Understanding Consumer Discretionary

Consumer discretionary can be best described as the category of goods and services which are not needs but wants. These non-essential goods and services are availed by customers who have the desire to possess them and are willing to shell out money for them. Ideally, consumers using discretionary products have a sufficient income to which allows them to savour these facilities and products. The performance of consumer discretionary companies is an indicator of the economyâs condition as it depicts the spending pattern of citizens. In weakening economies, the consumers cease to spend on discretionary goods and services and conversely splurge on them when the economy begins to strengthen.

The category includes durable goods, apparel, entertainment and leisure, and automobiles and few examples of the same are Apple Inc., McDonalds, Walt Disney and Amazon.

In this article, we would look at four ASX-listed stocks who are grouped under the consumer discretionary category, and browse through their FY19 results and stock performances:

Webjet Limited

Company Profile: A digital travel business, Webjet Limited (ASX:WEB) caters to both global consumer markets and wholesale markets via B2C and B2B. The company was established in 1998 and is ANZâs pioneer online travel agency. It is a tech-savvy and innovation profound player and aids consumers with light deals, hotel accommodation, holiday package deals, travel insurance and car hire worldwide.

Stock Performance and Returns: At the close of market on 30 August 2019, WEBâs stock was valued at A$ 12.370, up by 1.56 per cent, with a market cap of A$ 1.65 million and ~ 135.6 million outstanding shares. With a P/E ratio of 25.910, the YTD return of the stock is positive 15.01 per cent. In the last one, three and six months, it has delivered returns of -12.12 per cent, -19.55 per cent and â 21.17 per cent, respectively.

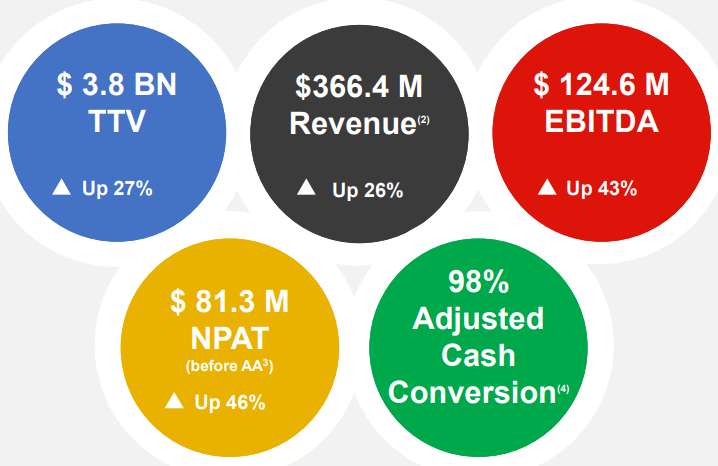

FY19 Results: On 22 August 2019, WEB announced its financial results for the 12 months ending 30 June 2019, stating that it had delivered a 43 per cent increase on pcp in EBITDA to $124.6 million. The company transacted $3.8 billion in TTV, and its revenue was up by 26 per cent to $366.4 million and the NPAT was $81.3 million, soared by 46 per cent. As part of the result, WEB announced a fully franked final dividend of 13.5 cents per share, which takes the total dividend for the year up by 10 per cent on pcp, to 22 cents. The declared dividend would be paid to shareholders on 10 October 2019.

WEBâs FY19 Highlights (Source: WEBâs Report)

Post the acquisitions of both JacTravel and DOTW, WEBâs WebBeds business was notified to be the largest business across bookings, TTV and EBITDA, with the TTV being up by 59 per cent to $2.2 billion on pcp and EBITDA was $67.3 million, zoomed 148 per cent. Besides this, WEBâs OTA outperformed with flight bookings and grew almost twice the underlying market, and the TTV and EBITDA margins were up by 10.9 per cent and 40.4 per cent, respectively.

Going forth, WEB would provide a guidance range for the period ahead at the AGM on 20 November 2019. The first 6 weeks of trading of FY20 have been strong, with WebBeds TTV up 50 per cent to pcp and OTA TTV is up 9 per cent while the Republic TTV was up by 4 per cent.

