Lithium explorer Kidman Resources Limited (ASX: KDR) has entered into a Scheme Implementation Deed (SID) with Wesfarmers Limited (ASX: WES). The Scheme Implementation Deed confirms the terms of Wesfarmersâ proposal announced on 2 May 2019 to acquire all the outstanding shares in Kidman for $1.90 cash per share via a scheme of arrangement.

The offer price of $1.90 cash per share is representing an attractive premium of 47.3% to Kidmanâs closing share price of $1.29 on 1 May 2019. Further, the offer price is representing the premium of 44.4% to the 3 month VWAP as at 1 May 2019.

The Board of Kidman has concluded that the Scheme is in the best interests of Kidman shareholders and has recommended Kidman shareholders to vote in favour of the proposed Scheme.

The implementation of the Scheme is subject to various conditions, including:

- an Independent Expert concluding that the Scheme is in the best interests of Kidman shareholders

- Kidman shareholder approval

- no âmaterial adverse changeâ, âKidman prescribed occurrenceâ or âCovalent regulated eventâ, as defined in the SID.

- Court approval; and

- other customary conditions.

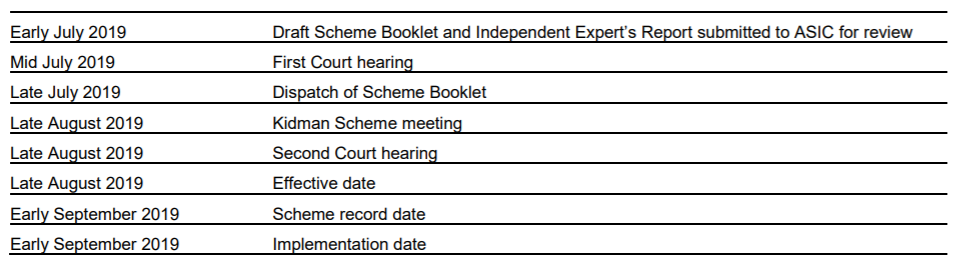

Indicative timetable for the Scheme (Source: Company Reports)

Indicative timetable for the Scheme (Source: Company Reports)

In the last three weeks, Wesfarmers has worked closely with Kidman and the Mt Holland lithium project joint venture company, Covalent Lithium, to complete its confirmatory due diligence, following which it has confirmed its view that the acquisition of Kidman provides an attractive opportunity to invest in and develop a large-scale, long-life and high-grade lithium hydroxide project in Western Australia.

Wesfarmers Limited has further made its own plan for the development of the Mt Holland lithium project which it intends to propose once

In 2019, the company is focusing on:

- completing the definitive feasibility study for the Mt Holland Lithium Project and proceeding to a final investment decision;

- commencing the next stage of the project financing process as well as to evaluate other marketing opportunities on its current near term uncontracted and longer-term production share from the project.

- progressing to definitive, binding offtake agreements;

Currently the outlook for lithium is positive, with demand supported by the growth in the electric vehicle (EV) market. The companyâs strategy to produce refined, battery grade lithium hydroxide is set to address this demand directly with a premium refined lithium product for global suppliers and manufacturers.

Now, letâs have a glance at the companyâs stock performance and the return it has posted over the past few months. The stock traded at a price of $1.900, up by 1.064% during the dayâs trade with a market capitalisation of ~$761.02 million as on 23 May 2019. The counter opened the day at $1.905 and reached the dayâs high of $1.915 and touched a dayâs low of $1.892 with a daily volume of ~ 7,575,718. The stock has provided a year till date return of 73.27% & also posted returns of 43.51%, 38.24% & 39.78% over the past six months, three & one-month period respectively. It had a 52-week high price of $2.480 and touched 52 weeks low of $0.825, with an average volume of ~2,541,579.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.