According to the number revealed by the Australia Bureau of Statistics (ABS), the total alcohol consumption in Australia has been on a decline since 2008-09, reaching a record low of 186 million litres of pure alcohol, or 9.4 litres for every person in Australia aged 15 years and above in 2016-17. ABS also added that while the dip in wine consumption was recent, the fall in beer intake was the primary cause of declining liquor consumption, averaging at a negative 2.4% per year over the last ten years.

Australian Wine Industry

Australian exports around 60% of its total wine production and is the fifth largest exporter in the world. It has some of the oldest grapevines worldwide and a total vineyard area spanning ~146,000 hectares with more than 2,000 wine exporters.

China, in particular, has been propelling the demand for Australian red wine over the last few years. According to the Australian Wine Industry Regulator, Wine Australia?s recently released data for the year ended June 2019, Australia?s total wine exports have climbed up 4% in value to $2.86 million, but volumes have dropped by 6% to 801 million litres. This is due to the fact that the higher price segments recorded higher sales growth during the period.

Australia?s top five wine export markets (by value) include Mainland China, the United States of America, United Kingdom, Canada, and Hong Kong in that order.

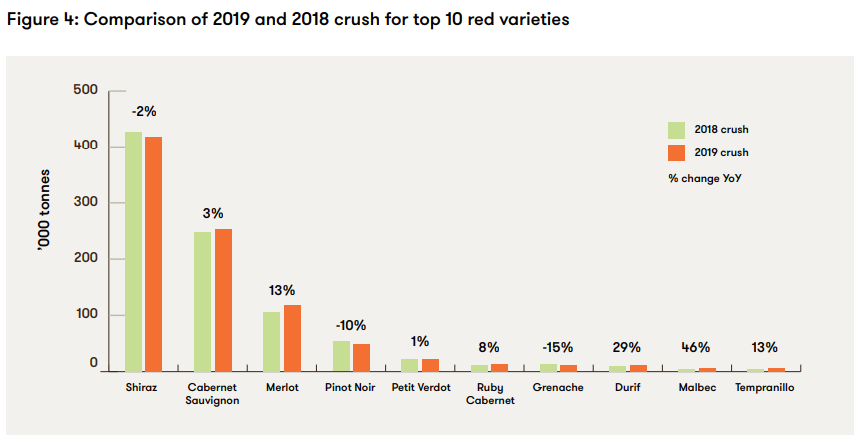

Also, Wine Australia?s National Vintage Report 2019 suggested that around 1.73 million tonnes of wine grapes were crushed in Australia in 2019, which is 3% lower than the harvest recorded in 2018.

(Source: National Vintage Report 2019)

Let?s take a look at some of the leading Australian wine companies.

Treasury Wine Estates Limited

A Melbourne, Australia-based Treasury Wine Estates Limited (ASX:TWE), established in 1843, operates as a leading global wine company in Australia, New Zealand, Asia, Europe, and the Americas. The company?s brands include Beaulieu Vineyard, Chateau St Jean, Beringer, Penfolds, Lindeman?s, Wolf Blass, amongst many others.

The company has around 9.09k planted hectares of vineyards (owned and leased) in New Zealand and Australia; 3.8k planted hectares in many viticulture sites in the US, including Central Coast, Lake County, Sonoma County, and Napa Valley, along with facilities in Europe. It is involved in the viticulture, winemaking, marketing, sale, and distribution through distributors, wholesalers, retails chains, independent retailers, on-premise outlets, and also directly to consumers. It also provides bottling services to third-party clients.

Treasury Wine?s current market capitalisation stands at around $11.75 billion, with approximately 719.1 million shares outstanding. Today, on 23rd July 2019 (AEST 01:10 PM), the TWE stock is trading at $16.505, up 1.01% by $0.165, with approximately 913,690 million shares traded.

In addition, the TWE stock has generated a positive return yield of 11.31% YTD.

Change in Director?s Interest ? On 26th May 2019, company Director, Mr Colleen Jay acquired a Direct Interest in Treasury Wine Estates through the purchase of 605 ordinary shares, at a value/consideration of $15.46 per ordinary share.

Earlier in the same month, the company?s Director and Chief Executive Officer (CEO), Mr Michael Anthony Clarke sold 400,000 ordinary shares (direct and indirect interests) in TWE on 1st and 3rd May 2019, on receiving Board pre-trade approvals. However, following the transactions, Mr Clarke continues to hold a significant relevant interest in 1,795,445 company securities, comprising 542,994 ordinary shares and 1,252,451 performance rights.

