The S&P/ASX 200 Consumer Discretionary (Sector) was down by 1.57% and closed at 2,493.3 on 26 August 2019, while the benchmark index S&P/ASX 200 settled at 6,432.1, down 1.41%. Letâs take a look at three stocks operating in the S&P/ASX 200 Consumer Discretionary (Sector) - AHG, JIN, LOV - which have recently posted their financial results for FY19.

Automotive Holdings Group Limited

West Perth-based auto retail and logistics player, Automotive Holdings Group Limited (ASX:AHG), on 22 August 2019, released its full-year results for the year ended 30 June 2019.

Financial Highlights:

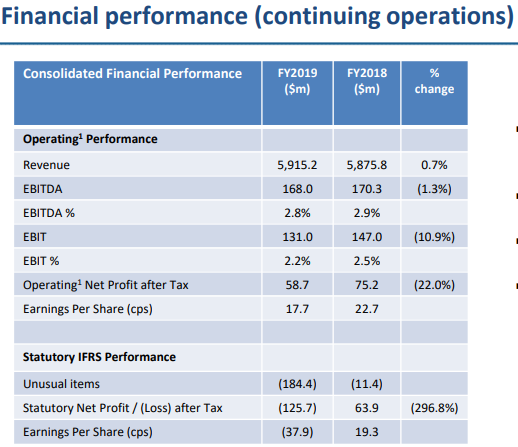

The company incurred a statutory loss after tax (including discontinued operations) of $232.6 million, highlighting challenging conditions in franchised automotive retail volumes and margins, in addition to weaker than anticipated performance of the Refrigerated Logistics division in the second half of the year. The statutory loss for continuing operations was $125.7 million. The Group revenue increased from $5.88 billion in FY2018 to $5.92 billion in FY2019. Its operating EBITDA declined from $170.3 million in FY2018 to $168 million in FY2019. Moreover, operating NPAT declined significantly in FY2019, from $75.2 million in FY2018 to $ 58.7 million in FY2019. The operating EPS of the company also declined from 22.7 cents per share to 17.7 cents per share.

Financial performance (continuing operations) (Source: Companyâs Report)

Operations Review:

Continuing Operations:

FY2019 was a challenging year for the automotive retail sector, as it got influenced by the banking Royal Commission and the negative wealth effect in the Australian housing market as well as economic uncertainty. The period witnessed a decline in the Australian new car market; however, there are indications that declining sales of new cars are slowing. The margins remained under pressure during the year. The regulatory changes to finance and insurance had an impact on dealership operations. However, the company is hopeful that the introduction of new financial products might result in an improvement in penetration rates over time. The easyauto123 business of the company has continued to build momentum and witnessed improvement in sales volume as well as financial performance.

The company reported an increased contribution and scale from its Trucks business. Thus, it decided to report this unit separately. The strong brand portfolio and relationships with major clients helped the Trucks business in delivering substantial growth in revenue as well as earnings as compared to FY2018.

The AMCAP business of the company experienced a consistent year-on-year performance. On 10 July 2019, AHG unveiled the completion of sale of its interest in Motorcycle Distributors Australia Pty Ltd (a company whose line of business is the retail sales of new and used motorcycles) to Austrian-based player KTM Sportmotorcycles GmbH.

Discontinued Operations:

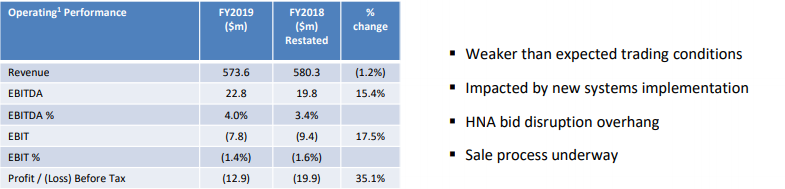

The Refrigerated Logistics business reported an operating loss before tax worth $12.9 million, which was $19.9 million for FY2018. The result demonstrated the challenges related with, amongst other matters, the application of new computer systems for transport management, the disturbance triggered by the terminated HNA sale process along with weaker than anticipated trading situations across the reporting period.

As per an update on the strategic assessment of the Refrigerated Logistics division along with the analysis of the carrying value of receivables created from the business across the previous financial years, it was found that the sale of this unit was the best option to maximise the shareholdersâ value.

Refrigerated Logistics performance (Source: Companyâs Report)

Stock Performance:

The shares of AHG have generated an excellent YTD return of 110.53%. The opening price of the share of AHG was A$3.130 on 26 August 2019. By the end of the trading session on 26 August 2019, the closing price of the share was A$3.190, down by 0.312% as compared to its previous closing price. AHG has a market cap of A$1.06 billion with ~ 331.62 million outstanding shares and an annual dividend yield of 2.13%.

Jumbo Interactive Limited

Jumbo Interactive Limited (ASX:JIN), a leading digital retailer of national jackpot lotteries as well as charity lotteries, released its annual report for the year ended 30 June 2019 on 22 August 2019.

