Dividend is the reward paid by the company from a portion of its earnings to a class of shareholders. These are often decided by the Board and approved by the shareholders using their voting rights. Dividend stock companies are those which pay regular dividend to its shareholders. People usually invest in high-yielding dividend stocks as it gives them some sense of predictability, providing the investors some sense of control on them.

Let us now look at the following high-yielding dividend stocks:

BHP Group Limited

BHP Group Limited (ASX: BHP) is one of the top producers of major commodities including Iron Ore, metallurgical coal and copper. The company also has substantial interests in oil, gas and energy coal.

Dividend:

The company announced the ordinary fully paid dividend of USD 0.78 which was to be paid by 25 September 2019.

Economic contribution Report:

For the FY19, total direct economic contribution was US$46.2 billion. This consists of payments to suppliers, salaries and benefits for its above 72k staffs and contractors, dividends, taxes and royalties, and a voluntary investment of US$93.5 million was done in social projects throughout the communities. During the year, tax, royalty and other payments to government totalled US$9.1 billion and global effective tax rate was 36%.

FY19 Financial Highlights

- Net proceeds of US$10.4 billion were returned to shareholders through a combination of an off-market buy-back in December 2018, and a special dividend in January 2019. These returns, when added to dividends announced in respect of FY2019, delivered record annual cash returns to shareholders.

- Higher prices and record production from several operations contributed to strong operating cash flows and enabled BHP to announce a record final dividend of US 78 cents per share.

- FY2019 financial performance from continuing operations was strong. Higher prices and solid underlying performance contributed to EBITDA of US$23 billion at a margin of 53 per cent. Underlying attributable profit was US$9.5 billion.

Outlook

- Planned maintenance at Atlantis and natural field decline would result in volumes to be in the range of 110 and 116 MMboe in FY2020.

- The impact of lower volumes would result in conventional unit costs to be in the range of US$10.50 and US$11.50 per barrel in FY2020, partially offset by lower maintenance activities at its Australian assets.

Stock Performance:

On 3 October 2019, BHP stock closed the trading session, at $35.280, moving down by 2.81 percent from the previous close. It recorded an annual dividend yield of 5.28%. The market cap of the stock is $106.93 bn, while the stock gave a return of 0.77% in the past 30 days period.

Rio Tinto Limited

Rio Tinto Limited (ASX: RIO) is one of the largest metals and mining corporations which is engaged in the production of materials essential for human progress. The primary focus of the company is on the extraction of minerals, but it also has significant operations in refining, particularly for refining bauxite and iron ore.

Shareholdings of KMP/PDMR:

As per the recent announcement on ASX, KMP or key managerial personnel - Alfredo Barrios, Christopher Salisbury, Arnaud Soirat and Simon Trott acquired 1,172.475110 shares at GBP 42.570900/share, 308,006910 shares at GBP 92.480000/share,1,041.185550 shares at GBP 92.48000 and 19.497510 at GBP 92.480000 by the way of dividend reinvestment on shares held in a VSA.

Change in Directorâs particulars:

The company has advised that David Constable, a non-executive director of the company has been appointed as a director of Fluor Corporation with effect from 20 September 2019.

Notice of dividend currency exchange rates:

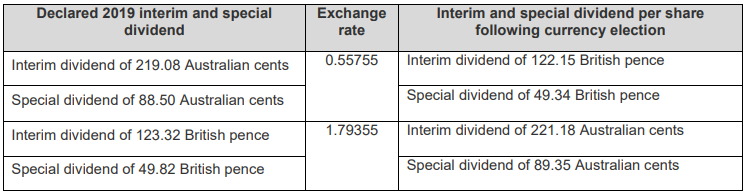

The company announced an interim dividend of 151.00 US cents per share and a special dividend of 61.00 US cents per share for the half-year period ending 30 June 2019, with an interim dividend of 219.08 Australian cents per ordinary share and a special dividend of 88.50 Australian cents per ordinary share to be paid to Rio Tinto Limited shareholders.

Similarly, Rio Tinto plc shareholders are to be paid an interim dividend of 123.32 British pence per ordinary share and a special dividend of 49.82 British pence per ordinary share.

Financial Performance Source: Companyâs Annual Report

FY19 Financial Performance (closed 30 June 2019)

- Gross Revenue was almost in line with the past year performance while the underlying EBITDA increased by 11% to $10.3 bn in H1 19.

