The shares of Suncorp Group Limited (ASX:SUN) and Magellan Financial Group (ASX:MFG) rebounds on Wednesday. Overall, the Financial sector performance edged up by 0.37% to 6,207.0 points, representing a gain of 22.8 points in a day-trade. Letâs discuss what made these two stocks to join the rally of financial sector stocks.

Suncorp Group Limited (ASX: SUN)

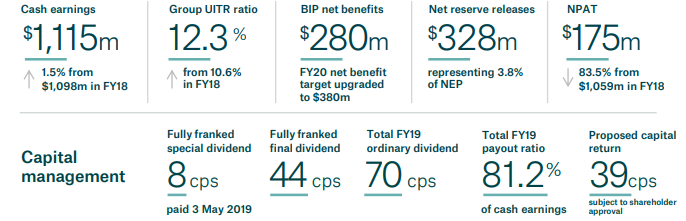

Suncorpâs stock is up 4.95% after the company announced its plan to distribute $506 million surplus capital from the sale of Australian Life Insurance Business, plus a share consolidation. The return equates to 39 cents per share, which comes in addition to a fully franked special dividend of 8 cents per share (~$104 million) paid on the sale of insurance business in May 2019 and the final dividend of 44 cents per share, announced today (7 August 2019).

A top-20 ASX-listed company, Suncorp Group Limited is a leading financial services provider in Australia and New Zealand, with more than $96 billion in total assets. The company intends to combine a $506 million capital return with a related share consolidation that is estimated to bring down the number of shares on issue by approximately 2.9%.

Suncorp clarifies that this consolidation would be accretive to earnings per share while each shareholderâs proportionate interest in Suncorp would remain unchanged following the capital return. However, the proposal for distribution is subject to shareholder approval, expected at Suncorpâs 2019 Annual General Meeting on 26 September 2019.

If approved, Suncorp plans to make the capital return on 24 October 2019 that will bring the total return to shareholders from the sale of the Australian Life Insurance business to $610 million.

Fiscal 2019 Results- Suncorpâs capital distribution plan seems to dampen the immediate impact of massive decline the company reported in its FY2019 Net Profit After Tax (NPAT). To put it in perspective, it could be seen that Suncorpâs shares surged up 4.95% to trade at $13.34 as at 7 August 2019 (AEST 2:25 PM) despite the fact that the companyâs NPAT declined 83.5% to $175 million in the year ended 30 June 2019, compared to $1,059 million NPAT reported in FY2018.

Snapshot of Suncorpâs FY2019 performance (Source: Company Announcement)

In the FY2019 results released on 7 August 2019, Suncorp reported that its NPAT of $175 million, includes a $910 million after tax non-cash loss on sale of the Australian Life Insurance and Participating Wealth Business. Letâs have a look at the segment-wise performance of the group:

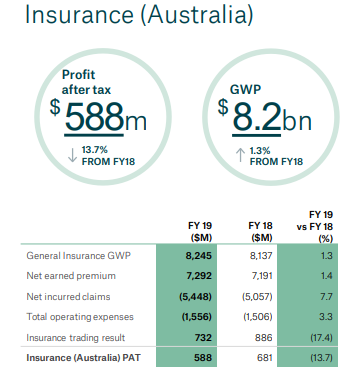

- Australia- Suncorpâs Insurance (Australia) Profit After Tax was down 13.7% to $588 million in FY2019 compared to previous corresponding period. It reflects the increase of 7.7% in Net incurred claims driven by higher natural hazard costs.

Banking & Wealth profit after tax was $364 million, down 1.4% on FY2018, due to the challenging operating and economic conditions combined with higher regulatory and compliance costs. Also, there has been reduction in agribusiness lending due to prevailing drought conditions and the northern Queensland floods.

Suncorpâs Insurance Australia Performance (Source: Company Announcement

On the positive note, Suncorp experienced a 0.4% growth in home lending portfolio and 3.6% growth in business lending portfolio over the year. The Group also maintained impairment losses at low level of 2bps of GLA, reflecting the sound credit quality of the lending portfolio.