Asia Depletions and Australian Vintage Update - On 1st May 2019, Treasury Wine Estates released an announcement stating that the shareholders may not consider Wine Australia?s export data as a direct indicator of Treasury Wine?s trading performance. The company recapitulated that relying on short-term trade import and export data may be misleading as it does not consider any structural differences in the company?s business model, the premium mix of TWE?s portfolio, or the variability in its export shipment profile.

In addition, TWE also outlined a few highlights of its operating performance across all regions for the nine months ended 31st March 2019. These include continued positive momentum in Asia (including Chinese New Year festive period) with record depletions delivered for the concerned period, and confirmation of expectations for Vintage 2019, which is a very strong and high-quality Luxury wine for TWE (intake up 10% on 2018). The company also reiterated its EBITS guidance, which stands at ~25% in FY19 and expected to be 15% to 20% in FY20.

Australian Vintage Ltd

Australian Vintage Ltd (ASX: AVG), based in Balmain, Australia is engaged in the production, packaging, commercialisation of wine under the brand names Nepenth, McGuigan Wines, Passion Pop, Tempus Two and Miranda. The products are distributed through retail, wholesale, distributor channels and regional outlets across Australia, UK & Ireland, Europe, Asia, New Zealand and the Americas. With a market capitalisation of ~$131.93 million and 280.71 million shares outstanding, the AVG stock is trading (23rd July 2019, AEST 01:30 PM) at $0.470.

Trading and Vintage Update - Recently on 30th April 2019, Australian Vintage reported that for the year to 31st March 2019, the total sales were up 9% on the prior corresponding period with the UK/Europe segment up 19% and the Australasia/North America Packaged segment up 5%.

Additionally, the company crushed 83,000 tonnes of grapes, down 11% on last year and 28% down on expectation. The grape yields from owned and leased vineyards were also down on a prior year by 18% and down 22% on expectation.

The company also mentioned that subject to no material changes in the current exchange rates, the 2019 net profit after tax (NPAT) and before SGARA is expected to be up by 35% to 40%. After SGARA, net profit after tax is expected to be in line with the last year.

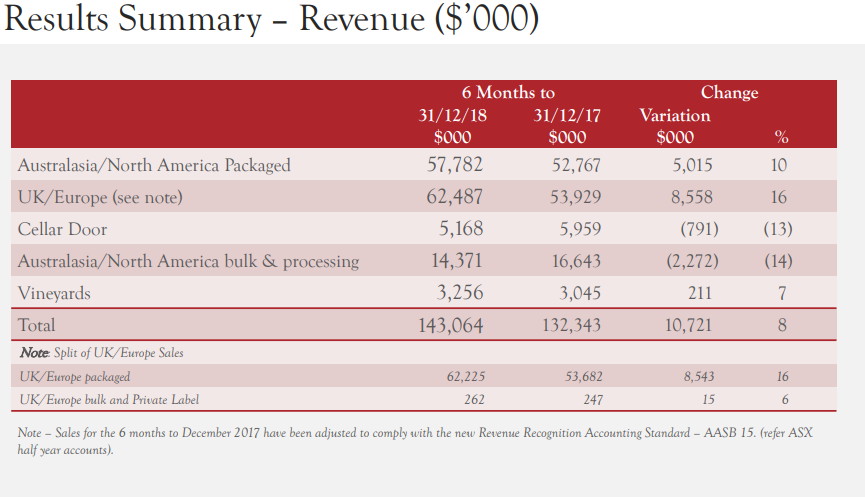

First Half 2019 Results ? Australian Vintage recorded an NPAT of $ 6.5 million compared to $ 4.4 million for the six months to December 2018, while the revenue was also up 8% to $143.1 million, with improved sales in the key segments of Australasia/North America and UK/Europe.

(Results Summary; Source: Half Year Results 31 December 2018 Presentation)

The cash flow from operating activities remained positive at $10.9 million compared to $ 11.0 million as at December 2017, while the company continued to focus on its strategy of growing business exports, increasing brand sales, and cost control.