- During the financial year, cash flow from operations increased by 39% to $7.2 bn in 1H 19 from $5.2 bn in H1 18.

Stock Performance:

On 3 October 2019, RIO stock closed the market session, at a price of $87.53, dipping by 3.908 percent from the prior close. RIO stock has given a return of 2.54 percent in the past 30 days, with an annual dividend yield recorded at 5.16%. The market cap of the stock is $33.81 bn with the PE Ratio of 7.970x.

Commonwealth Bank of Australia

Commonwealth Bank of Australia (ASX: CBA) is one of the leading providers of financial services with the major divisions: retail banking services, business and private banking services, institutional Banking, wealth management and international finance services.

Quarterly Interest Payment:

On 1 October 2019, Commonwealth Bank of Australia advised the next interest payment of 3.36% per annum from and including 30 September 2019 to but excluding 30 December 2019. The interest payment date was mentioned as 30 December 2019 and the record date as 15 December 2019.

CountPlus completes acquisition of Count Financial:

CountPlus has recently acquired Count Financial Limited from Commonwealth Bank and is now operating the Count Financial business. The Commonwealth Bank will provide an indemnity to CountPlus of $200 million.

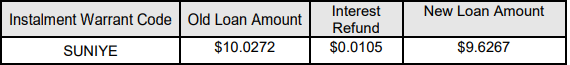

CBA Instalment Warrants - SUN Warrants Restrike:

CBA Equity Products Group will apply the combined cash proceeds of the Capital Return of $0.39 together with an interest refund, where applicable, to reduce the Loan Amount in respect of the SUN Instalment Warrants. The Consolidation will also result in warrant holdings being reduced by a ratio of 0.9710 per 1 existing warrant held.

Financial Performance Source: Companyâs Annual Report

Change of interests of substantial holder:

The voting power of Commonwealth Bank of Australia and its related bodies corporate in Australian Finance Group Ltd was reduced to 8.79% from 9.81% on 26 September 2019.

CBA Instalment Warrants - STW Warrants:

The company declared the record date for entitlements to be 30 September 2019 for the estimated $0.838779, unfranked dividend for the STW Commonwealth Bank Instalments.

Issue of AUD 100 Million Worth of Subordinated Notes:

The company will issue subordinated notes worth AUD 100 million, 3.66 % subordinated notes due 2034 will be issued pursuant to CBAâs U.S.$70,000,000,000 Euro Medium Term Note Programme.

Dividend:

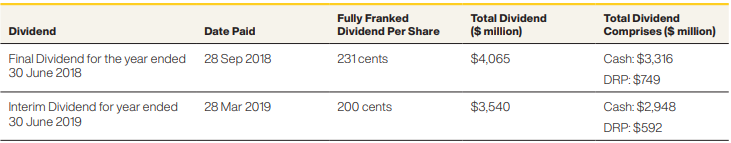

In CBAâs 2019 full-year report for the period closed 30 June this year, it was mentioned that the business performed well despite economic uncertainties. Funding, liquidity and capital strengths were also maintained and managed. This enabled the board to declare the final dividend of $2.31 per share. Therefore, the full year dividend turned out to be $4.31 per share returning $7.6 billion to its shareholders.

Financial Performance Source: Companyâs Annual Report

Financial Performance (closed 30 June 2019)

- During the FY19, Cash NPAT was decreased by 5% reflecting a challenging operating environment, though business fundamentals remained strong. The decrease was driven by a 2% reduction in total operating income, a 2% increase in operating expenses and an 11% increase in loan impairment expense.

- Total operating expenses for the FY19 went up to $11,269 million from $10,995 million. The increase was driven by 3% increase in staff costs and 8% increase in Information technology. This, however, was offset by 4% decline in occupancy and equipment and 1% decrease in other expenses.

Outlook:

CBA is in a good position to face the changing environment scenarios backed up by the resilient balance sheet, strong customer base and leading distribution and digital assets.

Stock Performance:

On 3 October 2019, CBA stock last traded at $77.550, slipping by 2.575 percent from its earlier closed price. The performance of the stock increased by 11.52% in past 6 months, earning an annual dividend yield of 5.41%. The market cap of the stock is $140.91 billion, with the PE Ratio of 16.390x.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.