Meaning of Franked Dividends:

A system of eliminating any double taxation of dividends gives rise to what is called a franked dividend, as tax paid on the dividend gets reduced at the end of the security holders. Primarily, Australian company tax (30%) takes into account the tax paid by the companies on dividends. Thus, the reduction at investorsâ front is the reduction by the amount, which is equal to the tax imputation credits, which overall reduces the tax that investors need to pay.

Companies pay dividends out of their profits; and dividends are already taxed once at the company level, when they are paid. In that case, shareholders should ideally pay a much lower tax on those dividends.

Basics of Franking Dividends:

Three situations of franking dividends:

- 100% Franked Dividends: If the company has said that it will give 100% or fully franked dividends, it means that the dividend comes with the tax paid which is up to the company tax rate of 30%;

- 50% Franked Dividend: If the company has said that it will give 50% or less than 100% franked dividends, it means the dividend comes with 50% or less than 100% tax paid on the dividend at the company tax rate;

- 0% Franked Dividends: If the company has said that it will give 0% franked dividends, it means that the dividend comes with no tax credit attached.

In S&P/ASX 200 Index, there are 200 biggest companies of the Australian market. Of the total, 184 companies paid dividends in 2017. Out of these 184 companies, 50% of them paid fully franked dividends, 25% paid partially franked dividends and the rest paid unfranked dividends.

Below are some examples of the top companies that recently paid fully franked dividends to their shareholders.

BHP Group Limited

About the Company: BHP Group Limited (ASX: BHP) is into minerals exploration, production and processing (particularly coal, iron ore, copper and manganese ore) and hydrocarbon exploration, production and refining. The market capitalisation of the company stood at A$ 109.73 billion, as on 25 September 2019 (AEST 01:52 PM).

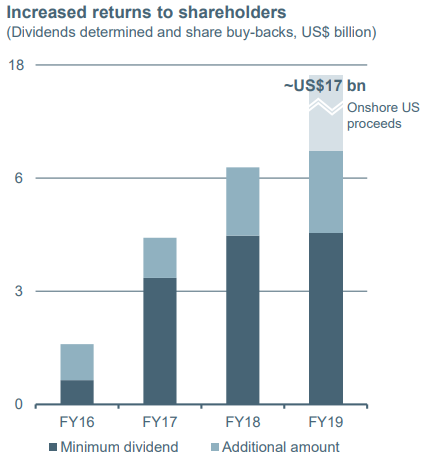

Dividend: BHP has a strong track record of paying fully franked dividends. In its resultsâ release for the financial year ended 30 June 2019, the company also declared a final dividend of 78 US cents per share (fully franked). The final dividend is equivalent to a 73% payout ratio. This brings the whole year dividend to US$ 1.33 per share. The annualised dividend yield of the company is 5.15%, as on 25 September 2019 (AEST 01:52 PM).

Source: Companyâs Presentation

Stock Performance: The stock of BHP has produced returns of -9.59% and 0.32% in the time period of three months and six months, respectively. The stock was trading at A$ 36.570 on 25 September 2019 (AEST 02:01 PM), down 1.826% from its previous close, with a PE multiple of 16.63x.

Wesfarmers Limited

About the Company: Wesfarmers Limited (ASX: WES) is into a diverse business operation, which covers general merchandise, outdoor living, apparel, office supplies, etc. The market capitalisation of the company stood at A$ 45.55 billion, as on 25 September 2019 (AEST 02:03 PM).

Dividend: With its announcement regarding full-year results for the period ended 30 June 2019, the company also declared a final dividend of A$ 0.78 per share (fully franked). This brings the full year dividend to A$ 2.78 per share including a special dividend of A$ 1.00 pe share (fully franked).

Declared Shareholder Distributions (Source: Companyâs Presentation)

Stock Performance: The stock of WES has produced returns of 9.58% and 13.93% in the time period of three months and six months, respectively. The stock was trading at A$ 40.130 on 25 September 2019 (AEST 02:07 PM), down 0.1% from its previous close, with a PE multiple of 8.25x and an annual dividend yield of 4.43%.

Westpac Banking Corporation

About the Bank: Westpac Banking Corporation (ASX: WBC) is one of the leading banks in Australia and provides a broad range of banking, financial and related services. The Group has four customer facing divisions:

- Consumer- This division is responsible for sales and services to consumer customers in Australia under the BankSA, BT, Westpac, St.George, RAMS and Bank of Melbourne brands;

- Westpac Institutional Bank (WIB)- This division is responsible for delivering a broad range of financial products and services to commercial, corporate, institutional and government customers with connections to Australia and New Zealand;

- Business- This division is responsible for sales and service to micro, small-to-medium enterprises, commercial business and private wealth clients in Australia;

- Westpac New Zealand- This division is responsible for sales and services of banking, wealth and insurance products for consumer, business and institutional customers in New Zealand.

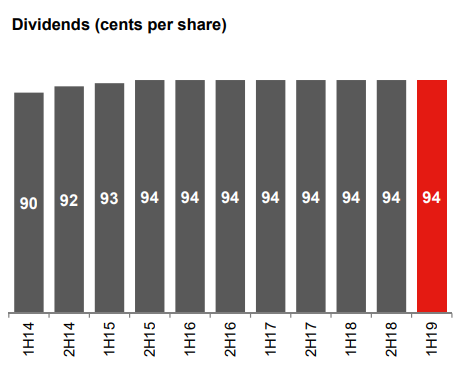

Dividend: WBC declared an interim dividend of A$ 0.94 per share, which is fully franked, as part of its half year result announcement for the period ended 31 March 2019. This represents a payout ratio of 98% with a dividend yield of 7.6%. The dividend reinvestment plan was applied with a 1.5% discount to the market price.

Source: Companyâs Report

Stock Performance: The stock of WBC has produced returns of 5.61% and 14.55% in the time period of three months and six months, respectively. The stock was trading at A$ 29.915 on 25 September 2019 (AEST 02:15 PM), down 0.017% from its previous close, with a PE multiple of 14.520x and an annual dividend yield of 6.28%.

National Australia Bank Limited

About the Bank: National Australia Bank Limited (ASX: NAB) was formed in 1858 and currently has over 33,000 people who serve nine million customers in more than 900 locations across New Zealand and Australia as well as globally. The company has three segments:

- Business and Private Banking (BPB): This segment focuses on serving three main aspects- small businesses, medium businesses and investors.

- Consumer Banking and Wealth (CBW): This segment supports millions of consumer banking relationships in Australia by providing a comprehensive range of financial services and products.

- Corporate and Institutional Banking (CIB): This section delivers a variety of lending and transactional products and services linked to financial and debt capital markets.

Dividend: The company declared a total dividend of A$ 0.83 for the half year ended 31 March 2019, with a dividend payout ratio of 77.4%. It is lower as compared to the year-ago periodâs dividend payout ratio of 96.9%. The companyâs annual dividend yield stood at 6.08% as on 25 September 2019 (AEST 02:17 PM)

Source: Companyâs Presentation

Stock Performance: The stock of NAB has produced returns of 11.06% and 20.31% in the time period of three months and six months, respectively. The stock was trading at a price of A$ 29.920 on 25 September 2019 (AEST 02:17 PM), with a PE multiple of 14.590x.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.