Retail Sector

Be it fashion, furniture or electronics, Australia has it all, being a top urbanised society. Market experts believe that the Aussie independent retailers are one of the top performers across the world. The thriving and healthy retailers of the country have a monthly revenue (per retailer) of approximately ~$42k. The growth of the sector is heavily incentivised by technological advancements and government policies.

We would discuss the Australian Retail Sector Landscape in detail but let us first understand what Retail means- The part of a countryâs economy which comprises of businesses that sell finished products via offline and online stores to the public constitute the Retail sector. In terms of economics, it is the point in the value chain, where the seller sells goods to the buyers for their consumption, and not for further trade on them. Major retail players across the globe include- Walmart, Costco, Carrefour, Amazon.com and Kroger, to name a few.

Australiaâs Retail Sector

Australiaâs retail sector is the second-largest employer in the country, after healthcare and is a vital component which helps in broadening the Aussie economy. Amid the rising unemployment and deteriorating labour market with low increase in wages and rising household debt, along with inflation below the target range and less consumption; the Australian Retail sector has firmly held its ground and had depicted significant growth in the past few years. The low interest rates and the increase in housing credit have had a direct and positive impact on the consumer spending.

However, a bleak atmosphere has clouded the Retail sector of late, as it falls prey to the rising influx of foreign companies, who are formulating innovative approaches in the retail functionality. This has changed the consumer preferences, driven by the advancement in technology.

What do the recent statistics reveal?

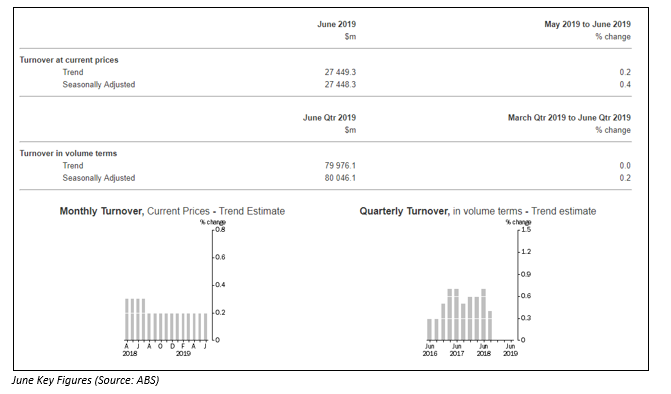

According to the most recent Retail trade trend released by the Australian Bureau of Statistics (ABS), the retail trend estimate followed suit of April and May 2019 and reported a rise of 0.2 per cent in June 2019. The seasonally adjusted estimate rose by 0.4 per cent in June 2019, after 0.1 per cent rise in both the April and May 2019.

In trend terms, the Australian turnover rose by 2.7 per cent in June 2019 compared to pcp. Amid the top industries that rose in trend terms were clothing, footwear, personal accessory (all by 0.6 per cent) and other retailing by (0.4 per cent). In terms of volume, the turnover remained unchanged during the June quarter 2019.

Further, ABS would release the July 2019 issue of the Retail trend statistics on 3 September 2019.

Besides, according to a market research conducted by one of the Big Four Consulting Firms, Deloitte, the real retail turnover growth is most likely to move down from 2.2 per cent in 2018 to just 1.5 per cent in 2019 but would strengthen again in 2020 to 2.9 per cent. Consumer sentiment has been hurt due to the slump in the Australian economy, which has had a direct impact on their willingness to spend.

However, the ease provided by the Reserve Bank of Australia in the form of low interest rates and the reforms posed by the Royal Commission for the betterment of the Aussie economy might prove to be a good sign for retailers, especially in the post-federal election phase.

Is the Australian Retail Sector in Recession?

Experts believe that the Aussie economy has decelerated to its frailest ever since the global financial crisis in 2009. The Retail sector austerity continues to exist presently as the economic headwinds and the accelerating structural changes pose to impact the sectorâs overall performance. Woolworths Holdings Limited, a leading retail group with a strong presence in 11 countries apart from South Africa and Australia, reduced the value of its David Jones business, by approximately $437 million, for the second time since 2018, stating that the recession dagger was dangling over the Australian retail sector. Besides this, it has made a provision against stores with onerous leases of approximately $22 million.

The brand has lost over half of its total value since it was bought five years ago. Investors are currently vexed, as anticipation states that Woolworths has overpaid for its bold leap in the initial David Jones investment to create a leading southern hemisphere retailer. Woolworths had completed its acquisition in 2014, for approximately $2.1 billion.

Before discussing the different aspects surrounding the matter, it is important the understand the business in discussion. David Jones is a leading premium department store and has been providing the products and services from leading national and international brands. David Jones operates in Australia and New Zealand region.

The chain has tried to inculcate changes in its Australian business, by strengthening its online offering, cut costs and store space while planning to introduce exclusive brands in clothing, footwear and lingerie. Sadly for the company, these measures could not withstand the soft patch of the Australian economy, which fell victim to grave macro and micro factors of fall in housing prices, weak spending and slackened demand.

The reasons doing the round behind the underperformance of the company are said to be the shift of consumers towards virtual shopping, a late start to winter and poor fashion choices in ladieswear. Moreover, the competitive edge in Australia is likely to be bigger than South Africa.

Australian Retailers Association

The Australian Retailers Association (ARA) is Australiaâs largest association. On 1 August 2019, the association stated about an interesting strategy that bears potential to enhance e-Commerce in the country. According to the ARA, ROPO (Research Online, Purchase Offline) would aid retailers towards incorporating strong e-commerce offerings into their stores. The offer would enable purchase completion as well as serve as a platform to distribute the purchases. This would benefit the local retail corporations who are presently encountering pressure with the arrival of large global brands, and their offline and online portals.

The ARA also notes in its release on 2 August 2019 that the trade war between China and the US, if not averted soon, would dampen the retail situation ever more in Australia, as these are two of the countryâs largest trading partners. Globally, economies are increasing tariffs or levying new ones.

To battle the growing global demand for rapid and convenient delivery, local retailers have implemented complex supply chains that extend beyond the Aussie shores, exposing them to additional costs. This increases the uncertainty around consumers and businesses, to which a digital procurement network would come in handy. Australia is making a significant progress in the Artificial intelligence and robotics sphere, and the cloud-based networks can be a boon to survival.

In the context of Retail, let us now look at the share performance of a few companies, post the closure of the trading session on 2 August 2019, which are listed and traded on the ASX.

| Company Name | Stock value (A$) | Performance (%) | YTD Return (%) |

| Kogan.com Limited (ASX: KGN) | 5.12 | Up by 2.811 | 42.69 |

| Nick Scali Limited (ASX: NCK) | 6.15 | Down by 2.844 | 23.87 |

| City Chic Collective Limited (ASX: CCX) | 1.86 | Up by 2.198 | 86.17 |

| Lovisa Holdings Limited (ASX: LOV) | 10.82 | Down by 1.636 | 79.10 |

| Woolworths Group Limited (ASX: WOW) | 35.77 | Up by 0.534 | 22.06 |

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.