Australian integrated property group, Goodman Group (ASX: GMG) released Q3 FY19 operational updates today. The operational update emphasises that the group has delivered strong operating performance over the quarter of this fiscal on the back of escalated demand from the customers in urban locations.

Greg Goodman, CEO of Goodman Group, stated that the demand in urban centres for industrial properties is persistent due to rising consumerism, exaggerated need for convenience and structural trends of urbanisation. Furthermore, he mentioned customer demand is surpassing the supply of urban logistics and customers continue to invest in improving the efficiency of their supply chains. These market fundamentals are consistently leading to higher occupancy, steady growth in rent and an increase in development work in progress.

The update asserts that the location of GGMâs portfolio is a key factor behind delivering such occupancy as customerâs evolving supply chain continues to invest, further resulting in improved customer service and convenience for the end consumer.

(Source: Companyâs Report)

(Source: Companyâs Report)

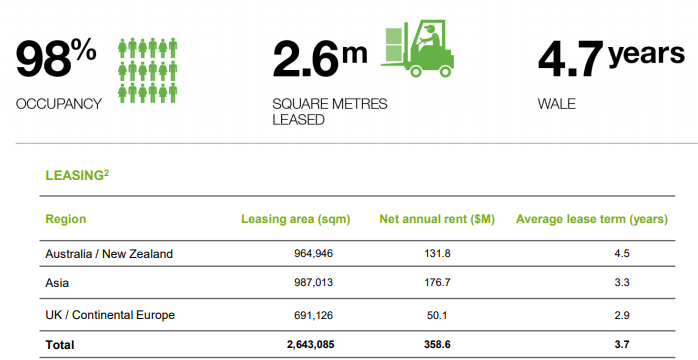

During the period GMG group leased 2,643,085 sqm across the platform resulting in rent revenue of $359 million per year with a WALE of 3.7 years.

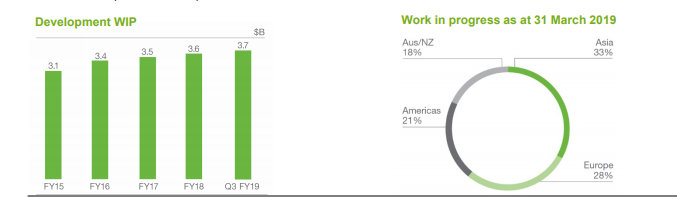

GGM is strategically tapping markets where demand is strongest with $3.7 billion of development work in progress as at 31 March 2019. It further expects work in progress to grow over $4 billion by June 2019 on the back of high-value projects in the pipeline. 80% of the work in progress was reportedly undertaken within partnerships or for third parties. The group would continue to expand the land banks in urban areas to meet future demand along with extending the scale of developments.

(Source: Companyâs Report)

(Source: Companyâs Report)

The group expects asset under management to exceed $45 billion by June 2019 with robust growth over the next few years because of strong property fundamentals, solid investment demand along with combined partnership performance. AUM in partnerships stood at $40.8 billion due to revaluation gains, development completion, net acquisition and exchange rates. AUM growth would support underlying base management fee revenues.

(Source: Companyâs Report)

(Source: Companyâs Report)

Outlook â

The group believes that the portfolio will continue to perform strongly driven by steady rental growth with consistent high occupancy. The high quality of locations and rising scale of development projects have raised the expectation of work in progress to $5 billion in FY20. GMG anticipates the current demand for the investment will drive growth in AUM beyond $45 billion along with support from strong partnership returns.

The group is focused on expanding land bank through strategic acquisitions in the high barrier to entry markets where the portfolio of the company is concentrated. The group anticipates FY19 operating earnings per security of 51.1 cents, up 9.5% on FY18, and distribution per security of 30 cents, up 7% on FY18

On 15 May 2019, the stock of the company last traded at A$ 13.320, down 0.225%. Performance of the stock in the long term is attractive with 1039.92% return in the last ten years and 162.8% return in the last five years. The 52-week high and low of stock are A$13.670 and A$8.835 respectively.

Take a look at the companyâs 1H FY2019 result.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.