A wise investor generally prefers to invest in diversified stocks as different stocks react differently to the same economic event, reducing the risks. Diversification works better as it protects investors against a financial crisis. A well-diversified portfolio also enables investors to yield a higher return without increasing the risk level. As stocks are a risky form of investment, an investor should not put all his money into a single stock, rather should spread his wealth. Investors can also diversify their investments across gold, equity, debt, real estate and other investments.

Investors usually diversify their portfolio to minimise the unsystematic risk, which is associated with a particular company or industry. However, in case of a systematic risk, there are lesser chances of few stocks performing better as it affects the entire stock market. With more equities in the portfolio, investors can limit the exposure to the unsystematic risk. The number of stocks one holds does not create as much difference as the proper selection of stocks.

For creating a successful investment portfolio, an investor should first decide on a clear objective for the investment portfolio and frame his investment holdings in a tax-efficient manner. This will enable the investor to create a portfolio that will be consistent with the long-term growth of his investments.

Now, let us have a look at two diversified stocks (from different industries) listed on the Australian Stock Exchange:

Goodman Group

An integrated property group, Goodman Group (ASX: GMG) consists of the stapled entities Goodman Logistics (HK) Limited, Goodman Industrial Trust and Goodman Limited. The Group operates across multiple countries like Brazil, Australia, North America, New Zealand, the United Kingdom, Asia and Europe. It is a major industrial property group, listed on ASX on 2nd February 2005. It is also among the worldâs largest specialist fund managers (listed) of business space and industrial property.

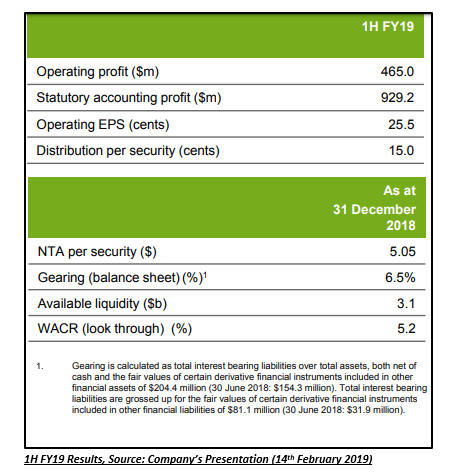

Key Updates: On 24th June 2019, the Group announced a fully unfranked dividend for fully paid ordinary/units stapled securities amounting to 15 cents. The dividend is related to a period of six months with no other securities plan applicable to it. It is payable on 9th September 2019, carrying a record date and an ex-date of 28th and 27th June 2019, respectively. The annual dividend yield of the Goodman Group currently stands at 2.02 per cent (as per ASX).

The Group also released its Investor Day 2019 presentation, highlighting the strategic initiatives and business drivers in its different areas of operation.

The Group delivered a robust performance in the third quarter of the financial year 2019, driven by strong customer demand. During the nine months to 31st March 2019, the Group recorded a 3.3 per cent like-for-like NPI growth in its managed partnerships and $44.1 billion of total assets under management.

Financial Performance - 1H FY19: The Group achieved a 10.4 per cent increase in its operating profit to $465.0 million in HY19, relative to HY18 figure. The operating EPS of the Group was also 9.4 per cent up on HY18, to 25.5 cents. The Group benefitted as its portfolio was in the locations that were close to key urban centres, attracting customers. The total assets under management of the Group also improved substantially during the period to AUD 42.9 billion at 31 December 2018.

Outlook: In its Q3 FY19 operational update, the Group mentioned that it expects its WIP to reach $5 billion in FY20. The Group also anticipated strong partnership returns and improvement in AUM beyond 45 billion dollars by June 2019. Besides this, the Group reaffirmed its FY19 guidance: operating earnings is forecasted to increase by 9.5 per cent in FY18 to 51.1 cents while distribution per security is expected to increase by 7 per cent in FY18 to 30 cents.

Outlook: In its Q3 FY19 operational update, the Group mentioned that it expects its WIP to reach $5 billion in FY20. The Group also anticipated strong partnership returns and improvement in AUM beyond 45 billion dollars by June 2019. Besides this, the Group reaffirmed its FY19 guidance: operating earnings is forecasted to increase by 9.5 per cent in FY18 to 51.1 cents while distribution per security is expected to increase by 7 per cent in FY18 to 30 cents.

