The S&P/ASX 200 index closed lower at 6,405.5, slipping 0.04% on 16 August 2019. The Consumer Discretionary player, Automotive Holdings Group disclosed an update on it strategic review of Refrigerated Logistics division and the review of the carrying value of receivables generated from the business, while Real Estate company Charter Hall Retail REIT posted a statutory profit of $ 53.1 million and the operating earnings of $ 128 million for the financial year ended 2019. Letâs take a close look at the two companiesâ latest developments.

Automotive Holdings Group Limited

Automotive Holdings Group Limited (ASX:AHG) is a diversified automotive retailing an logistics group with operations across Australiaâs mainland state and in New Zealand. It is one of the largest automotive sector retailers with operations in Western Australia, New South Wales, Queensland and Victoria. The Groupâs logistics businesses inlcude AHG Refrigerated Logistics covering transport and cold storage; AMCAP for motor parts and industrial supplies distribution; VSE (vehicle storage and engineering); Genuine Truck bodies for body building services to the truck industry and KTM Sportmotorcylces and HQVA concerning import and distribution of KTM and Husqvarna motorcycle across Australia and New Zealand.

Source: Companyâs Website

The Group has a market capitalisation of around AUD 1.02 billion and approximately 331.62 million shares outstanding. On 16 August 2019, the AHG stock was trading at AUD 3.210, up 4.56% by AUD 0.140, with approximately 663,989 shares traded. Besides, the AHG stock has generated positive returns of 87.77% in the last six months, 101.97% YTD and 31.76% in the last three months.

Update on Refrigerated Logistics business - Recently on 16 August 2019, Automotive Holdings Group released an update on the strategic review, which was initiated in February 2019, of the Refrigerated Logistics division and the review of the carrying value of receivables generated from the business across prior financial years and FY2019. The outcome of the receivables review is that there has been a material overstatement of the Refrigerated Logistics division's revenues in FY2018, the quantum of which is approximately $ 18 million pre-tax, which would call for a restatement of the Companyâs FY2018 results. Meanwhile, the impact of the misstatement for FY2018 would be included in the Notes to AHG's upcoming ASX 4E and Consolidated Financial Statements for the financial year 2019.

The overstatement was a result of the impact of complexities associated with the introduction of the new computer systems for transport management. Now, as a result of the restatement, the company would need to further write-down the carrying value of the Refrigerated Logistics division by $ 24 million.

In addition to the above, with the conclusion of strategic review of the Refrigerated Logistics division, Automotive Holdings Groupâs Board declared that it would consider selling the Refrigerated Logistics division to maximise shareholder value and a formal sale process would be pursued as a strategic priority for the company. However, Automotive Holdings Group is not sure whether it would receive an acceptable offer for the Refrigerated Logistics division or that a transaction will be implemented.

Subject to completion of the final audit processes in respect of AHG's financial results for FY2019, the Group also affirmed its previous guidance for FY2019 Operating NPAT of ~$ 50 million. Also, the months of May and June are usually the ones with higher profitability in the automotive retail sector and this is expected to have a positive bearing on the final FY2019 financial results.

The Groupâs operating NPAT for the six months to 31 December 2018 was around $ 24.2 million and the statutory loss of $ 225.6 million was recorded for the period. No interim dividend was declared for the period to strengthen the balance sheet.

Other updatesâ Recently on 25 July 2019, Automotive Holdings Group informed that the Australian Competition and Consumer Commission (ACCC) had decided to grant a merger authorisation to AP Eagers' (ASX: APE) takeover offer whereby it has proposed to acquire all of the equity in Automotive Holdings Group that it does not already own, subject to an undertaking to the ACCC to divest Kloster Motor Group. The merger authorisation was expected to be effective on 16 August 2019 while the AHG Board continues to unanimously recommend that AHG Shareholders accept the offer (Closing date: 16 September 2019), in the absence of a superior proposal.

AP Eagers responded to the overstatement of revenues news that was released today. It informed the market that it does not consider these circumstances to alter AHGâs intention to pursue a sale of the refrigerated logistics division nor does it impact AP Eagersâs off market takeover offer to acquire all of the ordinary shares in AGH. Also, AHG directors unanimously recommended that AGH shareholders accept the offer made by AP Eagers in the absence of a better proposal and declared the offer unconditional. AHG also informed that AP Eagers has waived off all of the remaining defeating conditions to the offer.

On 10 July 2019, the Group informed the market that it had finally settled the divestment of its interest in Motorcycle Distributors Australia Pty Ltd (MDA) to the Austrian company KTM.

AHG previously owned a 74% interest in MDA and its subsidiaries which are engaged in import and distribution of KTM and Husqvarna motorcycles across Australia and New Zealand. While KTMS held 26% of the business and would assume 100% ownership going forth. The transaction values the total business at ~ $ 18 million.

