This article talks about five companies listed on ASX. These companies have declared full-year results, half-year results, dividends and other updates related to the business. On 16 August 2019, the Australian Benchmark Index S&P/ASX 200 was trading at 6,408.3 or 0.2 basis point.

Treasury Wine Estates Limited (ASX: TWE)

On 15 August 2019, the company released FY 2019 results for the period ended 30 June 2019. Accordingly, it has recorded net sales revenues of $2831.6 million in FY19, up by 16.6% in reported currency terms over the previous corresponding period. EBITS was up by 25% in reported currency terms to $662.7 million in FY19 compared with FY18.

Subsequently, the company recorded NPAT of $419.5 million in FY19 up by 16.4% from $360.3 million in FY18 on reported currency terms. The company declared a fully franked dividend of 20 cents per share for the period, which takes the total dividend for the year to 38 cents per share. Besides, the dividend has ex-date on 4 September 2019, record date on 5 September 2019, and payment date on 4 October 2019.

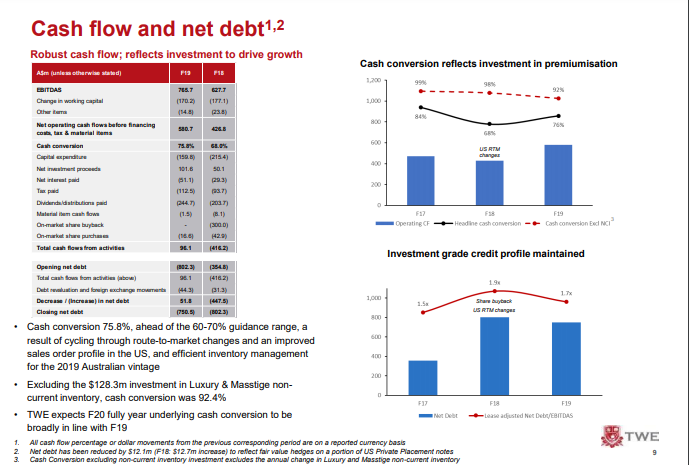

Cash Flow & Net Debt (Source: TWEâs 2019 Annual Results Investor & Analyst Presentation)

Reportedly, the company is well placed to continue the premiumisation strategy in FY20, and the Australian vintage had another outstanding luxury intake for TWE. The investments made in French production assets & Australian luxury winemaking capabilities would underpin the subsequent stage of progress via premiumisation strategy.

Besides, the companyâs priority remains the competitively advantaged route-to-market in the US & Asia, and it intends to target operational efficiency, enhanced returns from brand building investments.

As per the release, the company reaffirmed reported EBITS growth of 15% to 20% in FY20, backed by growth in all markets. Besides, it would pursue a disciplined approach while executing the US route-to-market model to achieve the target.

On 16 August 2019, TWEâs stock was trading at A$16.9, down by 3.152% (at AEST 2:16 PM).

QBE Insurance Group Limited (ASX: QBE)

On 15 August 2019, the group disclosed half-year results for the period ended 30 June 2019. Accordingly, the insurance group posted statutory NPAT of $463 million for the half year FY2019, which represented an increase of 29% from $385 million in the prior corresponding period. The gross written premiums were slightly up by 1% to $7,637 million in H119 compared with $7,887 million in H118.

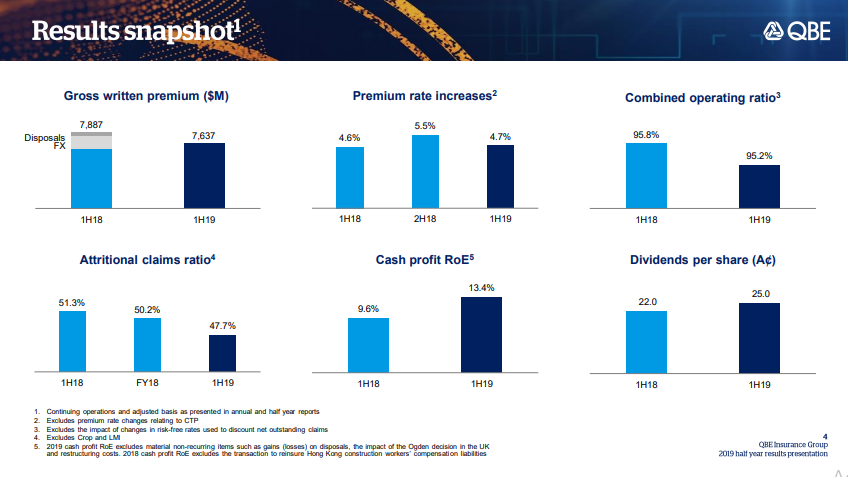

Highlights (Source: QBEâs 2019 Half Year Results Presentation)

