Fund manager Magellan Financial Group Limited (ASX: MFG) has completed capital raising of $275 million in a placement made at a near 52-week high.

MFG Chairman and Co-founder, Hamish Doughlass is using acquisitive tactics to make some cheap money from investing capital in companies at a cost of about five times earnings when a stock of Magellan itself is trading at many multiples of that. And it wouldnât be a surprise if we tell that these strategies of former investment banker are working to attract fresh capital in a bull market.

Magellan capitalised on the froth of its near record share price to quote an issue price of $55.20 per new share, raising $275 million fresh capital. To put it in perspective, we can see that Magellan offered a 6% discount on $58.72 (closing price of 12 August 2019) to make the offer compelling, when it knew that the comparative price is close to the top end of 52-week string, i.e. $62.60.

Now the offer has closed and that too successfully! Magellan informs that it would issue ~4.98 million new MFG shares in the settlement of placement transaction on 19 August 2019.

Brett Cairns, Magellan CEO stated that Magellan is delighted to see the encouraging results of its capital raising program, strongly supported by investors. He added that Magellan aims to continue deliver the long-term value for its shareholders.

The whole placement was led by Macquarie Capital (Australia) Limited, which acted as a Sole Lead Manager, Bookrunner and Underwriter of the Placement.

Latest Financial Results for the full year ended 30 June 2019

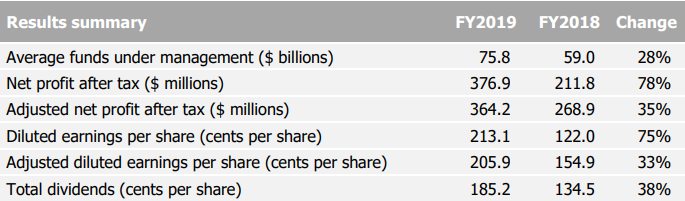

On 13 August 2019, Magellan reported its FY2019 results, posting a growth of 78% in its net profit after tax to $376.9 million. After taking into account non-cash items and other one-off costs, the adjusted net profit after tax of the company came to $364.2 million, an increase of 35% on the figure of previous corresponding period.

Snapshot of Magellanâs financial performance for FY2019 (Source: Company Announcement)

As at the end of Fiscal 2019, the average funds under management of the company stood at $75.8 billion, up 28% compared to $59.0 billion in FY18. Strong growth in funds under management resulted in 22% improvement in Magellanâs management and services fees to $472.5 million in FY19.

The Board declared a total dividend of 185.2 cents per share for the financial year 2019. This represents an increase of 38% on the previous yearâs dividend and includes a final dividend of 78.0 cents per share, franked at 75%, and a performance fee dividend of 33.4 cents per share, total 111.4 cents, for the six-month ended 30 June 2019.

Magellan notified that the amount of 111.4 cents dividend would be payable on 29 August 2019 to the shareholders entitled to receive dividend on the record date of 19 August 2019.

Launch of Magellan High Conviction Trust

Magellan also announced the launch of public offering of the Magellan High Conviction Trust, which reportedly will invest in Magellanâs 8 to 10 best ideas with the objective to concentrate funds towards the high-quality global companies.

Magellan High Conviction Trust is a new ASX-listed investment trust which targets to deliver investors a cash distribution of 3% per annum. The investment strategy of the trust is to design a replica of Magellanâs proven High Conviction strategy that must has assured a return of 16.6% per annum net of fees since inception on 1 July 2013 to 31 July 2019.

In the initial public offering, Magellan would set apart a priority offer to underlying investors of the Magellan Global Trust, Magellan Financial Group, and the Magellan High Conviction Fund. Under this priority offer, eligible applicants can apply for up to $50,000 of units and may be entitled to receive additional units in the face of loyalty points to the worth of 7.5% of the value of units allotted to them, told Magellan. Whereas, wholesale and general public under the IPO would be given a benefit to receive additional units of the value of 2.5% of the worth of units allotted to them.

Hamish Douglass has confirmed to take up his proportion of priority units and even subscribe for additional $20 million worth of units under the wholesale offer. Douglass believes that this structure of offer provides a win-win outcome for investors, who would participate in the raising and will receive valuable additional units in the Magellan High Conviction Trust.

It is worth noting, that all one-off costs associated to the Loyalty Units, IPO Foundation Units, and all other costs of the offer is to be borne by Magellan. The announcement read that IPO has been lodged with the Australian Securities & Investments Commission on 13 August 2019 and the Offer is scheduled to open on 21 August 2019.

Stock Performance

MFG stock price plunged 6.83% to close at $55.740 on 14 August 2019. The stock last traded at a price to earnings multiple of 31.620x with a market capitalisation of $10.6 billion and 177.09 million shares outstanding.

Over the past 12 months, the stock has surged up 113.98% including a positive price change of attractive 156.01% in year-to-date and 37.38% in the past three months.

Also Read: Magellan Groupâs Total FUM Reached A$83,232 Million in April 2019

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.