Charter Hall Retail REIT

Sydney, Australia-based Charter Hall Retail REIT (ASX:CQR) owns a portfolio of supermarkets and shopping centers located in the non-metropolitan areas throughout Australia, New Zealand and overseas in the United States. The companyâs market capitalisation stands at around AUD 2.03 billion with approximately 440.9 million shares outstanding. On 16 August 2019, the CQR stock was trading at AUD 4.590 with approximately 653,414 shares traded. Besides, the CQR stock has so far delivered positive returns of 2.22% in the last three months and 3.37% YTD.

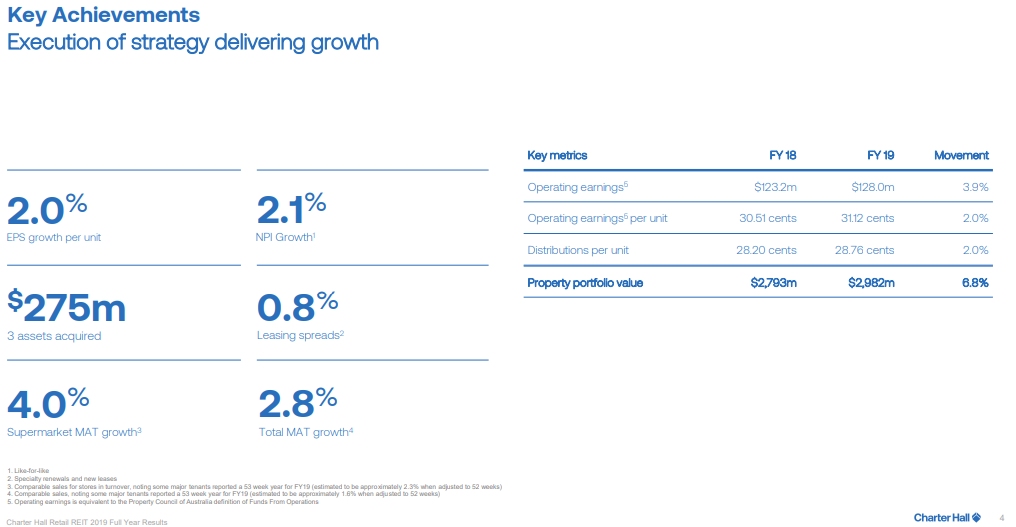

FY19 Results - On the same day, Charter Hall Retail REIT announced its FY19 results for the year ended 30 June 2019, posting a Statutory profit of $ 53.1 million and the operating earnings of $ 128 million or 31.12 cpu, up 2% on the prior corresponding period (pcp). The company is focussed on curating a portfolio of convenience and convenience-plus assets in metropolitan markets, that are the dominant convenience centres in their catchments. During the year, the portfolio occupancy was maintained at 98.1% while around three centres were added to the companyâs portfolio and these have enhanced the portfolioâs future income growth potential. The Portfolio WALE remained stable at 6.5 years following ten major lease extensions and the Like-for-like net property income (NPI) grew by 2.1%, as compared to 1.8% in the pcp.

Source: FY19 Results Presentation

Charter Hall Retail REIT renewed around 175 specialty leases and 191 new leases delivering positive specialty leasing spreads of 0.8% and the portfolio value increased by $ 189 million with valuations across the portfolio remaining stable. The entire portfolio was externally revalued in FY19, with income growth offsetting portfolio cap rate expansion of 3bps to 6.18%. Also, the portfolio continues to be heavily weighted towards high quality tenants with major tenants including Woolworths, Coles, Wesfarmers and Aldi representing 46% of the rental income.

The company also acquired three high-quality convenience-plus assets with Gateway Plaza, Vic; Campbellfield Plaza, Vic and Rockdale Plaza, NSW while disposing two smaller regional assets.

The full year distribution of 28.76 cpu was up 2% on pcp. The companyâs balance sheet gearing stood at 32.9% with $ 143 million of undrawn debt capacity and weighted average debt maturity of 4.9 years (no debt maturing until FY22).

Charter Hall Retail REIT also provided FY20 guidance for operating earnings growth to be in the range of 1.5% - 2.0% over FY19. The distribution payout ratio range is expected to remain between 90% and 95% of operating earnings.

The company would continue to opportunistically look to sell assets and take advantage of opportunities as they arise to improve the portfolio.

Unit Purchase Plan â On 6 May 2019, Charter Hall Retail Management Limited, as responsible entity of Charter Hall Retail REIT successfully completed a non-underwritten Unit Purchase Plan (UPP) announced 8 April 2019 in connection with CQRâs $ 150 million institutional placement. A total of approximately $ 14.73 million was raised under the UPP, with 3,266,771 new units to be issued to eligible applicants on 9 May 2019 at an issue price of $ 4.51 per unit.

Institutional Placement â Earlier on 2 April 2019, Charter Hall Retail Management Limited completed the fully underwritten institutional placement announced on 1 April 2019, which raised around $150 million though the issue of approximately 33.3 million new units at $ 4.51 each.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.