The placement was successfully completed on 14 August 2019. The proceeds would be used to meet the expected costs associated with the Trustâs IPO and support MFGâs under-development new retirement product, while catering to other investment strategies and enhancing MFGâs balance sheet.

Let us have a look at the stock performances of FUMâs under discussion (as on 26 August 2019) post the closure of the trading session along with their YTD returns.

| FUM Entity | Stock Price and Performance (A$ and %) | YTD Return (%) |

| Evans Dixon Limited (ASX: ED1) | 0.68, up by 2.256 | -59.45 |

| Platinum Asset Management Limited (ASX:PTM) | 4.010, down by 0.249 | -16.60 |

| Magellan Financial Group Limited (ASX:MFG) | 51.96, down by 0.25 | 122.89 |

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.