Macquarie Group reported the operating performance of the first three months of Fiscal 2020, broadly in line with expectations but down on the prior quarter.

On Thursday, Investment Bank Macquarie Group Limited (ASX: MQG) announced its expectation of Fiscal 2020 result to be âslightly downâ on Fiscal 2019. This is conditional upon the completion of transactions and market conditions remaining the same as informed by the bank for the first time in May this year.

For Q1 FY20, Macquarie stated that its operating group net profit contribution was broadly in line with 1Q19 and âslightly downâ on 4Q19.

Managing Director and Chief Executive Officer of Macquarie, Shemara Wikramanayake stated that Macquarieâs annuity-style businesses were down on the previous corresponding period, primarily due to the timing of performance fees and higher operating expenses. Also, the Corporate and Asset Finance (CAF) business of the bank experienced a reduction in loan volumes and realisations.

Macquarieâs markets-facing business performed better than the previous quarter because of the robust performance of commodities platform in Commodities and Global Markets (CGM), stated Ms Wikramanayake. She, however, told that the growth in the markets-facing segment was partially offset by Macquarie Capitalâs lower investment-related income.

The bank noted that a strong contribution from client hedging and trading opportunities across the commodities platform has been the major factor contributing to the growth of Commodities and Global Markets. The primary players to the trading activity were North American Gas & Power, Global Oil and EMEA Gas & Power businesses.

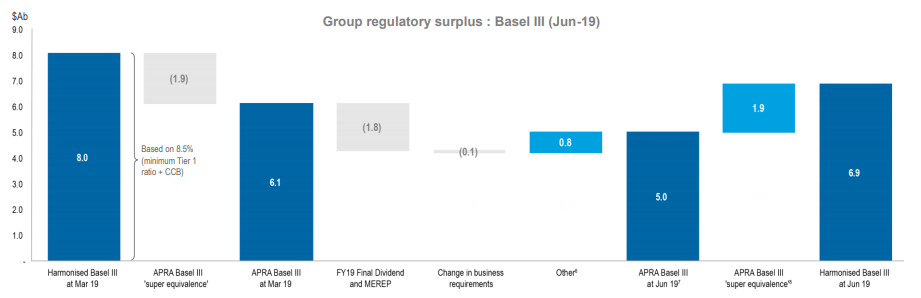

On the regulatory front, Macquarie confirmed a healthy financial position, significantly up from the Australian Prudential Regulation Authorityâs (APRA) Basel III regulatory requirements with Group capital surplus of $A5.0 billion as at the end of Q1 FY2020. Similarly, the Bankâs APRA Basel III Common Equity Tier 1 capital ratio was 12.0% (harmonised: 14.9%) and its APRA leverage ratio was 5.4% (harmonised: 6%) as at 30 June 2019. Macquarieâs LCR was 166% and NSFR was 111% at the end of the quarter.

Group regulatory surplus: Basel III June-19 (Source: Company Announcement)

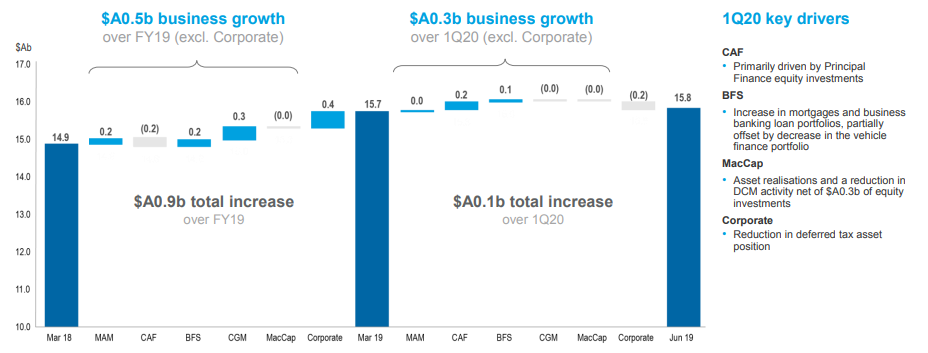

The report read that Macquarie Asset Managementâs (MAM) asset under management grew 2% to $A552.7 billion as at 30 June 2019, predominately driven by market movements. Q1 FY20 Macquarie Investment Managementâs (MIM) assets under management stood at $A368.1 billion, up 2% from $A361.0 billion at 31 March 2019. During the quarter MIM was reportedly awarded $A4.8 billion in new, funded institutional mandates and contributions.

Macquarie Infrastructure and Real Assetâs (MIRA) equity under management was $A120.2 billion as at 30 June 2019, up 3% from $A116.9 billion as at the end of the prior quarter. Macquarie European Infrastructure Fund 6 exceeded its initial target of â¬5 billion, closing at a hard cap of â¬6 billion.

With respect to Banking and Financial Services (BFS), the investment bank reported total deposits of $A53.1 billion at 30 June 2019, down 1% on the prior quarter. The Australian mortgages portfolio increased 3% to A$39.7 billion, funds on the platform increased 3% to A$88.8 billion and the business banking loan portfolio was up 1% to $A8.3 billion as at 30 June 2019 compared to the previous quarter ended 31 March 2019.

Macquarie Capitalâs investment-related income was down predominantly due to lower revenue from asset realisations. However, its fee revenue was up on 1Q19 driven by the higher fee revenue from M&A and DCM.

