August 2019 has been the most awaited month for share market enthusiasts, investors and ASX-listed companies. Each day of the month has been unveiling the earnings and profitability reports, outlining the present situations and delivering the future outlook of these companies.

How has the Earning Season been so far?

Mid-way through but disappointing enough for investors, the earnings season has not been the best in Australia in August 2019. Majority of the companies have been posting earnings below expectation or lesser than the prior corresponding periods. This has been catalysed majorly by the global volatility in the markets, slowing of retail spending, tariffs and trade war concerns. Companies have proved that they are vulnerable to the both domestic weaknesses and global concerns.

How has the ASX performed amid the volatility?

The first two weeks of August were slashed due to the headwinds from underperformance of companies and the major banks of the Australia, which weighed the market heavily. The looked upon minerals and metals magnates like Woodside Petroleum Limited (ASX:WPL) and Orora Limited (ASX:ORA) fell after tough results and operations.

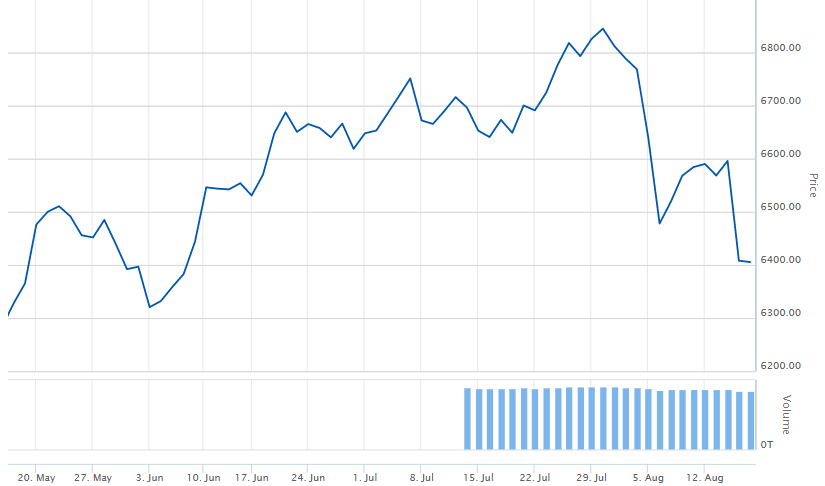

In the current third week of the season, experts believe that the S&P/ASX 200 Index might have a slight improvement in its performance, after dropping by over 2.5 per cent in the last two weeks. The ASX had hit its record high in July 2019 of 6875.50 but disappointingly enough, it closed at its worst since November 2018 in the second week of August.

Factors Contributing to the Investor Roller-Coaster Ride

So far, 2019 has been in the limelight for various factors that have laid their fruits in this reporting season. The never ending, rather escalating trade war between China and US has taken the global markets by a toll. The resource stocks have been amongst the most affected ones, as the price of oil, iron ore and base metals glided down on the charts. With the Royal Commissionâs intervention into the financial spectrum and introduction of reforms, which resulted in drifts of bankâs credit ratings as well as, the money borrowing and lending process in Australia underwent a sinusoidal shift. The historic and consecutive rate cuts by 25 basis points to as low as 1 per cent, is all set to be slashed further to 0.5 per cent by early next year. Toppling these issues, was the property pressure and the related concerns, which have improved and downgraded simultaneously.

Another triggering cause of the downtrend and factor of concern has been the deteriorating rate of employment, which is anticipated to slow in the coming years and weigh on the countryâs domestic growth and would be around 5.5 per cent by the middle of next year.

Australian Shares in 2019

It is a well-accepted principle of the stock exchanges, that asset markets are easily forecasted for a longer term than for a short term, as business and its impacts are dynamic in nature. Short time forecasts are less reliable as the tenure is more prone to price volatility on a daily basis. When perceived as an overall picture, 2018 had been a bad year for most of the investment assets in Australia, with a majority of them having recorded negative returns. During January 2019, experts were of the opinion that the S&P/ASX 200 index had weakened by over 6 per cent in 2018, which has left less bullishness in the share prices of the Australian equity market. The Government debts, especially from the US (a fact that cannot be ignored) had been on a rise and the US share market and its behaviour is a major catalyst for the Australian equity market. Moreover, earnings had lifted significantly in 2018 and were forecasted to have a judicious upliftment in 2019 as well.

For the past few years, the Aussie market analysts have been excessively bullish on the earnings growth trajectory in the country and have made significant contributions to the volatile ride for the cost of equities.

ASXâs Present Performance

The S&P/ASX 200 Index aided in adhering well to the sentiments of investors on 19 August 2019, as the index settled the dayâs trade on a comparatively higher note. Amid the concerns discussed before, and the fact that any adversity across the globe or within the economy may have a spill over effect on the share market, the improved performance of the index depicts that Australia is a strong economy, and bears the potential to stand upright on the back of its constituent sectors, be it metals and minerals, technology or financial institutions.

Post trading hours on 19 August 2019, the S&P/ASX 200 Index closed at 6,467.4 basis points, up by 0.97 per cent or 61.9 basis points, giving an optimistic start to the third week of the earning reports season.

XJOâs three months performance (Source: ASX)

Gainers and Decliners for the day

Let us look the top 5 Gainers and Decliners at the end of the trading session on 19 August 2019. The gainers, who may have primarily propelled the market upswing and catalysed the day for investors are the most looked upon stocks in the entire exchange.

Topping the chart was Industrial player Smartgroup Corporation Limited (ASX: SIQ), which soared up by 21.681 per cent at A$11. The next best performer was real estate company Lendlease Group (ASX:LLC), which zoomed up by 10.857 per cent to A$15.01, followed by Beach Energy Limited (ASX:BPT), which had its shares up by 10.803 per cent to a price of A$1. The communication Services player Domain Holdings Australia Limited (ASX:DHG) followed suit, up by 9.215 per cent to a price of A$3.2, followed by Industrial player McMillian Shakespeare Limited (ASX: MMS), which was up by 7.661 per cent to A$13.21.

Lead declines of the day included Metals and Mining company Bluescope Steel Limited (ASX:BSL), slashing by 8.361 per cent, after it released its FY19 results and reported a NPAT of $1,016 million, down by $553 million on pcp. The next decline of the day was reported by Ooh!media Limited (ASX: OML), by 7.85 per cent. The third decline of 6.291 per cent was reported by NIB Holdings Limited (ASX:NHF), which could not grasp the investorâs eye on the day of its FY19 results release, where it reported the total group revenue of $2.4 billion, which was up by 8.3 per cent on pcp. The fourth decline of 5.115 percent was posted by Saracen Mineral Holdings Limited (ASX:SAR), which released its FY19 results and posted a record profit of A$92.5 million, up by 22 per cent on pcp. The trail was followed by Metals and Mining company Regis Resources Limited (ASX:RRL), which was down by 4.618 per cent. It released its FY19 results, wherein its revenue was up by 8 per cent standing at $654.8 million.

With the reporting season period still not over, the market experts and investors are awaiting more announcements, results and forecasts to anticipate the trade behaviour of the stocks in the days to come. It would be interesting to witness the remainder of 2019 and understand the path that the Australian Securities Exchange takes as it enters 2020, which is said to be a year of stabilisation, and has a better outlook than 2019.

For insight and stocks to look at, please read our article here, which has been designed to aid you this reporting season.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.