Four stocks have come up with recent updates on their financial performance. Bubs Australia released its June quarter report wherein it reported record revenue for the period, exceeding revenue reported during FY18. 9 Spokes International also released the FY19 annual report and updated on the resolutions taken in the annual meeting of shareholders. # Limited came up with the quarterly update for the period ended 30 June 2019, reporting a robust increase of 523% year-on-year in revenue. Frontier Digital Ventures made an announcement on the financial results concerning 1H2019 ended 30 June 2019.

Bubs Australia Limited

Bubs Australia Limited (ASX: BUB) is engaged in offering a range of organic baby food and goat milk infant formula products. The company recently released its quarterly activities report for the period ended 30 June 2019.

June Quarter Highlights: During the quarter, the company reported the highest quarterly revenue on record amounting to $ 18.46 million, driven by a threefold increase in the sales of Bubs® goat milk infant formula when compared with the year-ago period. Revenue during the quarter exceeded the FY18 full year revenue of $ 16.91 million. Revenue for FY19 stood at $ 51.3 million, up 179% from the same period a year ago. The company had $ 23.3 million in cash reserves as at 30 June 2019.

Infant formula products witnessed the highest increase in gross sales during the period, up by 341% on prior corresponding period. Of the total gross sales during the quarter, Australia accounted for 85%, followed by China at 12% and other international markets at 3%. As compared to the prior corresponding period, Australia witnessed an increase of 127% in gross sales.

Strategic Developments: During the quarter, the company established a joint venture in China with Beingmate Baby & Child Food Co. Other partnerships during the quarter included a strategic eCommerce partnership with Alibaba Tmall for Bubs® products and a channel partnership with Kidswant. In addition, the company also signed a strategic alliance with Chemist Warehouse. The period also saw a major equity investment by C2 Capital Partners. The company also acquired Australia Deloraine Dairy Pty Limited, a CNCA licenced infant formula processing facility.

Australia Deloraine Dairy (Source: Companyâs Report)

Stock Performance: The stock of the company generated YTD returns of 196.60% over a period of one year. BUB stock closed trading at a market price of $ 1.415 on 19 July 2019, up 5.204% from its previous closing price. It has a market cap of $ 685.4 million and 509.59 million outstanding shares.

9 Spokes International Limited

9 Spokes International Limited (ASX: 9SP) operates in the information technology industry. The company recently released the results of the annual meeting of shareholders. Some key resolutions taken in the meeting involved shareholder ratification and approval for the previous issue of 43,500,000 shares. The shareholders also ratified and approved the previous issue of 80,073,630 shares.

In another recent announcement to the Australian Securities Exchange, the company agreed upon a variation to its Barclays contract, wherein it sought the removal of exclusivity provisions that prevented the company from pursuing additional bank customers or deploying open banking services in the United Kingdom. The variation represents an important step in accelerating the companyâs growth opportunities.

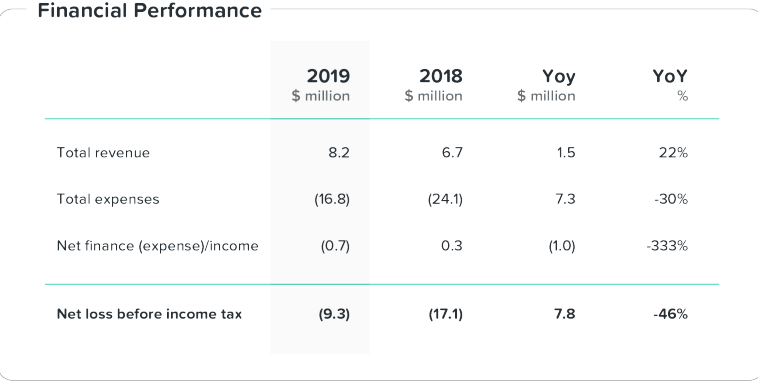

FY19 Financial Highlights: During the year, the company reported revenue of $ 8.2 million, up 22% year-on-year. Expenditure for the year reduced by $ 7.3 million, representing a reduction of 30% on the prior corresponding year. During the year, the companyâs user base almost doubled from 50,000 to 95,000.

Financial Performance (Source: Company Reports)

To support the distribution and growth of its platform and extend the sales model through global distribution partnerships, the company also announced a commercial relationship and co-selling agreement with Microsoft. The company also conducted discussions with Visa USA. Another major development during the period involved the delivery of two new bank Enterprise Channel Customers. OCBC Bank and Bank of New Zealand, signed in August 2018 and March 2018, respectively, were successfully delivered in December 2018. OCBC went live in January 2019 and BNZ went live at the beginning of April 2019.