Reportedly, the net earned premiums were up by 3% to $5,671 million in 1H19 compared with $5,837 million in 1H18. The commission & expense ratio was down to 30.9% in 1H19 against 31.2% in 1H19. Besides, the debt to equity ratio of the group was down to 36.8% in 1H19 compared with 38% in 1H18.

Meanwhile, the groupâs underwriting results involves a subdued input from North America crop insurance business, and the adverse impacts were noticed by normalisation of Australian Lenderâs Mortgage Insurance business.

As per the release, the capital of the group continues to be strong in terms of regulatory & rating agency capital requirements. The groupâs indicative APRA PCA multiple was 1.75x as at 30 June 2019 within the groupâs range in between 1.6x to 1.8x target PCA, and credit rating was retained an excess above S&P âAAâ minimum capital.

Meanwhile, the group had announced a 60% franked dividend of 25 cents per share for the period. The ex-date for the dividend is 22 August 2019, record date for the dividend is 23 August 2019, and the payment date is 4 October 2019.

On 16 August 2019, QBEâs stock was trading at A$12.06, up by 1.669% (at AEST 2: 32 PM).

Sydney Airport (ASX: SYD)

On 15 August 2019, the half-year disclosure was reported to the market by the airport. Accordingly, the total revenues were $797.1 million in H119, up by 3.4% from 770.8 million in H118. The total passengers were slightly down by 0.2% due to subdued domestic passenger traffic.

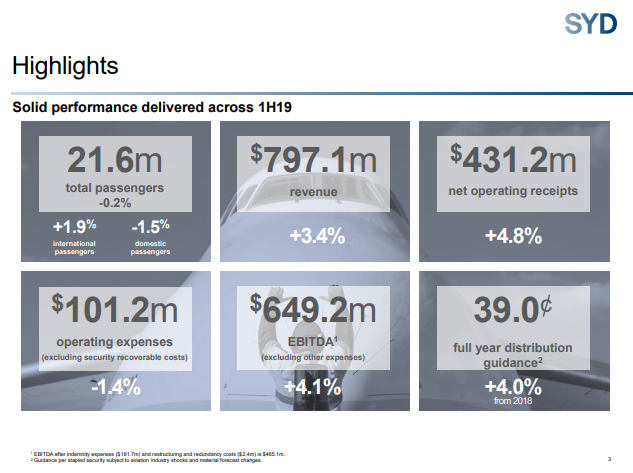

Highlights (Source: Sydney Airport Half Year Results Presentation)

Reportedly, the operating expenses of the airport were slightly up by 0.4% to $147.9 million in H119 compared with $147.4 million in H118. The EBITDA was down by 25.4% to $465.1 million in H119 compared with $623.4 million in H118; this was mainly due to indemnity, restructuring and redundancy expenses totaling $332 million. Importantly, the indemnity expenses were related to the matters being handled in the European Courts for dividend withholding tax.

As per the release, the capital expenditure for the period was $116.1 million with an emphasis on increasing aeronautical capacity & prioritising projects such as faster processing facilities for arrivals & baggage. Besides, the airport confirmed the three-year capex guidance in the range of $0.9 to $1.1 billion for the 2019-21 period.

Meanwhile, the airport undertook management & organizational restructuring during the half year, and the direct reports to the CEO were reduced to five from ten while complementary functions were grouped together.

Outlook

Reportedly, the business has demonstrated a history of performance & growth across economic cycles, and the airport confidently confirms the distribution guidance of 39 cents per security for the year 2019, subject to aviation industry shocks, material changes to forecast.

On 16 August 2019, SYDâs stock was trading at A$8.19, up by 1.236% (at AEST 2:38 PM).

On 15 August 2019, the company announced full year results for the period ended 30 June 2019. Accordingly, the company recorded a statutory net profit after tax of $161.2 million for the year down from $212.2 million in the pcp, and the statutory EPS was 13.4 cents per share against 17.7 cents in the pcp.

