Blue-chip companies are generally mature companies and are popular amongst the larger institutional investors like endowment firms, insurance firms, mutual funds, etc. and also conservative retail investors. These companies are well established and are financially sound.

From an investment point of view, the blue-chip stocks are comparatively safer as they are historically known to give a stable return. Blue chip stocks are generally known to be less volatile in nature and are highly liquid as they get easily traded in the market.

Blue-chip stocks could also be categorised are those stocks whose market capitalisation is above $10 billion. Some of the famous blue-chip stocks in Australia includes BHP Group Limited (ASX:BHP), Commonwealth Bank of Australia (ASX: CBA), Telstra Corporation Limited (ASX: TLS) , Rio Tinto Limited (ASX: RIO), National Australia Bank Limited (ASX: NAB), Australia and New Zealand Banking Group Limited (ASX:ANZ)

In this piece of article, we have covered two blue-chip stocks, QBE Insurance Group Limited (QBE) and Sydney Airport (SYD).

QBE Insurance Group Limited

About the company: QBE Insurance Group Limited (ASX: QBE) ranks amongst one of the top 20 general insurance and reinsurance companies in the world and has operations in all the important insurance market. The company provides commercial, personal as well as specialty products. Other than this, the company also provides risk management solutions to its clients.

Recent Update/s: On 19 July 2019, QBE Insurance Group Limited released an update to the market where it highlighted the announcement made by UK Ministry of Justice regarding the change in the statutory discount rate for determining lump sum payments with respect to the UK personal injury claims.

The company in the past had disclosed that it has been using a 0.25% discount rate in order to determine Ogden related lump sum payments.

The company has been estimating the probable influence of the change and based on this it believes that adoption of the revised statutory rate of -0.25% would result in a one-off increase in the net central estimate of outstanding claims liabilities of the Group which is approximately US$60 million. The impact would be reported as adjustments in the first half of FY2019 as well as FY2019 statutory results.

On 24 June 2019, the company announced that it would be simplifying its reporting and revealed three divisional segments instead of five.

The reporting segment would be as follows. The operations in Asia and Europe would together comprise âInternationalâ. The operations at Pacific and Australian & New Zealand regions would fall under the Australia Pacific segment, and the operations at North America would remain as it is.

This simplification would not have any influence on the overall result of the Group. The Board of QBE is of the opinion that this restructured segmenting would provide investors with a simpler and more meaningful picture of the scale and the underlying performance of the groupâs segments.

Stock Performance: In the prior 6 months, the QBE stocks have provided a return of 6.88%. The opening price of the shares of QBE on 22 July 2019 was A$11.800. At present (AEST: 12:08 pm, 22 July 2019), the shares of QBE are trading at A$11.750, down by 0.424%. QBE has a market cap of ~ A$ 15.51 bn, ~ 1.31 bn outstanding shares, a PE ratio of 28.77x and an annual dividend yield of 4.24%.

Sydney Airport

About the company: Sydney Airport (ASX: SYD) is a company is engaged in airport operations and it belongs the industrial sector. It provides services like aeronautical, retail, property, car rental and parking and ground transport services via Aviation (Sydney Airport) as well as Leasing & Advertising.

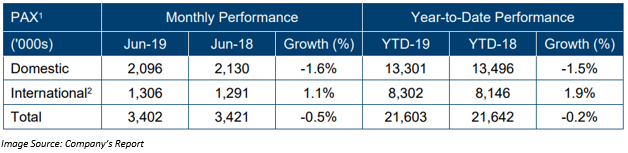

Recent Update/s: On 19 July 2019, Sydney Airport released its traffic performance for the month of June 2019. The company reported an increase in the number of international passengers who travel via the airport by 1.1% to 1.3 million passengers as compared to the previous corresponding period. The YTD growth in international passenger was 1.9%. However, there was a decline in domestic passengers by 1.6% to 2.1 million passengers. The domestic passengers travelling through the airport also saw a drop on a YTD basis by 1.5%.

The total number of passengers who passed through the Sydney Airport in the month of June 2019 was 3.4 million, down by 0.5% as compared to June 2018.

In June 2019, the top 5 quickest expanding passenger groups was from Vietnam, Taiwan, Japan, USA and India. From all these regions, the company reported a double-digit growth as compared to June 2018.

The impact in the number of domestic travelers was influenced by capacity reductions along with the subdued load factors.

In its earlier traffic performance for the month of May, the company highlighted that Malindo Air would be starting daily service from Kuala Lumpur via Denpasar in August 2019 which would operate 162 seat airline. Meanwhile, Qantasâ seasonal Sapporo service is scheduled to begin during the middle of December 2019 which would be a 251 seat A330-200 aircraft and will operate thrice a week to late March.

On 12 July 2019, the company announced the resignation of Jamie Motum followed by the appointment of Karen Tompkins as company secretary of Sydney Airport Limited as well as the co-company secretary of Sydney Airport as responsible entity of The Trust Company (Sydney Airport) Limited (TTCSAL)Trust 1. Also, Sylvie Dimarco, as well as Gananatha Nayanajith Minithantri, would remain to be working as the co-company secretaries for The Trust Company (Sydney Airport) Limited.

Stock Performance: In the prior 6 months, the SYD stocks have provided a return of 26.44%. The opening price of the shares of SYD on 22 July 2019 was A$8.100. At present (AEST: 12:08 pm, 22 July 2019), the shares of SYD are trading at A$8.035, down by 1.169%. SYD has a market cap of ~ A$ 18.35 bn, ~ 2.26bn outstanding shares, a PE ratio of 49.18x and an annual dividend yield of 4.74%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.