BHP Group Limited (ASX:BHP) is an ASX-listed behemoth miner and also a significant producer and consumer of fossil fuels. As a significant contributor to the global economy, BHP shares the responsibility to take care of the surrounding environment in which the company operates.

BHP the Giant Miner

BHP runs various operations, which produce ferrous metals, non-ferrous metals like copper and potash, petroleum, and coal, in the process the company consumes a substantial tranche of fossil fuels.

BHP produced 238 million tonnes of iron ore, 1,689 kilotonnes of copper, 121 million barrels of oil equivalent, and 70 million tonnes of coal in FY2019.

Also Read: BHPâs High ESG Considerations Kept Coal And Cobalt Out Of The Companyâs Portfolio

While the company produced such a vast amount of resources, it is also focusing on its carbon footprints.

BHP Emission Profile

The total Scope 1 and Scope 2 emissions of the company stood at 14.7 million tonnes of carbon equivalent in FY2019, down by 10.90 per cent against the previous yearâs combined emission including (Scope 1, Scope 2, and Onshore US).

The emission declined amid a change in the electricity emissions factor for Minerals Americas that resulted from the interconnection of Chileâs northern grid system and the southern grid system.

The northern grid system of the company relies highly on fossil fuels; while the southern grid has a high proportion of renewable energy. The integration of both the grids allowed the company to lower the emission in FY2019.

BHP also plans to achieve a net-zero operational greenhouse gas (or GHG) emission over the long-term in accordance with the Euro-6 standards. To meet this objective, BHP intends to develop a medium-term target for operational emissions.

Key Sources of Emission

The electricity use makes up 43 per cent of the companyâs operational emissions, including:

- In-house power generation

- Outsourced power (purchased from global grid network)

The emissions from fuel and distillate account for 42 per cent of the operational emissions, and methane emissions from the companyâs petroleum and coal assets make up to 15 per cent of the operational emissions.

The Value Chain Emission

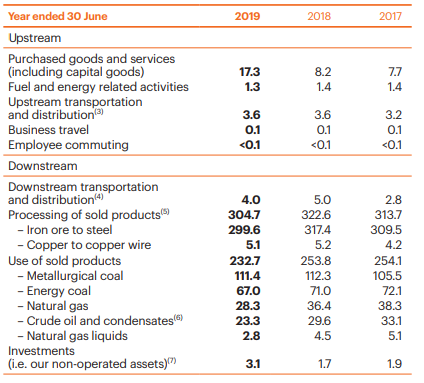

The value chain emission or the Scope 3 emission of the company remained significantly higher from the operational emission, and BHP is working with the value chain participants to seek emission reductions across the life cycle of the products.

The Scope 3 emission of the company comes from the downstream processing and use of the companyâs product, in particular, from the utilisation of the companyâs iron ore and metallurgical coal in the steelmaking process.

The emissions associated with the processing of the non-fossil fuel commodities of the company such as iron ore, copper concentrate, etc., stood at 305 million tonnes of carbon equivalent. While the emissions from the utilisation of the companyâs fossil fuel commodities such as metallurgical and energy coal, oil and gas, etc., stood at 233 million tonnes of carbon equivalent.

The detailed Scope 3 greenhouse gas emission of the company is as below:

(Source: Companyâs Report)

Investing in Low Emission Tech

To thread on the path, which leads to a net-zero emission, the company requires a deep understanding of the development pathway for low emissions technologies (or LETs).

The company follows a threefold LET strategy:

- To adopt mature technologies such as light electric vehicles and integrate them effectively and safely into the operations.

- To create road maps for the adoption and development of lightweight vehicle technologies.

- To look for early-stage LETs that hold high future results potential

In July 2019, the companyâs Board approved a new Climate Investment Program to invest in technologies, which would help the company to reduce the operational emissions. This new program would build on the existing program of investing in low emission technologies and carbon capture & storage.

These programs would mark a total investment of US$400 million over the five years from FY2020.

Participation in Global Emission Control

Apart from adopting measures to curb the operational and value chain emission, BHP is also focused towards the global emission as it remains an eminent systematic risk.

The climate change policy of the company focuses on reducing the emissions from deforestation via supporting the REDD+, which is a United Nations program that aims to reduce emission from deforestation and forest degradation.

BHP in a partnership with the International Finance Corporation and Conservation International developed a US$152 million Forests Bond, which is first of its kind and was issued by the International Finance Corporation in 2016.

The company also developed a Finance for Forests (or F4F) initiative in FY2018 in a partnership with Conservation International and Baker McKenzie.

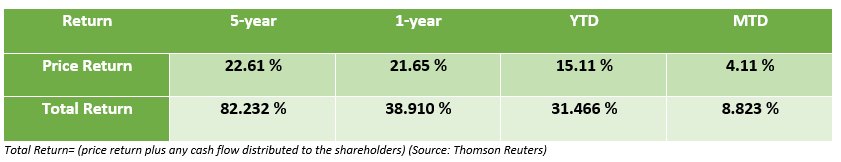

BHP Stock Performance, Return Profile, and Trend Analysis

BHP started a long-term rally post listing on the Australian Securities Exchange. The long-term rally of the company halted in April 2011 (high- $45.128) to drop to the level of $14.060 (low in January 2016). After dropping by approx. 69 per cent from April 2011 to January 2016, the stock recovered sharply to mark a recent high of $42.330 (high in June 2019).

The stock of the company is presently trading at $37.795 (as on 19 September 2019 12:55 PM AEST).