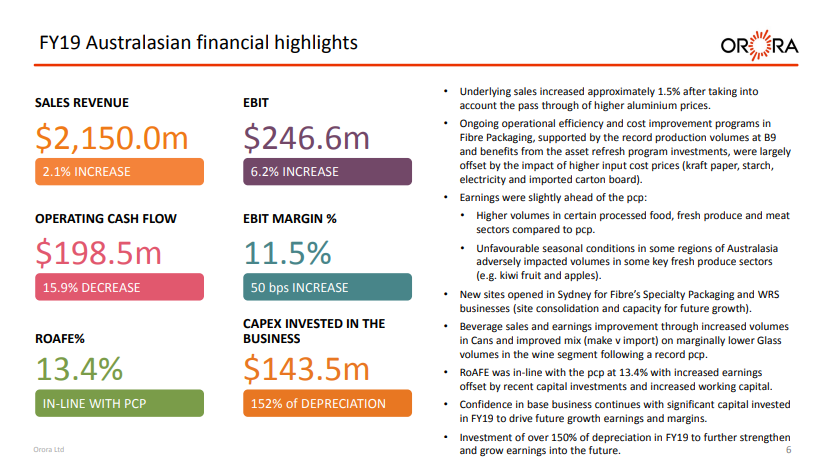

FY19 Highlights (Source: Orora - Result Investors Presentation Slides - FY19)

Meanwhile, the underlying NPAT was up by 4% to $217 million for the period, and underlying EBIT was up by 3.7% to $335.2 million. In Australia, the sales revenue was slightly up by 2.1%, and earnings improved across the Australian business. In North America, the company achieved decent sales growth while the earnings declined over the pcp, backed by forex & acquisition impacts.

Reportedly, the company invested over $300 million in the acquisition, innovation and organic capital projects to drive sustainable growth. These investments included acquisitions in North America and asset upgrades in Australia & New Zealand.

Besides, the company has been advancing with $75 million in innovation initiatives, and $66 million have been committed to such programs. The company is consistently focusing on the evolving needs of the customer while emphasising innovations.

More importantly, the company intends to de-risk the adverse market conditions, cost disruptions through investing in efficiency, growth, innovation, and synergies from acquisitions.

As per the release, the company has declared a 30% franked dividend of 6.5 cents per share for the period. Besides, the dividend is scheduled to go ex on 16 September 2019 with a record date on 17 September 2019, and it is payable on 21 October 2019.

On 16 August 2019, ORAâs stock was trading at A$2.755, up by 2.416% (at AEST 2: 45 PM).

Downer EDI Limited (ASX: DOW)

On 15 August 2019, Downer announced that it was awarded a contract extension by the Capability, Acquisition and Sustainment Group (CASG). Accordingly, the contract extension was awarded to the companyâs dedicated team â Defence Major Services Provider (MSP) consortium.

Meanwhile, the contract involves supporting the Critical Systems Branch (CSB) within the Joint Systems Division of the Department of Defence. Reportedly, the extension has a tenure of four-year, and it is valued at $154.5 million. Besides, it allows CASG to extend the contract by another four years.

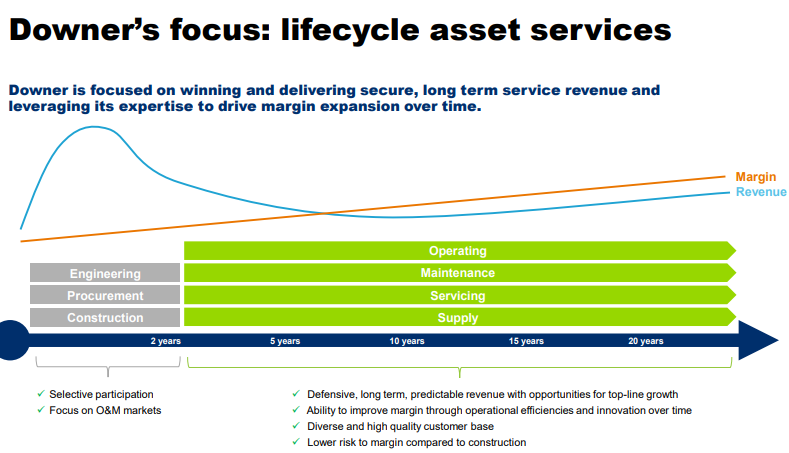

(Source: Companyâs Report dated 2 May 2019)

On 16 August 2019, DOW was trading at $7.36, up by 0.136% (at AEST 2:50 PM).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.