BHP, the mammoth miner, has briefed on its future business strategy today which signals that the giant is diverting from the thermal coal business despite asset attractiveness. BHP plans to divert from commodities such as lithium and cobalt as well.

The companyâs decision to divert from commodities, which are raising social concerns, could be in the best interest of the company concerning the Environmental, social and governance (ESG) considerations.

The thermal coal market is in a conundrum over the increased stance of global economies to shift towards a zero-emission economy given the raising awareness in the global market over the dire impact of coal use in the energy sector. In the recent event, many economies reduced their exposure to thermal coal in line with Euro-6 emission standards.

BHPâs decision to not leap forward towards the thermal coal signifies ethical, environmental considerations, which could mark a loss of business opportunity in a short-term, but eventually lead to a sustainable business regime.

Cobalt is another commodity which is currently associated with social issues. An ample amount of cobalt comes from the Democratic Republic of Congo (DRC), which is very well known for its political instability and unethical matters.

In the recent events, the DRC included cobalt under the âstrategic metalâ category, which allowed the government to raise the royalty charges substantially on the mining and production of the metal, an unethical practice by a government. Another issue with the DRC is child labour; the countryâs reputation is well dented with it.

Over such issues, one of the electric vehicle segment pioneers- Tesla, decided to shift and reduce the usage of cobalt in its electric storage batteries. In addition, countries such as China, Japan, etc., are working with hybrid cell technology, which would eventually bring down the usage of cobalt.

While there are no environmental or ethical issues associated with lithium, the ample supply of the metal in the global market could justify the companyâs decision to not dive into the commodity.

The decision to keep off its hand out of such controversial businesses, demonstrate the companyâs high standards of ESG considerations.

The Chief Financial Officer of BHP, Mr Peter Beaven, mentioned that the demand from electric vehicle segment could keep lithium going and to lesser extent cobalt; however, the abundant supply of the former, and substitution of the latter, reduce the attractiveness of these commodities for the company.

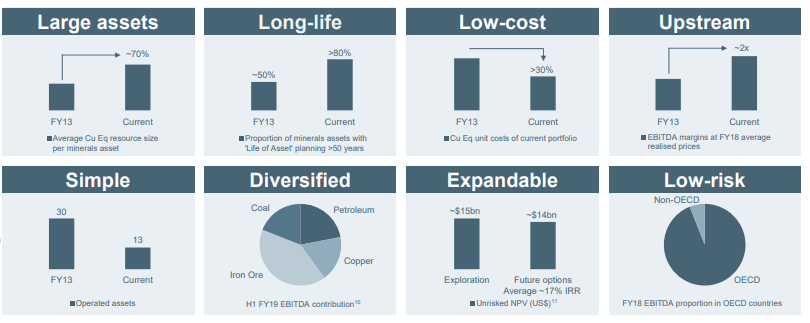

BHP mentioned in the presentation that the business strategy of the company is to maximise long term by positioning the portfolio to deliver high returns to the shareholders.

Source: Company Presentation

Source: Company Presentation

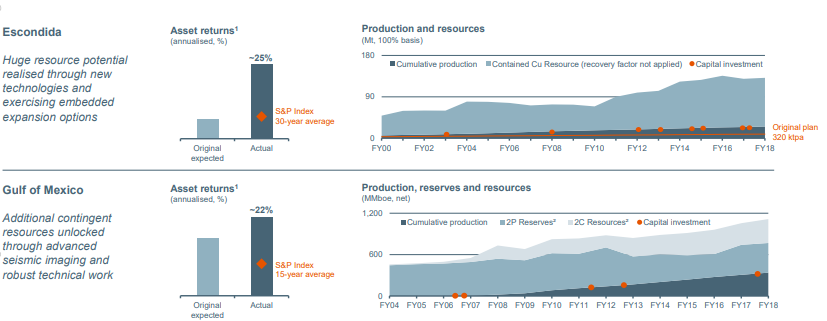

BHP seeks long-life assets, such as Escondida in Chile with embedded optionality to maximise the value.

Source: Companyâs Report

Source: Companyâs Report

The company reshaped the portfolio by the demerger of South32 and US$18 billion of divestments.

Source: Companyâs Report

Source: Companyâs Report

As per the company, the energy exposure of the company is just 3 per cent of the asset base and is made up of two very high-quality mines, which in turn, generates high margin for the company.

The recent Jansen potash project of the company is currently in shackles as the potash market is already oversupplied and the company would decide within 18 months whether to spend up to US$5.7 billion on the first stage of the Canadian project.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.