Trend Analysis

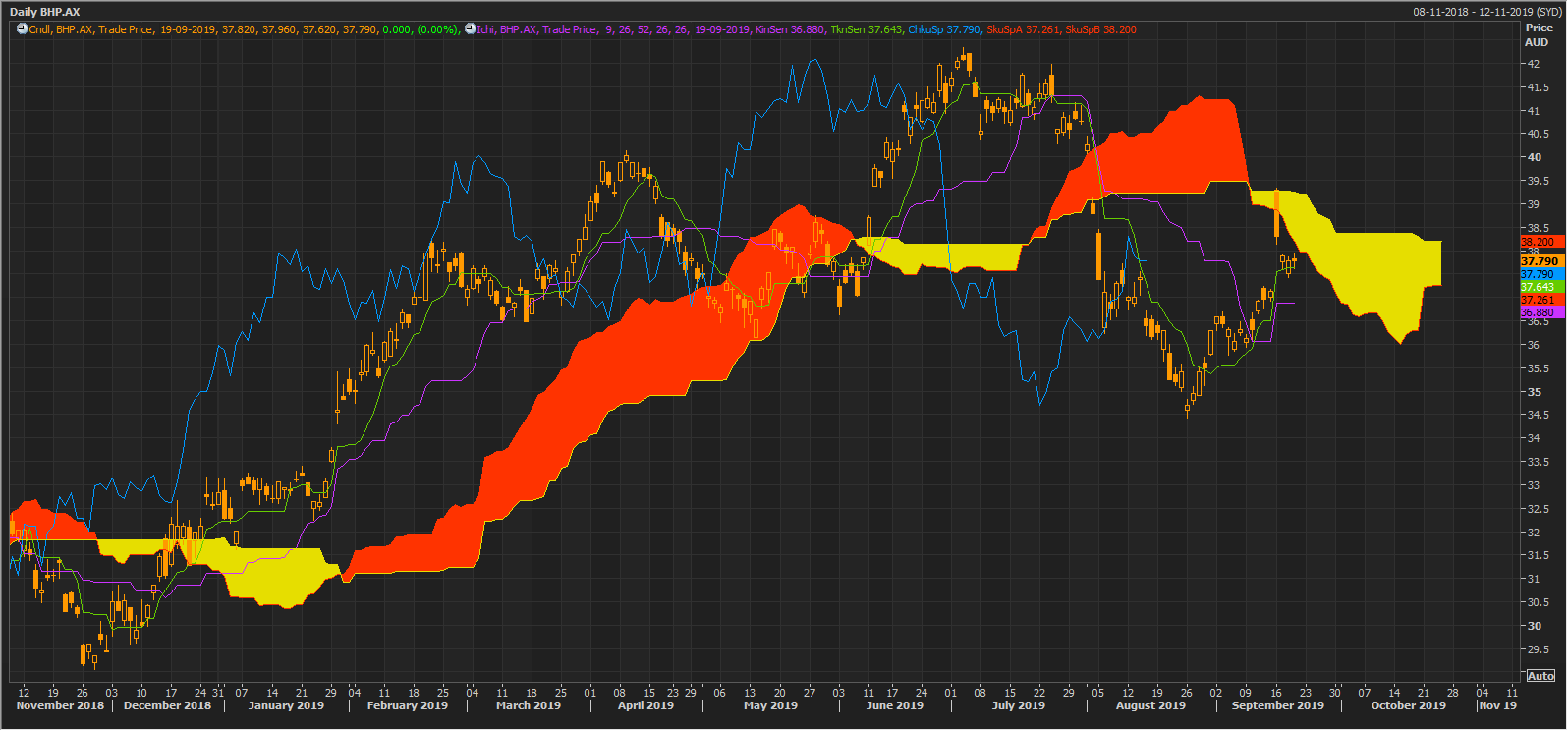

BHP Daily Chart (Source: Thomson Reuters) (Ichimoku Study)

On the daily chart, the Span A, which is the mean of the conversion and base line, is moving below the Span B, which the mean of 52 days high and low, of the Ichimoku.

The moving of Span A below Span B suggests a chance of a trend reversal towards downside over the short-term. The Span A is at $37.261, and the Span B is at $38.200.

The spread between Span A and Span B is narrowing down, which is supporting the chances of the trend reversal towards downside as Span A is below Span B.

Also Read: Twin Shocks of Copper and Iron Ore Set Rio and BHP Uptrend on a Detour

BHP Daily Chart (Source: Thomson Reuters) (Ichimoku Study)

However, despite the signs of trend reversal over the short run, the daily chart of BHP is showing slight positive signs.

The conversion line, which is the mean of 9 days high and low is trading above the base line, which is the mean of 26 days high and low.

The crossover of conversion above the base line signifies a positive crossover of the Ichimoku. The conversion line is at $37.643, and the base line is at $36.880.

The positive crossover of the conversion and base line is below the cloud where Span A is below Span B, which in turn, suggest that the crossover is not very strong; however, still bullish in depiction.

To wrap up, BHP is checking on its emissions, and the company is adopting measures to lower its operational and value chain emission of greenhouse gases. The company is also engaged in global initiatives, which are designed to bring down the GHG emission on a global scale.

BHPâs strategy for controlling Scope 3 (value chain emission) and operational emission is to invest in the potential technologies, which holds the long-term capability to slash out the operational emission of the company.

To curb the value chain emission, BHP recently introduced a low-LNG freight with a loading capacity of 27 million tonnes of iron ore.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.