Treasury Wine Estates Limited (ASX:TWE) is a vertically integrated wine business, which engages in grape growing, sourcing, production and distribution of wine.

Asia Depletions and Australian Vintage Update: For the nine months to March 2019, the company believes to have witnessed good operating performance across all regions. Going forward, it confirms continued progress in Asia with record depletions delivered during the period. The company also notified that Vintage 2019 in Australia is expected to be high-quality Luxury wine vintage for the company. The luxury intake on Vintage 2018 increased by approximately 10% due to its multi-regional sourcing strategy. The company confirmed reported EBITS growth guidance to be approximately 25% in FY19 and 15% to 20% in FY20.

The company also updated that the Wine Australia export data for the quarter ended March 2019 should not be used as a direct read through to TWEâs trading performance. The company notified that the use of short-term trade export and import data may not be a true reflection of TWEâs underlying trading performance in the Asia region. The data did not take into account the key structural differences in the business model, the premium mix of its portfolio and the variability in the export shipment profile.

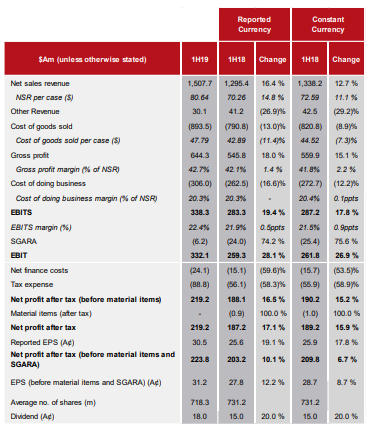

1H FY19 Highlights: During the six months ended 31st December 2018, the company reported net sales revenue amounting to $1,507.7 million, up 16% on the prior corresponding period. Earnings before interest, tax, SGARA and material items stood at $338.3 million, up 19% on pcp. EBITS margin went up by 0.5 ppts to 22.4%. During the period, the company reported NPAT amounting to $219.2 million, up 17% on the prior corresponding period. EPS during the period stood at 30.5 cents, up 19% on pcp.

The cash conversion rate for the period was reported at 53.5% on the back of growth in revenues and timely sales execution in the Americas and Asia. The company also declared a fully franked interim dividend of 18.0 cents per share, representing a pay-out ratio of 58% and growth of 20% on the prior corresponding period. This indicates that the company is providing better returns.

1HFY19 Financial Performance (Source: Company Reports)

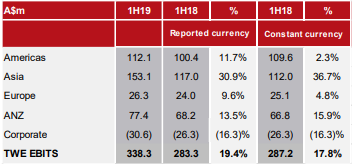

Regional Growth in EBITS: During the first half, the company witnessed strong EBITS growth across all regions owing to its premiumisation strategy, which led to an increase in the availability of Luxury wine for allocation in key markets. EBITS in the Americas was reported at $112.1 million with a growth of ~12%. EBITS margin for the period was reported at 18.5%. Growth in Asia was strong with an uplift of ~31% at $153.1 million and EBITS margin of 38.9%. Growth in Europe and ANZ was reported at 9.6% and 13.5%, respectively.

Region-Wise EBITS (Source: Company Reports)

During the first half, the company witnessed highest ever net sales revenue growth backed by portfolio premiumisation, volume growth and price realisation. In addition, strong EBITS growth was reported across all regions, Asia being on the top due to the competitive advantage of business model, brand portfolio and outstanding sales execution. The company strengthened its customer partnerships in all regions with the increased availability of Luxury wine, new product development and a strong pipeline of innovation, which has the potential to drive future performance.

Outlook: The company expects to report a balanced earnings outcome across FY19 and expects to achieve ~25% growth in EBITS in FY19. Furthermore, the company is committed to EBITS margin accretion and progressing towards an EBITS margin target of 25%. The company is expecting cash conversion in the vicinity of 60% to 70% in FY19. In addition, the cash conversion target of 80% has remained appropriate for the longer term. The company is anticipating maintenance and replacement capital expenditure to be in the ambit of $130 million to $140 million.

The company reported gross margin and EBITDA margin of 41.9% and 23.8% in 1H FY19, reflecting a growth of 1.1% and 0.8% Y-o-Y. The net margin of the company stood at 14.3% in 1H FY19 in comparison to the industry median of 12.2%. This represents that the company is effectively converting its top line into the bottom line. The company posted return-on-equity of 6.2% in 1H FY19 against the industry median of 5.8%, which represents that the company is providing sustainable returns to its shareholders as compared to the broader industry.

The stock of Treasury Wine Estates Limited, at market close on 26th July 2019, traded at a price of $17.700 per share, up 1.841% during the dayâs trade, with a market cap of $12.5 billion. The stock has produced returns of 15.56%, 1.22% and 12.13% for the one month, three months and six month period, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.