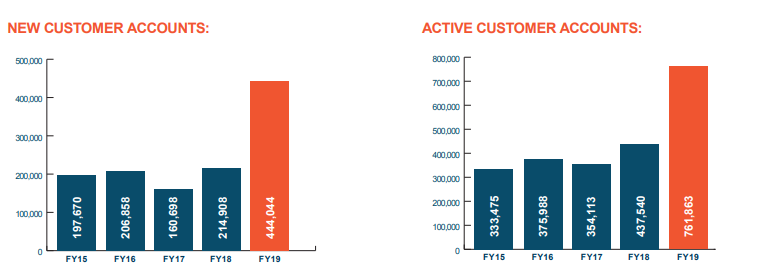

The company during the period reported strong customer growth and engagement, which was underpinned by increased large jackpot activity, leading to a strong financial result for FY19. The total transaction value increased by 75% year-on-year to $321 million, primarily on account of increase in the Australia Lotteries segment of 75.4% to $319.73 million, backed by increased customer activity and large jackpot activity. The companyâs revenue increased by 64% to $65.21 million, while NPAT grew by 124% to $26.4 million. Its fully franked ordinary dividend for FY19 stood at 36.5 cents, up by 97% as compared to the prior corresponding period (pcp). A final dividend of 21.5 cents has been declared for the second half of FY19, scheduled for payment on 20 September 2019.

The new customer accounts increased by 106.6% to 444,044 and number of active customers went up by 74.1% to 761,863 on pcp.

Source: Companyâs Report

The new Powerball setup was a success with $100 million Powerball jackpots during August 2018 and January 2019. It helped in driving various large jackpots from 32 in FY2018 to 49 in FY2019.

The balance sheet of the company remained strong for the period with a substantial increase in net assets from $47.211 million in FY2018 to $77.378 million in FY2019. The total shareholdersâ equity for FY2019 was $77.378 million. The position of net cash and cash equivalent of JIN by the end of FY2019 was $84.583 million.

Appointment of Non-Executive Director:

On 19 August 2019, the company announced the appointment of Professor Sharon Christensen as a Non-Executive Director to the board, effective from 1 September 2019.

Stock Performance:

The shares of JIN have generated an excellent YTD return of 171.67%. The opening price of the share of JIN was A$19.320 on 26 August 2019. By the end of the trading session on 26 August 2019, the closing price of the share was A$20.005, up by 1.086% as compared to its previous closing price. JIN has a market capitalisation of A$1.23 billion with approximately 62.12 million outstanding shares, an annual dividend yield of 1.84% and a PE ratio of 45.080x.

Lovisa Holdings Limited

Fast fashion jewellery retailer, Lovisa Holdings Limited (ASX:LOV), on 22 August 2019, released its full-year results for the year ended 30 June 2019.

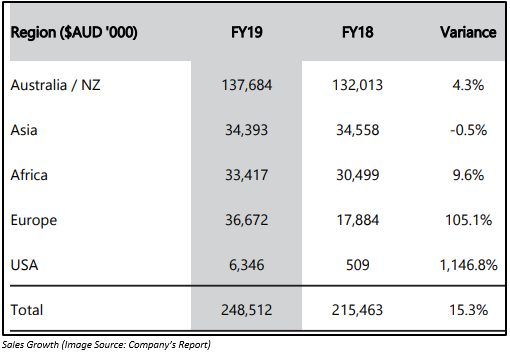

The company reported an increase of 15.3% in revenue to A$250.3 million, driven by strong growth in store numbers. At the same time, the growth was offset by a drop in comparable store sales of 0.5% across the group, impacted by challenging trading conditions, in addition to cycling comparable store sales of more than 7.4% for the first half as compared to store sales in the second half. The gross profit for FY2019 stood at A$201.4 million, up by 16% as compared to the previous corresponding period. EBITDA increased by 7.1% to $62.3 million, while EBIT went by 2.8% to $52.5 million. LOVâs net profit after tax in FY2019 was A$37 million up by 3% on pcp. The company declared a final dividend of 15 cents per share (fully franked).

Activities:

During the period, the company opened 14 new stores in the UK, in addition to 8 stores trading in France and 9 stores in Spain. Around 19 stores are trading in the US. In South Africa, sales went up by 9.6% underpinned by the opening of new stores in the country. Australia and New Zealand market delivered a top-line growth. However, Australia was impacted by softer trading circumstances. The performance of the Asia region was down as compared to the previous year due to the closure of four stores in Singapore.

Outlook:

- Focus on expanding store network.

- Increase the number of stores in FY2020, higher than in FY2019.

- Continue investments in support structures

Stock Performance:

The shares of LOV have generated an excellent YTD return of 98.87%. The opening price of the share of LOV was A$12.000 on 26 August 2019. By the end of the trading session on 26 August 2019, the closing price of the share was A$12.010, down by 2.91% as compared to its previous closing price. LOV has a market capitalisation of A$1.3 billion with approximately 105.57 million outstanding shares, an annual dividend yield of 2.67% and a PE ratio of 35.250x.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.