Bapcor Limited

Company Profile: Australiaâs leading provider of automotive aftermarket parts, automotive services and equipment and accessories, Bapcor Limited (ASX:BAP) core business is he automotive aftermarket, which spans across the end-to-end supply chain covering retail and service, trade along with specialist wholesale. The company is operational across the ANZ and Thailand and was listed on the ASX in 2014.

Stock Performance and Returns: At the close of market on 30 August 2019, BAPâs stock was valued at A$ 6.670 with a market cap of A$ 1.89 billion and ~ 283.48 million outstanding shares. With a P/E ratio of 19.39, the YTD return of the stock is positive 14.02 per cent. In the last one, three and six months, it has delivered returns of 5.54 per cent, 12.48 per cent and 7.58 per cent, respectively.

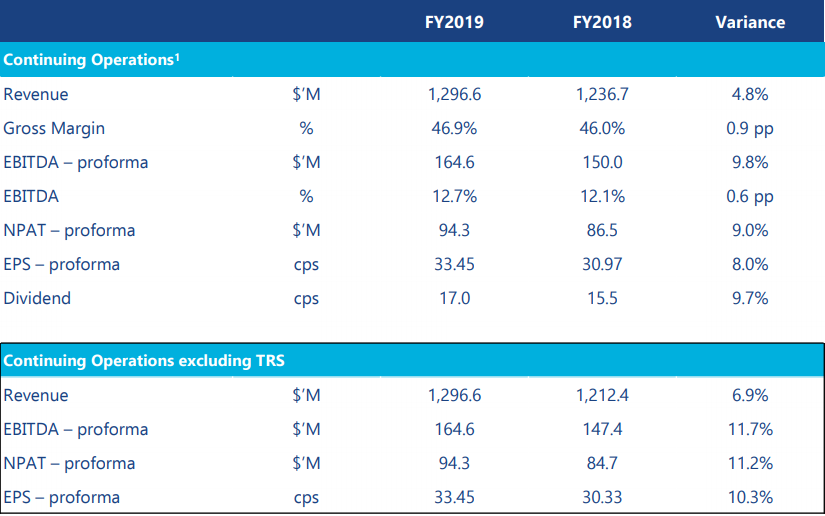

FY19 Results: On 21 August 2019, the company released its results for the twelve months ended 30 June 2019, stating that it had generated revenue from continuing operations of $1,297 million, up by 4.8 per cent. The EBITDA was $164.6 million, up by 9.8 per cent and the statutory NPAT was reported at $97 million, up by 14.8 per cent. BAPâs statutory EPS for the period was 34.40 cents per share, up by 1.5 per cent. In July 2018, the company had divested TRS in New Zealand.

BAPâs Financial Highlights (Source: BAPâs Report)

The net debt at 30 June 2019 was $336.3 million, up by $47 million on pcp, reflecting the companyâs investment in the Commercial Truck Parts Group in November last year. The inventory increased by $39 million, driven by acquisitions and the leverage ratio at 30 June was under 2x.

As part of the result, BAP declared fully franked final dividend of 9.5 cents per share, taking the yearly dividend to 17.0 cents per share, up by 9.7 per cent on pcp, which would be paid to shareholders on 26 September 2019.

CEO and MD Mr. Darryl Abotomey notified that BAP added 59 new company locations across its network, taking the total number of business locations to 950.

As outlook for FY20, the company would further develop people in existing stores and roll out electronic catalogue / online B2B, while increasing the wholesale sales penetration to franchisees and enhancing the marketing and promotion programs.

Super Retail Group Limited

Company Profile: Regarded as one of Australasiaâs Top 10 retailers, Super Retail group Limited (ASX: SUL) is the leader in retailing of auto, sport and outdoor leisure products across ANZ. With headquarters in Brisbane, the company was listed on the ASX in 2004. The companyâs brands include BCF, Supercheap Auto, Rebel and Macpac.