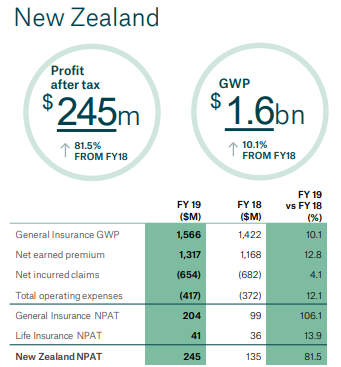

- New Zealand- Suncorpâs New Zealand General Insurance business delivered profit after tax of $245 million in FY19, up 81.5%, driven by strong top-line growth and favourable working claims experience. Net incurred claims were down 4.1% on the back of improved claims performance, supported by a benign natural hazard environment.

GWP grew 10.1% driven by premium increases across all portfolios and supported by unit growth in the direct business. The Life Insurance business delivered profit after tax of $41 million, up $5 million on the prior period. In-force premium growth was supported by policy retention and premium growth.

Suncorpâs New Zealand Segment Performance (Source: Company Announcement)

Groupâs cash earnings increased 1.5% to $1.1 billion and includes stranded costs of $13 million following the sale of the Australian Life Insurance and Participating Wealth Business, and a provision for remediation costs of $60 million, as per the companyâs report.

Dividend Distribution- For Fiscal 2019, Suncorp announced total dividend of 70 cents per share, including a fully franked final dividend of 44 cents per share. This reflects an 81.2% pay-out ratio on cash earnings.

Final Dividend is reported to be paid on 25 September 2019, with a record date of 15 August 2019. Further, the company seeks to maintain an ordinary dividend payout ratio of 60% to 80% of cash earnings and remains committed to returning surplus capital to shareholders.

Commenting of capital return, Acting Chief Executive Officer, Steve Johnston, said the capital management initiative further demonstrates Suncorpâs ongoing commitment to return capital to shareholders in excess of operating requirements. âThe proposed $506 million capital return, combined with the final dividend declared today would see over $1 billion in capital distributed to Suncorp shareholders over the coming months,â he said.

Strategic Alliance with TAL- Suncorp Group has started a 20-year strategic alliance with TAL Dai-ichi Life Australia Pty Ltd (TAL) offering life insurance services through SUNâs Australian distribution channels. The arrangement allows Suncorp to continue generating revenue from the distribution of life insurance.

Change in Management- In a separate announcement to ASX, Suncorp announced that its CEO Customer Marketplace Pip Marlow would leave the company by the end of August 2019. The company also announced an establishment of a new Customer and Digital function which will reportedly be led by Lisa Harrison. Suncorp told Lisa will become its Chief Customer and Digital Officer.

On the foundation of Suncorpâs strong digital footprints, this new Customer and Digital function is to develop innovative, digital-first customer propositions that would be responsible for Groupâs Customer and Digital Strategy, Digital Distribution; Brand and Marketing; and the Enterprise Portfolio Management Office.

SUN stock last traded at $13.320 on 7 August 2019.

Magellan Financial Group Limited (ASX: MFG)

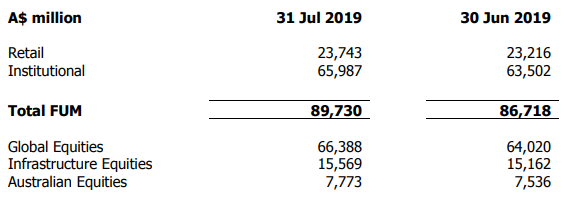

Established in 2006, Magellan Financial Group functions as a specialist funds management company based in Sydney, Australia. On 6 August 2019, Magellan reported an increase in its total FUM to A$89,730 in the month of July, compared to A$86,718 million as at the end of June. The company experienced a net inflow of $574 million, comprising of net retail inflows of $349 million and net institutional inflows of $225 million in July.

Snapshot of Magellan Financialâs FUM Latest Update (Source: Company Announcement)

For the six-month ended 30 December 2018, Magellan reported an increase of 62% in adjusted after-tax net profit to $176.3 million. This reflects a 28% increase in management and services fee revenue to $228.1 million, driven by the growth of 35% in average funds under management to $72.1 billion.

Magellanâs stock price surged up by 1.208% to close at $58.660 on 7 August 2019. The stock last traded at a price to earnings multiple of 30.630x with a market capitalisation of $10.26 billion. Over the past 12 months, the stock has jumped up by 141.10% including a positive price change of 31.64% in the past three months.

Also Read: Is the Bullsâ Game On for Magellan Financial Group Ltd â A Technical Viewpoint?

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.