Stock Performance: GMG is trading at AUD 15.00 today, up by 1.01 per cent (as at 12:26 PM AEST, 30 July 2019). With ~1.81 billion outstanding shares, the market capitalisation of the stock stands at AUD 26.94 billion. The Group has delivered a return of 39.04 per cent on a YTD basis, and a return of 24.06 per cent during the last six months.

Macquarie Group Limited

Listed in Australia, the Macquarie Group Limited (ASX: MQG) is governed by the Australian Prudential Regulation Authority (APRA) as a non-operating holding company of MBL (Macquarie Bank Limited). It is a diversified financial group that has its offices in 30 markets across the world. The activities of Macquarie are also supervised by several other regulatory agencies around the world. It acts as an investment intermediary for government, corporate, institutional and retail clients around the world, and generates revenue by offering a diversified range of products and services to its clients.

Key Updates: Recently, the Group released its 2019 AGM presentation and its first quarter update for the financial year 2020. The AGM presentation highlighted the overview of FY19, 1Q20 update, FY19 highlights and the FY20 outlook. During the first quarter of FY 2020, the performance of its operating groups was in line with the expectations, with their contribution slightly below the prior quarter (4Q19) figure but broadly in line with the Q1 of the 2019 financial year. The Group had a capital surplus of AUD 5.0 billion as at 30 June 2019.

In an ASX update on 24th July 2019, the Group responded to the APRA announcement associated with the group funding offered to Macquarie Bank Limited. The Group informed that it has removed the MAC clause to ensure that there would be no effect on the Macquarie Bank Limitedâs LCR calculation in future. Macquarie also mentioned in the update that it will reaffirm its historical LCR dating to 1st July 2017, considering the APRAâs interpretation of the MAC clause.

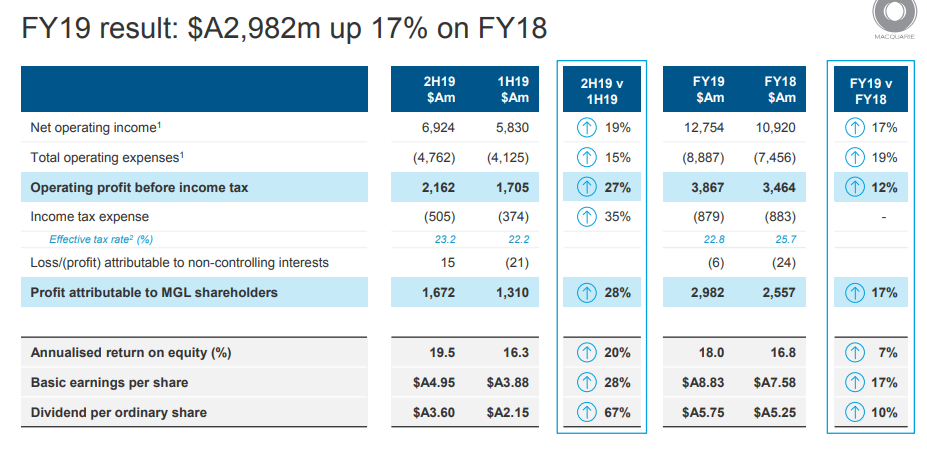

Financial Performance: The Group released its annual report for the financial year 2019 on 3rd May 2019. The Group reported that 2019 was a landmark year in which it delivered robust performance across all of our regions and businesses. The Group reported a rise of 17 per cent in its net profit after tax attributable to ordinary shareholders to AUD 2,982 million during the financial year. The Assets under management also witnessed a rise of 11 per cent relative to prior corresponding period to AUD 551.3 billion as on 31 Mar 19.

Source: Companyâs Presentation (3rd May 2019)

Source: Companyâs Presentation (3rd May 2019)

Outlook:The Group expects its FY20 results to be slightly down on FY19, subject to the completion of transactions, the impact of foreign exchange, the geographic composition of income, market conditions and the potential regulatory changes and tax uncertainties.

Stock Performance: MQG is currently trading at AUD 128.560, with a dip of 0.89 per cent (as at 12:35 PM AEST, 30 July 2019) with ~340.38 million outstanding shares and a market cap of AUD 44.15 billion. The stock has generated a YTD return of 21.39 per cent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.