Traditional businesses have undergone a phase of transformation in the last decade, acknowledging and appreciating the presence of the e-commerce portals. The way consumers buy and sell, watch movies, conduct research, trade and study- all of this has been improvised through the internet. The e-commerce services have been continuously evolving and bridging quality gaps between businesses, and there is perhaps no full stop to this booming technology.

In our Article on Netflix last week, we stated that big names like Amazon, Netflix and Redbox have become the jargons that are used in every household on a regular basis, and the advancement that these players are brimming is here to stay.

What is e-commerce?

The most comprehensible way to understand e-commerce is to consider it as an activity that allows commercial transaction to be conducted electronically on the internet. It is hence the purchase and sale of products via online platform across the internet. E-commerce is largely supported by electronic businesses and there are three expanses of e-commerce- online retailing, electronic markets and online auctions.

The major e-commerce companies across the globe include Amazon, Ali Baba, eBay, Jingdong, Flipkart and Zappos.

E-commerce in Australia: According to a report published by the Parliament of Australia, the value of online retail in the country has been continuously on the rise from approximately $17 billion per year in 2015 to approximately $23 billion in 2017. The Australian Competition and Consumer Commission stated that in 2017, Australians purchase an estimated $21.3bn value products via online platform. Comparing this with the global figures, wherein approximately 1.66 billion people across the world purchased goods online with total sales amounting to approximately $2.3 trillion, the Australian figures are quite healthy and depict that e-commerce and the online revolution in the country is on a constant rise, year over year. In 2018, Australians spent approximately $20 billion on online shopping, and the start of 2019 marked for almost 9 per cent of the total retail sale.

Market experts believe that the Aussie e -commerce market would increase at almost a ten per cent rate each year, and the market value in 2020 would be approximately $18.5 billion.

It is a boon for the Aussie community to be exposed to such technologically advanced times, as the country is rich on the technological front and has a great competitive e-commerce market. Apart from global leads, domestic players are also available on the virtual front, and not centred just to the stores.

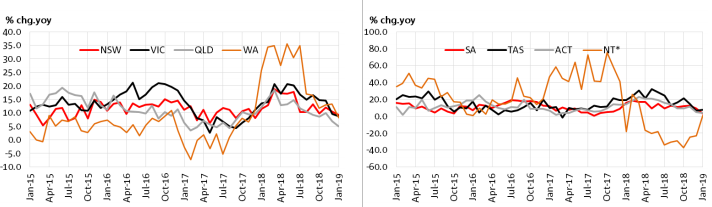

Online sale over the years by state (Source: NAB)

Online sale over the years by state (Source: NAB)

In the light of this context, let us look at a brimming update on the Australian e-Commerce front, which is spamming the virtual market front:

Amazon most likely to launch Channels in 2020: American multinational technology giant Amazon.com, Inc is making progress with its existence in the Aussie land although it might not be able to conquer the Australian market, the way it is spread in the US, given the comparatively smaller geography and concentrated content.

The company is most likely to launch Channels, one of its streaming businesses in the country in 2020. The Amazon Channels is an additional product which is available for streaming on top of the companyâs subscription video on demand service, Amazon Prime Video, which was launched in Australia in 2016 and is a hoard of original and licensed content.

Channels would act as a hub for third-party channels and streaming portals and would not require any external hardware. For consumers without a cable connection, Channels would be an online TV format, and would provide them with the opportunity to select and pick content and shows of their choice.

Market experts believe that Amazon, being amongst the biggest companies of the world, has the money and ability to have an optimistic and successful market in Australia upon the launch of Channels. The company had been examining content for the same in the country and exploring revenue share deals.

It would be interesting to see how the e-commerce market unfolds for Amazon amid the healthy competition that the Aussie land has to offer.

Understanding the company a little better, Amazon is based in Seattle and is focussed on e-commerce, digital streaming, cloud computing and AI. The company teams up along with Apple, Google, Facebook, to form the Big Four Technology companies. Regarded as the largest e-commerce market-place across the globe, Amazon is the largest virtual company by revenue and employs approximately 566,000 employees in the US, making it the second-largest private employer in the States.

Stock Performance: Trading on NASDAQ under the code name AMZN, Amazonâs stock was trading at $1,985.63, up by 1.07 per cent, by the end of trading hours on 22 July 2019. The market capitalisation of the company is $967.20 billion, and its P/E ratio is 99.06x.

Moving ahead of the evergreen Amazon angle, let us look at two e-commerce players which are listed on the Australian Securities Exchange:

KOGAN.COM Limited (ASX: KGN)

Company Profile: With a basket of portfolios in the retail and services businesses, KGN is a leader in price leadership and is known for its digital efficiency, with more than 8 million active subscribers. KGN aims at making in-demand products and services more reasonable and reachable.

Stock Performance: On 23 July 2019, the KGN stock is trading at A$5.435, up by 4.52 per cent, relative to its last trade (1:51 PM AEST). The company has a market capitalisation of A$487.4 million and approximately 93.73 million outstanding shares. The stock has delivered returns of 4.42 per cent and 23.52 per cent in the last one and six months, respectively.

Business Update: On 23 July 2019, the company updated that the Q4 FY19 saw significant contributions from the Kogan Marketplace (launched in 3QFY19) with sustained growth in Exclusive Brands. The company is also preparing for significant preparatory work to launch Kogan Energy, Kogan Cars and additional vertical segments in 1HFY20 (Kogan Mobile NZ, Kogan Credit Cards and Kogan Super).

Based on unaudited management accounts, 2H FY19 (compared to 2H FY18) saw Gross Transaction Value (GTV) growth to be more than 9%, above 12% profit growth, reduction In operating costs by 2% and more than 25% EBITDA growth.

New Agreements: On 1 July 2019, the market was notified that the company had signed an agreement with Splitit Payments Limited (ASX:SPT). As per the agreement, SPT would provide its unique instalment payment solution for the virtual purchases that are done via the Kogan.com website in Australia. With this deal, which is most likely to go live in the coming days, KGN dons the cap for the first leading Australian retailer to adopt the Splitit financial solution.

Another agreement in the companyâs kitty came in from Meridian Energy, whose Australian subsidiary, Powershop Australia, signed a multi-year agreement with KGN wherein the company would offer competitive power and gas services under a new brand, Kogan Energy.

JB Hi-Fi Limited (ASX: JBH)

Company Profile: A player of the consumer discretionary section, JBH is a specialty retailer of home consumer products like consumer electronics, software, whitegoods and appliances. It was listed on the ASX in 2003 and has its registered office in Southbank.

Stock Performance: On 23 July 2019, the JBH stock is trading at A$29.590, down by 1.01 per cent (1:51 PM AEST). The company has a market capitalisation of ~A$3.4 billion and approximately 114.88 million outstanding shares. The stock has delivered returns of 14.90 per cent and 35.07 per cent in the last one and six months, respectively.

New On Board: On 18 June 2019, the company made a few executive appointments. Cameron Trainor was re-appointed as MD of the JB Hi-Fi business. Lynda Blakely had been appointed as the Group HR Director. Simon Page had been appointed as the Group Technology Director.

2019 Macquarie Australia Conference: In April, the company presented at the 2019 Macquarie Australia Conference and stated that Q3 FY19 total sales growth for JB Hi-Fi Australia was down to 2.6 per cent from the 7.5 per cent in pcp. The YTD FY19 total sales growth was 4.1 per cent, a figure that was 9.8 per cent in FY18. As outlook for FY19, the company is anticipating Total Group sales to be circa $7.1 billion, and the Total Group NPAT to be in the range of $237 million to $245 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.