The financial services industry in Australia is dominated by four major banks, Commonwealth Bank of Australia (ASX:CBA), Westpac Banking Corporation (ASX: WBC), National Australia Bank Limited (ASX:NAB), and Australia and New Zealand Banking Group Limited (ASX:ANZ). These Australian banks are ranked amongst the top 25 safest banks across the globe.

WBC has announced regarding reducing its serviceability floor for home loans for the second time in 10 weeks to 5.35% (5.75 % in mid-July), effective 30th September 2019. 5.75 % in mid-July.

Calculating loan serviceability implies if the borrow is able to repay the loan at the floor rate set by the bank.

Letâs have a look at Westpac Banking Corporation in some detail below:

About the Bank:

Westpac Banking Corporation (ASX: WBC) is one of the leading banks in Australia and it provides broad range of banking, financial and related services. The Group has four customer facing divisions:

- Consumer- This division is responsible for sales and services to consumer customers in Australia under the BankSA, BT, Westpac, St.George, RAMS and Bank of Melbourne brands;

- Westpac Institutional Bank (WIB)- This division is responsible for delivering a broad range of financial products and services to commercial, corporate, institutional and government customers with connections to Australia and New Zealand;

- Business- This division is responsible for sales and services to micro, small-to-medium enterprises, commercial business and Private Wealth clients;

- Westpac New Zealand- This division is responsible for sales and services of banking, wealth and insurance products for consumer, business and institutional customers in New Zealand.

The market capitalisation of the bank stands at A$104 billion as on 24th September 2019.

Companyâs CFO to Retire In 2020:

Westpac Group CEO, Mr Brian Hartzer, announced that Peter King, bankâs CFO has decided to retire in 2020 after a career of 25 years. Mr King has been the CFO of the company for five years and prior to his current role, he served as Deputy CFO.

Class Action Filed Against Its Subsidiaries:

Westpac confirmed that it had received a class action filed by Slater and Gordon on behalf of Ms Tracy Ghee against its subsidiaries including Westpac Life Insurance Services Limited (WLIS) and BT Funds Management Limited (BTFM) in relation to aspects of BTFMâs BT Super for Life cash investment option. The claim has been filed.

Financial Highlights of 1H19:

- Statutory net profit was down by 24% to $3,173 million.

- Cash earnings were down by 22% to $3,296 million in 1H19.

- Regardless of the tough period, the balance sheet continued to remain strong across all dimensions of capital, liquidity and asset quality.

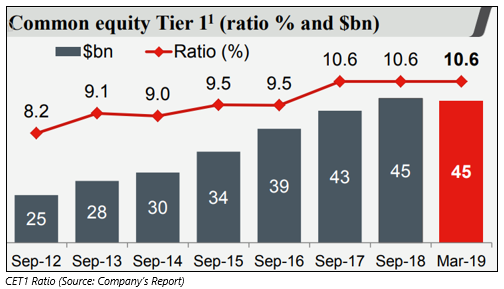

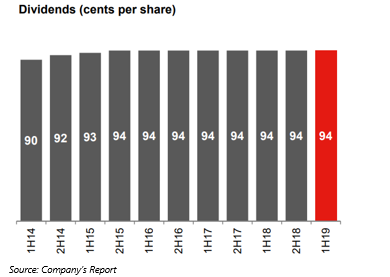

- Even though the cash earnings were lower, the Company reported CET1 capital ratio of 10.64% which allowed the company to maintain its interim dividend at 94 cents per share.

Divisional Performance:

- Consumer Bank: Cash earnings were down by 11% due to decline in NIMs because of lower mortgage spreads and higher wholesale funding costs;

- Westpac Institutional Bank: This segment reported cash earnings of $543 million, down by 2% from previous year, due to reduction in financial markets revenue;

- Business Bank: Cash earnings were down by 6% to $1,013 million, impacted by provisions from estimated customers refunds, payment and associated costs;

- Westpac New Zealand: Cash earnings increased by 15% to $NZ 555 million due to sound balance sheet growth (loans and deposits was up by 8%) resulting in higher operating income;

- BT Financial Group: This segment reported a cash earnings loss of $305 million

Balance sheet:

WBC has continued to keep its balance sheet strong across all dimensions:

- A net stable funding ratio (NSFR) of 113%, little changed over the half and prior year and is also above the 100% regulatory minimum;

- A liquidity coverage ratio (LCR) of 138%, up from 133% six months earlier and is also above the 100% regulatory minimum;

- A CET1 capital ratio of 10.6% more than the benchmark set by APRA. Risk weighted assets were lower over the half.

Dividends:

WBC has declared an interim dividend of 94 cents per share which is fully franked dividend. This makes the payout ratio of 98% with a dividend yield of 6.31% (as per ASX). The dividend reinvestment plan will apply with a 1.5% discount to the market price.

Outlook for 2020:

CEO of the WBC, Mr Hartzer stated that the Australian economy will remain subdued with GDP growth rate to be around 2.2%. The consumers were cautious because of flat wages growth and softening of house market.

WBC expects that the house prices are expected to remain subdued and home building is set to reduce through 2019 and 2020. System housing credit growth is expected to slow to 3% in the current bank year and fall further next year to 2.5%.

Comparison with its peers:

The main peers of WBC are NAB, CBA and ANZ and if we compare their dividend yield, WBC has given modest yields. The dividend yield of NAB, CBA and ANZ is 6.12%, 5.25% and 5.73%, respectively (as per ASX). As compared to its peers, WBC gives a decent dividend yield of 6.31%.

If we look at the P/E multiple of the stock, it is trading at 14.460x which is cheaper as compared to its peers. NAB is trading at a P/E multiple of 14.490x, CBA at 16.900x and ANZ at 12.750x.

Stock Performance:

The bank produced returns of 4.44% and 12.60% in the time period of three months and six months, respectively. Currently, the stock is trading close to a 52-week high level ($30.050) at $29.970 (as at 1:38 PM AEST, 24 September 2019).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.