The Industrial sector is one of the most important sectors of the Australian economy. The below-mentioned industrial stocks have made strong operational progress in the recent past. Letâs take a look at these stock.

Downer EDI Limited (ASX:DOW)

A leading provider of integrated services in Australia and New Zealand, Downer EDI Limited (ASX: DOW) has been chosen by AusNet Services Limited (ASX: AST), a major diversified energy network business, to provide operational and maintenance services on the electricity distribution network in Victoria.

Following the release of this news, DOWâs stock rose slightly by 0.436% during the intraday trade.

Both the parties have agreed for a five-year contract, which can be extended for a further six years. As per the companyâs release, the contract is worth around $600 million. With this new contract, Downerâs services will now be extended to Victoriaâs Northern and Eastern regions.

It is expected that the contract will commence in September 2019, post completion of the workforce transition process.

With this contract, Downer has established itself as a benchmark end-to-end service provider to owners of utility assets, said Downerâs CEO Grant Fenn.

As part of the contract, Downer will be performing various operations, including maintenance, capital works and will also provide emergency response for AusNetâs electricity distribution assets.

In June 2019, the company released a âChange of Directorâs Interest Noticeâ, in which, it announced that its Director, Grant Anthony Fenn has acquired 301,791 performance rights. Grant Anthony Fenn now holds 1,164,203 ordinary shares and 1,555,492 performance rights.

Board Changes: In May 2019, the company announced the appointment of highly experienced Peter Watson for the role of Non-Executive Director. Mr Watson held various senior level positions with big organisations, including LogiCamms Limited, Stephenson Mansell Group, Transfield Services, Watpac Limited.

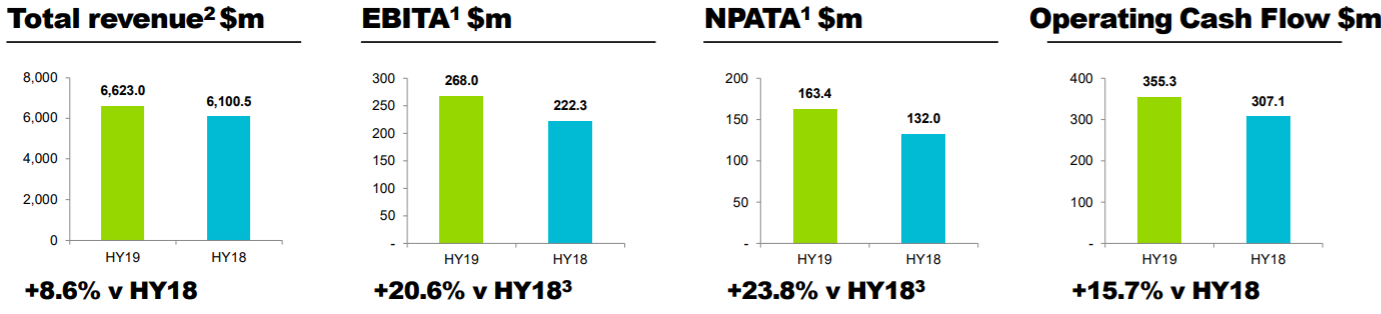

In the first half of FY19, the company reported NPATA growth of 23.8% as compared to pcp. The company reported a revenue of $6,623 million in the first half, up 8.6% on pcp. For the half year period, the company reported operating cash flow of $355.3 million with a cash conversion of 90.7%. At the end of the half year period, the company had a gearing of 23.8% and $1.4 billion of liquidity.

Half Year results (Source: Company Reports)

In FY19, the company expects its NPATA to be around $352 million and its EPS growth to be around 19%. In FY19, the company anticipates to maintaining conservative gearing position, providing balance sheet flexibility to support growth.

Share Performance: In the past six months, DOWâs shares have provided a negative return of 4.84% as on 22nd July 2019. DOWâs shares are trading at a PE multiple of 19.130x, with an annual dividend yield of 4.07%. Its 52 weeks high price stands at $8.170 and 52 weeks low price at $5.955, with an average volume of ~2,180,302. At market close on 23rd July 2019, the stock was trading at a price of $6.910, with a market capitalisation of circa $4.09 billion.

Qube Holdings Limited (ASX:QUB)

An integrated logistics solutions provider, Qube Holdings Limited (ASX: QUB) recently acquired LCR and its subsidiaries for a total value of $135 million, providing Qube with the ability to provide improved broad-spectrum mining and industrial services to its existing and future customers.

In June 2019, via its indirectly wholly-owned subsidiary, Qube Logistics, the company announced its intention to make an off-market takeover offer for Chalmers Limited (ASX:CHR). The Directors of Chalmers have recommended its shareholders to accept the offer.

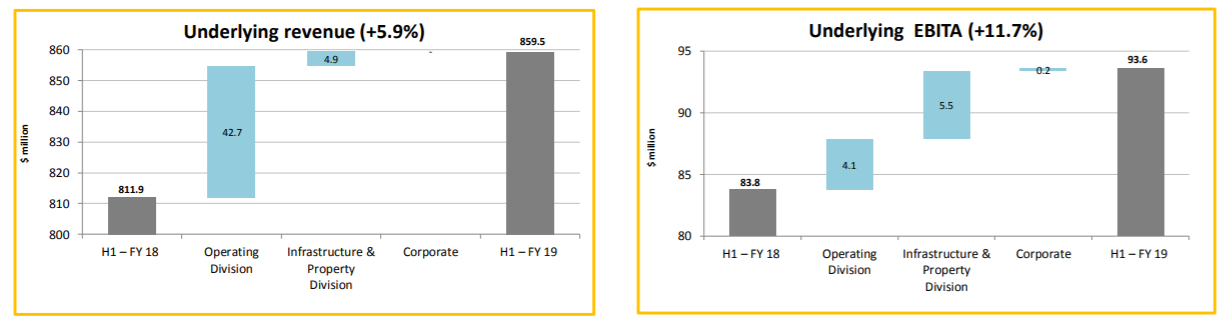

In the first half of FY19, the company reported statutory revenues of $837.0 million, up 5% on pcp. Further, the company reported underlying revenue of $859.5 million, which was 5.9% higher than pcp. The company witnessed a growth of 20.2% in its Statutory EBITA for the half year period.