Macquarie business growth in different segments (Source: Company Announcement)

In Corporate and Asset Financeâs (CAF) segment, Macquarie reported asset and loan portfolio of $A21.5 billion at 30 June 2019, broadly in line with the previous quarter. The bank highlighted some notable transactions for Asset and Principal Finance undertaken during the quarter. It included the launch of numobile in Australia to provide a low-cost option to customers utilising pre-owned mobile phones, and an offer to acquire Premier Technical Services Group PLC, a provider of tech-enabled specialist testing and compliance services.

Fiscal 2019 Highlights

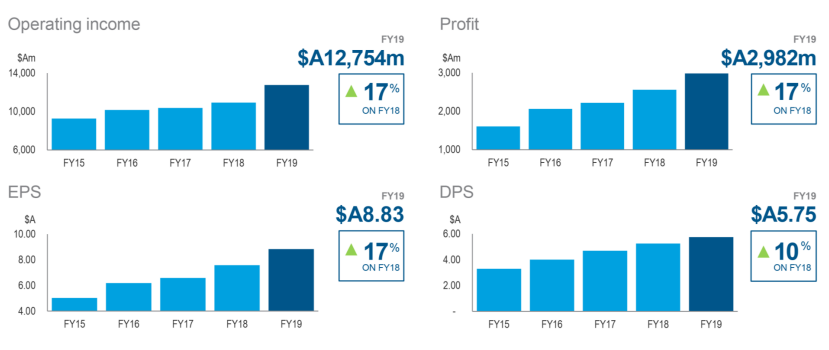

In an address to Macquarieâs shareholders, Chairman Peter Warne highlighted the record performance of Fiscal 2019. During that year, Macquarieâs operating income grew 17% to $A12.8 billion with net profit growth in the same percentage to $A2.98 billion. Dividend per share rose 10% to $A5.75 per share with earnings per share of $A8.83, up 17%.

The management accredited the diversified business model of Macquarie Group for the record performance of FY19. It included the steady performance of bankâs annuity-style businesses mixed with solid results of markets-facing businesses led by favourable market conditions.

Macquarie Groupâs FY19 Financial Performance (Source: Company Presentation)

Macquarieâs markets-facing businesses (Commodities and Global Markets (CGM) and Macquarie Capital) represented ~47% of the Groupâs FY19 performance and generated a combined net profit contribution of $A2,858 million, up 76% on FY18. This helped the group to offset the 4% decline of Macquarieâs net profit from annuity-style businesses (Macquarie Asset Management (MAM), Corporate and Asset Finance (CAF) and Banking and Financial Services (BFS)) to $A3,287 million, reflecting 53% contribution to the Groupâs FY19 profit.

Mr Warne also noted the importance of the Royal Commission and expressed the commitment of the bank to monitor and review the initiatives pouring in from the Commission as Macquarie strongly stands by the side of risk culture and conduct management approach.

Macquarie in Energy Sector

Macquarieâs involvement in the energy sector is currently under the transition phase to shift towards renewables in support of low carbon and climate-resilient economy.

To strengthen its footprints in the renewables sector, Macquarie Capitalâ increased its investment in renewables projects globally through Green Investment Group (GIG). This group continued to recycle capital across technologies including solar, waste-to-energy and battery storage during 1Q FY2020.

Also, Green Investment Group acquired a Swedish onshore 43 MW wind farm from OX2, Nordic wind developer, after securing a long-term Power Purchase Agreement (PPA) for the project with Axpo Nordic. Other notable principal transactions reportedly included an investment in Dovel Technologies, a leading technology solutions provider to federal agencies that blends deep domain expertise and advanced technologies in the health IT, life sciences, and grants management markets.

Further, the bank particularly focuses on trying to address the various challenges relating to the full transition of its energy sector to renewables.

Management Update

Macquarie Group announced that Garry Farrell intends to retire as Co-Head of CAF and from the Executive Committee, effective 1 September 2019. The bank further informed that Florian Herold, currently Co-Head of CAF, will join MacCap and will continue to lead Principal Finance.

Operating Group Update

While informing about some operating group update, Macquarie told that certain fiduciary businesses, such as the infrastructure debt business (MIDIS), moved from CAF Asset Finance in the Banking Group to MAM in the Non-Banking Group following receipt of required approvals, effective 1 July 2019.

Macquarie further stated that Effective 1 September 2019, each of CAFâs divisions would be aligned to other businesses, where they have the greatest opportunities in terms of shared clients and complementary offerings:

- CAF Principal Finance, excluding Transportation Finance, will join Macquarie Capital to bring together all principal investing activity and enhance its ability to invest directly and alongside clients and partners;

- CAF Transportation Finance will join Macquarie Asset Management, reflecting its evolution towards a fiduciary business following the recent sale of a stake in the portfolio to PGGM; and

- CAF Asset Finance will move to Commodities and Global Markets, reflecting a longstanding, shared focus on innovative financing solutions for corporates, some of which are already shared clients.

Further, on regulatory update, Macquarie stated that progress on licence applications to supplement existing EU licences is well advanced with three of the four targeted new licences now in place. The Bank stated that it does not believe that the UKâs withdrawal from the European Union (EU) will be a material event for the Group.

Macquarie is subject to an application process for a credit institution licence in Ireland that is expected to be issued in the second half of the calendar year 2019. Further, 1H20 results are stated to be reported under the new Group structure with rebased prior periods.

Stock Performance:

MQG shares last traded at $129.785, up 0.367%, on 25 July 2019. The stock closed at a price to earnings multiple of 14.640x with a market capitalisation of $44.01 billion.

Over the past 12 months, the stock has gone up by 2.93%, including a positive price change of 9.68% in the past six months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.