Stock Performance: The stock of the company generated returns of 55.56% and 129.92% over a period of 3 months and 6 months, respectively. The 9SP stock last traded at a market price of $ 0.026 on 29 July 2019, down 7.143% from its previous closing price. It has a market cap of $ 26.57 million and 948.89 million outstanding shares.

# Limited

# Limited (ASX: SYT) is a provider of mobile technology services. The company, which was formed in 2013, serves businesses and consumers.

Quarterly Performance: During the quarter ended 30 June 2019, the company reported unaudited revenue amounting to $ 2.49 million, up 41% from the previous quarter revenue of $ 1.76 million and 523% from the prior corresponding period revenue of $ 0.40 million. Quarterly active user base increased at a rate of 33.7% from 7,497,279 in the third quarter to 10,025,965 in the fourth quarter. Operating expenses for the period went down by 9.4% from $ 2.04 million in Q3FY19 to $ 1.84 million in Q4FY19. Cash receipts for the period were reported at $ 0.72 million, down 19% on previous quarter receipts of $ 0.88 million.

Revenue Performance (Source: Company Reports)

In the month of April, the company raised a total of A$ 5.38 million, through a placement and convertible note component. The capital raised comprised of a $ 1.84 million placement and a convertible note facility with Obsidian Global Partners LLC to provide up to $ 3.54 million. The funds will support the companyâs working capital requirement to accelerate its growth with respect to the pipeline of potential customers. The funds would also be directed towards general working capital expenditure and boosting the companyâs sales and support team.

Key Developments: During the period, # continued expanding its operations on the global level through a number of initiatives including commercial launch of the RGP in South Africa, broadening of its business presence in Brazil with new content offerings, a reseller agreement in Indonesia with PT. Asia Quattro Net and a new partnership agreement with Opari, Inc.

Outlook: Going forward, the company is targeting cash flow breakeven in FY20 and is planning to shift its focus from top line revenue growth towards higher margins and customer lifetime value with its product offerings.

Stock Performance: Over a period of one year, the stock generated negative returns of 77.27% and has a market capitalisation of $ 6.69 million. The SYT stock last traded at a market price of $ 0.002 on 29 July 2019.

Frontier Digital Ventures Limited

Frontier Digital Ventures Limited (ASX: FDV) is engaged in building online classifieds businesses in underdeveloped and emerging countries as well as regions. The company recently released an update for the six months ended 30 June 2019.

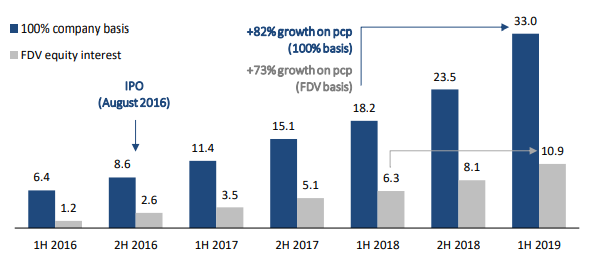

Financial Highlights: During 1H2019, the company generated revenue amounting to $ 33.0 million, up 82% from the same period a year ago. FDVâs share of half-year revenue amounted to $ 10.9 million, representing an increase of 73% from the year-ago period. Four companies in the portfolio namely Zameen, iMyanmar, AutoDeal and Infocasas, reported positive EBITDA in 1H2019. EBITDA for Zameen was the highest at A$ 347,366.

Portfolio Revenue (Pro-forma Unaudited) (Source: Company Reports)

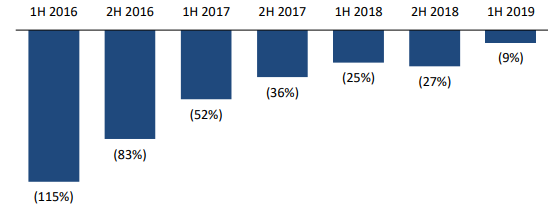

Outlook: The company is focused on delivering continued rapid revenue growth to progress towards profitability on a portfolio-wide basis. The company measures progress towards profitability in the form of portfolio EBITDA as a percentage of portfolio revenue. In light to the above, the company has reported strong improvement in profitability with EBITDA loss contracting from 115% of revenue in 1H2016 to 9% of revenue in 1H2019. Another objective of the company is to drive operational growth across its portfolio companies. During the first half of 2019, 7 out of 14 operating companies annualised more than A$ 1.0 million revenue.

Portfolio EBITDA as a % of Revenue (Source: Company Reports)

Stock Performance: The companyâs stock generated returns of 50.94% and 66.67% over a period of 3 months and 6 months, respectively. The stock last traded at a market price of $ 0.870 on 29 July 2019, up 8.75% from its previous closing price. It has a market cap of $ 196.39 million and 245.49 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.