FY 19 Interim Results (Source: Company reports)

For the half year period, the companyâs Board declared an interim dividend of 2.8 cents per share and a special interim dividend of 1.0 cent per share (both fully franked), reflecting the strong financial performance, high cashflow generation and positive outlook. During the half year period, the company made sound progress in the development of its Moorebank Logistics Park. The company is expecting to generate solid NPATA in the second half, which will be way ahead than pcp.

Share Performance: In the past six months, QUBâs shares have provided a return of 15.72% as on 22nd July 2019. QUBâs shares are trading at a PE multiple of 22.890x, with an annual dividend yield of 1.81%. Its 52 weeks high price stands at $3.160 and 52 weeks low price at $2.312, with an average volume of ~3,076,820. At market close on 23rd July 2019, the stock was trading at a price of $3.090, with a market capitalisation of circa $4.96 billion and a daily volume of ~7,574,581.

Cleanaway Waste Management Limited (ASX:CWY)

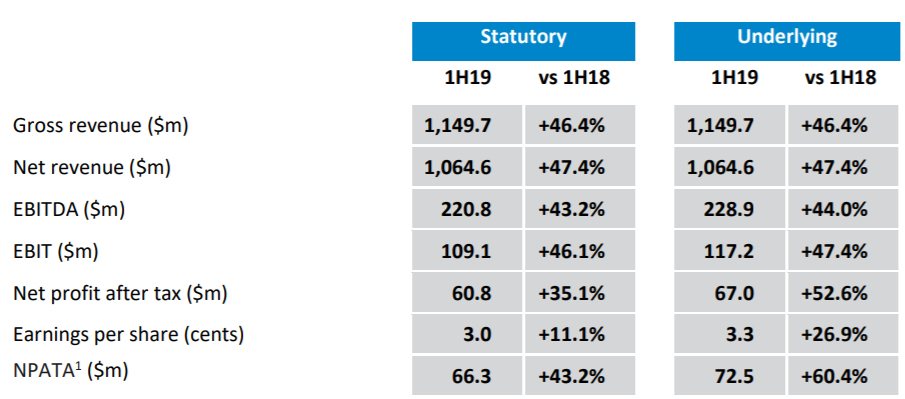

A leading waste management, recycling and industrial services company, Cleanaway Waste Management Limited (ASX: CWY) processes around 2,400 tonnes of recyclable waste in a single day. In the first half of FY19, the company reported gross revenues of $1,149.7 million, up 46.4% on pcp. For the half year period, the company earned EBITDA of $220.8 million (Statutory basis), up 43.2% on pcp.

For the half year period, the companyâs Board declared an interim dividend of 1.65 cents per share, fully franked, which is 50% higher than pcp.

Half-year results (Source: Company Reports)

For its Solid Waste Services business, the company earned a revenue of $682.4 million, which was 30.2% higher than pcp. The EBITDA for Solids Waste Services increased by 26.2% to $175.7 million in the half year period.

From its Industrial & Waste Services business, the company reported net revenues of $177.0 million, up 129% on pcp. In Liquid Waste & Health Services segment, the company earned net revenues of $251.0 million, up 77.1% on pcp.

Stock Performance: In the past six months, CWYâs shares have provided a return of 34.97% as on 22nd July 2019. CWYâs shares are trading at a PE multiple of 41.860x, with an annual dividend yield of 1.23%. Its 52 weeks high price stands at $2.510 and 52 weeks low price at $1.535, with an average volume of ~5,316,303. At market close on 23rd July 2019, the stock was trading at a price of $2.470, with a market capitalisation of circa $5.05 billion and a daily volume of ~2,381,012.

ALS Limited (ASX:ALQ)

A global leader in providing the laboratory testing, inspection, certification and verification solutions, ALS Limited (ASX: ALQ) is focused on driving growth by continuing to successfully operate its existing businesses while pursuing new opportunities.

In FY19, the company earned an underlying net profit after tax from continuing operations of $181.0 million. Revenues from continuing operations of $1,664.8 million in the full year were up significantly by 15.1% on the $1,446.9 million recorded in the pcp.

The Board declared a final dividend of 11.5 cents per share, partly franked to 35%, representing a payout ratio of 60.4% of full year underlying profit. During the year, the company invested $100 million in strategic acquisitions and growth projects.

The company recently released a âChange of Directorâs Interest Noticeâ, announcing that its Director, Raj Naran has disposed 14,983 ordinary shares for a total value of $112,971.82 via on-market trade.

Stock Performance: In the past six months, ALQâs shares have provided a return of 2.95% as on 22nd July 2019. ALQâs shares are trading at a PE multiple of 23.220x, with an annual dividend yield of 3.07%. Its 52 weeks high price stands at $9.400 and 52 weeks low price at $6.400, with an average volume of ~2,283,959. At market close on 23rd July 2019, the stock was trading at a price of $7.360, with a market capitalisation of circa $3.54 billion and a daily volume of ~3,223,698.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.