Stock Performance and Returns: At the close of market trading on 30 August 2019, SULâs stock was valued at A$ 9.350, down by 0.42 per cent, with a market cap of A$ 1.85 million and ~ 197.38 million outstanding shares. With a P/E ratio of 13.1, the YTD return of the stock is positive 37.48 per cent. In the last six months, it has delivered a positive return of 27.76%.

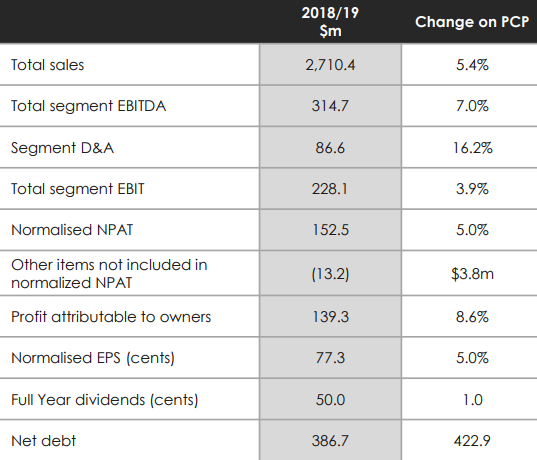

FY19 Results: On 15 August 2019, the company released its FY19 results, reporting total Group sales of $2.71 billion, up by 5.4 per cent on pcp and EBITDA of $314.7 million, up by 7 per cent on pcp. The NPAT reported was 5 per cent up on pcp, at $152.5 million and the EBIT was 3.9 per cent up on pcp, at $228.1 million. As part of the results, SUL declared a final fully franked dividend of 28.5 cents per share, contributing to full year dividends of 50.0 cents per share. The declared dividend would be paid to shareholders on 26 September 2019.

SULâs Group Highlights for FY19 (Source: SULâs Report)

Wesfarmers Limited

Company Profile: Operator of diverse businesses, Wesfarmers Limited (ASX:WES) is one of Australiaâs largest listed companies. Its business range covers home improvement and outdoor living, office supplies, industrial and safety products, apparel and general merchandise, to name a few. The company is headquartered in Western Australia and was listed on the ASX in 1984.

Stock Performance and Returns: At the close of market trading on 30 August 2019, WESâs stock was valued at A$ 39.100, down by 0.534 per cent, with a market cap of A$ 44.57 million and ~ million outstanding shares. With a P/E ratio of 8.070, the YTD return of the stock is positive 28.24 per cent. In the last three and six months, it has delivered returns of 5.30 per cent and 17.73 per cent respectively.

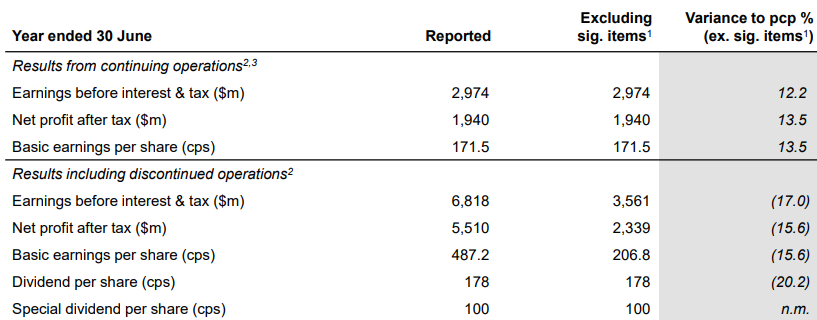

FY19 Results: On 27 August 2019, WES pleasingly notified the market about its FY19 results, reporting an NPAT of $5,510 million. The companyâs Net financial debt decreased from $3.6 billion to $2.1 billion, reflecting the demerger of Coles & net proceeds from other divestments and profits from asset disposals distributed via $1.1 billion special dividend in April 2019. As part of the results, WES declared fully franked final dividend of $0.78 per share, which would be paid to the shareholders on 9 October 2019. The company recorded a growth of 33 per cent in online sales with improved customer experience. During the period, the acquisition of Catch Group was completed, and Kidman shareholder vote would take place on 5 September 2019.

WESâ FY19 Highlights (Source: WES Report)

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.