Australian Beer Industry

As per the Brewers Association of Australia, the country has a dynamic beer sector that adds immensely to the overall economic activity and creates domestic jobs. It not only supports the Australian farmers? upstream but also includes brewing, packaging and the logistics along with retail, tourism and hospitality.

On average, every beer manufactured in Australian contributes $4.07 to the country?s Gross Domestic Product, as depicted below.

Source: www.brewers.org.au

?

Moreover, Beer is mostly a domestic industry in Australia, with three major local brewers, Carlton & United Breweries (CUB), Lion Brewery and Coopers Brewery accounting for a significant 79.4% of the total sales volume.

Recently, Belgium-based Anheuser-Busch InBev's (ABI) sold its Australian subsidiary, CUB, to Japan-based liquor giant, Asahi Breweries for $16 billion, and this is expected to stimulate the broader market beer sales, which have been flat for a while in Australia. The transaction is anticipated to be settled by the first quarter of 2020.

Let?s take a look at two of the ASX-listed beer companies in Australia.

Gage Roads Brewing Co. Limited

Gage Roads Brewing Co. Limited (AXS: GRB), based in Palmyra, Australia is engaged in brewing, packaging, marketing and sale of beer, cider, and other beverages in Australia and worldwide. The company?s market cap stands at around $103.99 million, with approximately 1.11 billion shares outstanding. Today, on 23rd July 2019 (AEST 1:45 PM), the GRB stock is trading at $0.093, down 1.064% by $0.001 with ~100,800 shares traded.

$8 million Capital raising ? On 24th April 2019, Gage Roads Brewing issued around 84,210,526 ordinary shares to the institutional and sophisticated investors at $0.095 each, thus raising a total of $8 million.

The proceeds from the transaction were indicated to be directed towards the implementation of the company?s packaging line expansion program, including installation of a new commercial scale canning line, a new high-speed bottle filler and other plant improvements.

The company also added that the market for beer in a ?can? format was growing significantly at 134% per annum, currently representing 11% of the craft beer market.

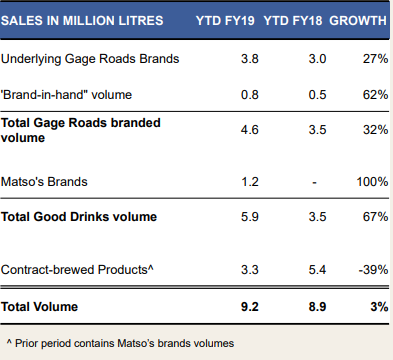

Q3 FY19 Highlights ? As per the figures posted for the concerned period, the company reported that the total YTD proprietary volume was up 67% and the GRB branded volume to independents was up 55%. A snapshot of the company?s financial results is as follows:

(Source: Capital Raising, Capex Program and Q3 Strategy Update)

?

Broo Ltd

Broo Ltd (ASX: BEE), based in Australia, is a unique brewing company, which offers beer, liquor, and malt beverages for customers in Australia. With a market capitalisation of around $11.49 million and ~638.25 million shares outstanding, the BEE stock on 23rd July 2019 (AEST 2:00 PM) is trading at $0.021, up 16.667%.

Quarterly activities Update ? The company reported a strong Q3 2019, with domestic wholesale increased to 86% and the retail revenues improved by 20% in the Australian market. Besides, the consolidated revenues increased by 40%. Prior to the first instalment of Chinese distribution fee in the next year, the company expects to be profitable for FY2020 on the back of significant cost reductions, new product lines and consistent sales growth.

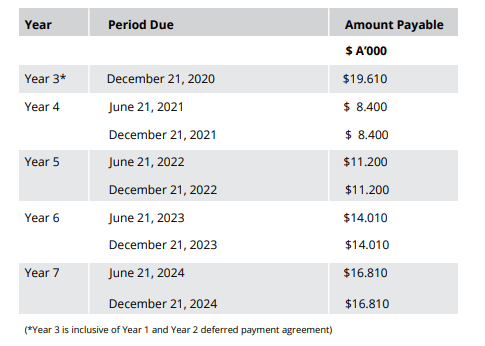

In the China market, Broo signed an exclusive a ?Take or Pay? agreement for a 7-year period with distribution partner, Beijing Jihua Information Consultant Ltd for Broo Premium Lager products. Accordingly, the aggregate distribution revenue payable to Broo based on a fixed rate per litre is, as depicted in the chart below.

Third Quarter FY19 Update (Source: Company Reports)

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.