ALS Limited (ASX: ALQ) provides several services, including the laboratory testing, inspection, certification and verification solutions. It ensures to offer a high quality, innovative, professional testing services through which the clients make informed decisions. It is one of the worldâs largest analytical and testing services provider and through its industrial division, the group serves the energy, resources and infrastructure sector.

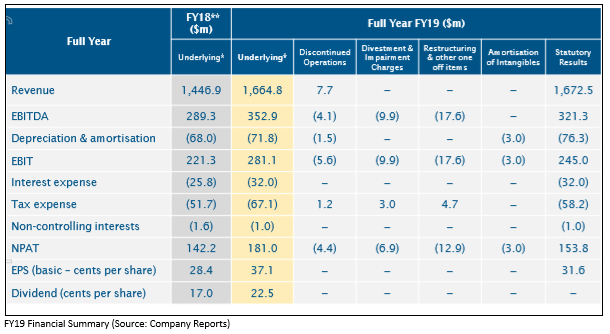

The company today, on 21st May 2019, announced its annual results. The underlying net profit after tax from continuing operations stood at $181.0 million for FY2019, exceeding the guidance range of $170 million to $175 million provided by ALS in November 2018. The results exhibited an increase of 27.3% from $142.2 million comparative underlying net profit after tax for FY2018.

The Directors of the company have declared a final dividend of 11.5 cents per share partly franked to 35%, representing a payout ratio of 60.4% of full-year underlying profit and reflective of the strong financial performance and cash conversion. ALS will pay the dividend on July 1, 2019, to shareholders on the register on June 4, 2019. The ex-date for the dividend payment is June 3, 2019.

The company retains a strong balance sheet and flexibility to pursue acquisition opportunities and fund organic growth with its leverage at 1.8x at March 31, 2019.

As per the groupâs outlook for 2020, with a robust platform driven by a strong balance sheet and prudent capital management structure, ALS is well placed to take advantage of the opportunities in the environmental, pharmaceutical and food sectors, and leverage its assets, market share and reputation in the commodities division.

Combined with the continued globalisation of the business through consolidation of its operational hub in the USA, global diversification of the Board and senior executive team, ALS is on track to implement its strategic objectives and consolidate its presence as a leading provider of services to the global testing, inspection and certification sector.

The companyâs on-market buyback stood at a total of 18.7 million shares with a total consideration of $131.4 million as of March 31, 2019. ALQ will continue to utilise prevailing cash balances and free cash flow to fund the buyback program.

The strong financial performance was underpinned by the enhanced levels of profitability and organic growth across all regions in Life Sciences division, the companyâs market leading position in businesses leveraged to the expanding mineral commodities sector and acquisitions in high growth areas of food and pharmaceutical in mainland Europe, South America and North America.

The company advised that the Annual General Meeting of ALS Limited will be held at 10.00 AM (AEST) on Wednesday, 31st July 2019, at the Pullman Hotel, King George Square, Roma and Ann Streets, Brisbane, Queensland.

On the price-performance front, while writing as of May 21, 2019, AEST 03:00 PM, the stock of ALS Limited was trading at $7.685, with a market capitalisation of $3.91 billion. The stock has yielded a YTD return of 21.05% and exhibited returns of 1.26% and 2.03% over the past six months and three months, respectively. Its 52-week high price stands at $9.40 with a 52-week low price of $6.40 and an average trading volume of 1,561,877. The stock is trading at a PE multiple of 27.170x.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.